Serenity's auto insurance policy includes a $500 deductible, a crucial aspect that can significantly impact her financial responsibilities in the event of an accident. Understanding how deductibles work is essential for any policyholder, as it determines how much out-of-pocket expense one must cover before the insurance company pays for claims. In this article, we will explore the implications of having a $500 deductible, the benefits and drawbacks of such a policy, and the role of insurance companies in managing these deductibles.

With the increasing complexity of auto insurance policies, it's vital to have a clear understanding of terms like deductibles, premiums, and coverage limits. This article will break down these concepts, providing clarity and actionable insights for Serenity and any reader looking to optimize their insurance policy. We will also delve into how insurance companies assess risk and determine premiums based on deductibles.

In addition, we will discuss the broader implications of auto insurance, including how it impacts financial planning and risk management. By the end of this article, readers will have a comprehensive understanding of Serenity's situation and how to navigate their own auto insurance policies effectively.

Table of Contents

What is a Deductible?

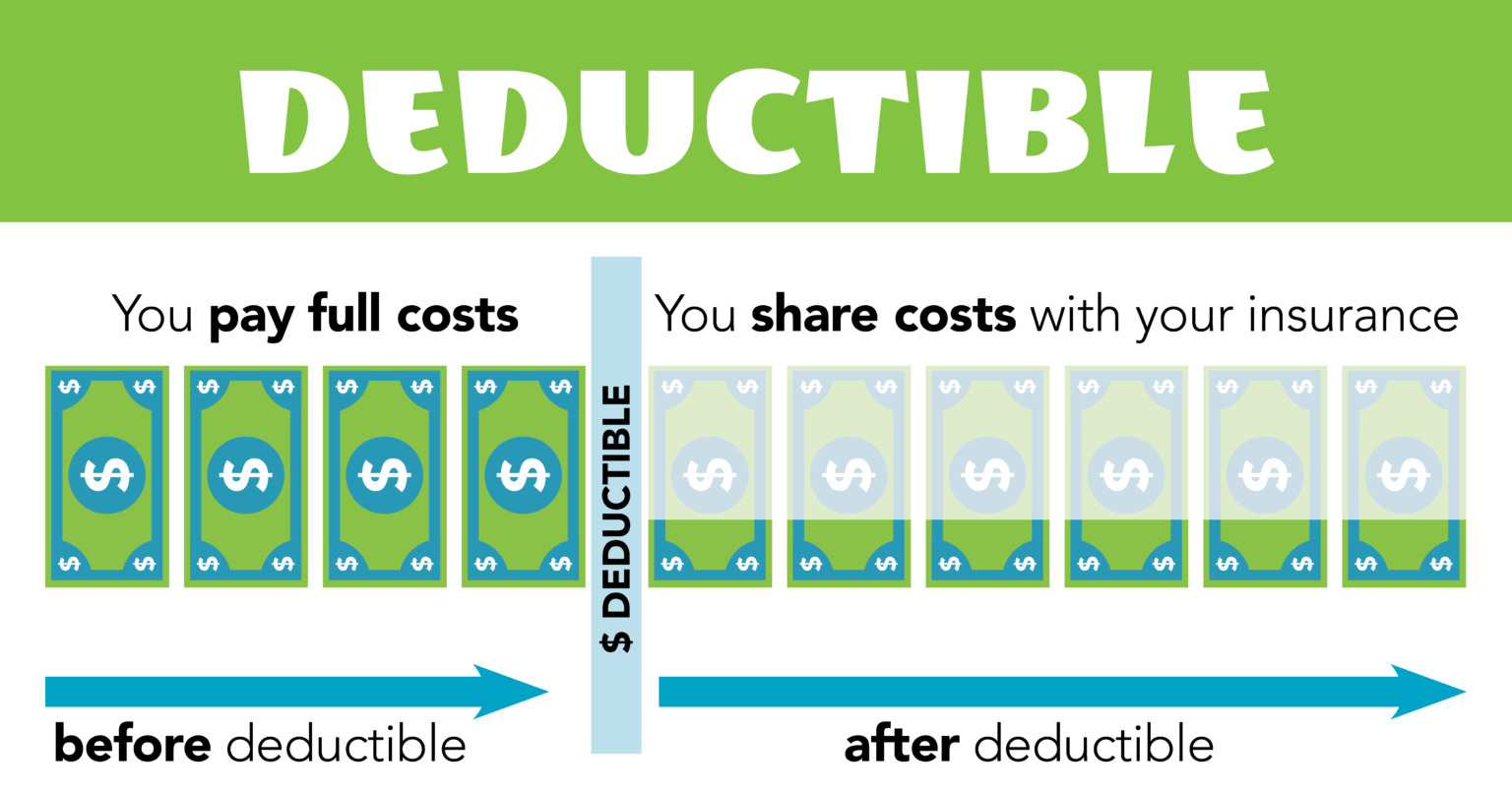

A deductible is a specified amount of money that a policyholder must pay out-of-pocket before their insurance coverage kicks in. For instance, with a $500 deductible, Serenity would need to cover the first $500 of any claim she files for her auto insurance.

Deductibles can vary widely depending on the insurance policy and the preferences of the policyholder. Here are some key points to understand about deductibles:

- Higher deductibles often result in lower premiums.

- Lower deductibles lead to higher premiums but reduce out-of-pocket expenses during a claim.

- Deductibles apply per claim, meaning that if multiple claims are made, the deductible must be paid for each claim.

Serenity's Case Study

Let’s examine Serenity’s auto insurance policy more closely. Her policy includes a $500 deductible, which means that if she gets into an accident and incurs damages of $3,000, she will need to pay the first $500. The insurance company will then cover the remaining $2,500.

Personal Information and Data Table

| Name | Insurance Company | Deductible | Coverage Amount |

|---|---|---|---|

| Serenity | XYZ Insurance Co. | $500 | $10,000 |

This scenario highlights the financial implications of her deductible. If Serenity has a history of accidents or is in a high-risk area, she may want to consider how often she might need to use her insurance and whether a $500 deductible is manageable for her budget.

Benefits of a $500 Deductible

Choosing a $500 deductible can have several advantages for Serenity:

- Lower Premiums: A $500 deductible typically results in lower monthly premiums compared to higher deductibles.

- Affordability: For many policyholders, a $500 out-of-pocket expense is manageable in the event of an accident.

- Encourages Responsible Driving: Knowing that a deductible must be paid may encourage safer driving habits.

Drawbacks of a $500 Deductible

However, there are also some drawbacks to consider:

- Out-of-Pocket Expense: In the event of multiple claims, the cumulative cost of deductibles can add up quickly.

- Financial Strain: For some drivers, an unexpected accident requiring a deductible payment can strain their finances.

- Potential for Higher Premiums: While a $500 deductible may lower premiums compared to higher deductibles, it is still important to shop around for the best rates.

The Role of Insurance Companies

Insurance companies play a vital role in managing deductibles. They assess risk based on various factors, such as driving history, the type of vehicle, and geographical location. Here’s how they determine premiums and manage deductibles:

- Risk Assessment: Insurance companies use algorithms to analyze the likelihood of claims based on a policyholder's profile.

- Premium Calculation: Deductibles affect premium rates; higher deductibles usually lead to lower premiums.

- Claims Management: When a claim is filed, insurance companies evaluate the damages and ensure that the deductible is applied correctly.

How to Choose the Right Deductible

Choosing the right deductible involves evaluating personal financial situations and driving habits. Here are some tips for Serenity and other drivers:

- Assess Financial Comfort: Consider how much you can afford to pay out-of-pocket in case of an accident.

- Evaluate Driving History: If you have a clean driving record, a higher deductible might save you money on premiums.

- Consider Vehicle Value: For older or less valuable vehicles, a higher deductible may be more logical.

Financial Planning and Auto Insurance

Auto insurance is a critical component of financial planning. Serenity, like many others, needs to incorporate her auto insurance into her broader financial strategy:

- Budgeting for Deductibles: Set aside funds to cover potential deductibles, ensuring you are prepared for unexpected expenses.

- Review Policies Regularly: Changing life circumstances, such as moving or changes in income, may necessitate a review of your insurance policy.

- Shop Around: Always compare insurance policies from different providers to find the best coverage and deductible options.

Conclusion

In summary, understanding the implications of a $500 deductible on Serenity's auto insurance is vital for making informed financial decisions. While it may offer lower premiums and manageable out-of-pocket expenses, it also presents challenges that require careful consideration.

We encourage readers to evaluate their insurance policies regularly and consider how deductibles fit into their overall financial strategy. If you have any experiences or insights regarding auto insurance deductibles, please leave a comment below or share this article with others who may benefit from it!

Thank you for reading, and we hope to see you back for more insightful articles in the future!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8tLHRnqWirKlitaK%2FjJpkbmhgYrGmsNScq6KanJp6sLqMoZyrZZGqwbB5yKeqrqqRo7CmeceeqWahnqjCs63NnJxmm5%2BivaK62GefraWc