When it comes to securing a mortgage, understanding the requirements for an FHA loan is essential for potential homebuyers. FHA loans, backed by the Federal Housing Administration, offer a viable option for individuals and families looking to purchase a home with less stringent requirements than conventional loans. In this comprehensive guide, we will explore the criteria for obtaining an FHA loan, the benefits it offers, and tips for a successful application.

Whether you're a first-time homebuyer or looking to refinance your current mortgage, knowing the requirements for an FHA loan can help you make informed decisions. The FHA loan program is designed to assist those with lower credit scores or limited financial resources, making homeownership more accessible. In the following sections, we will delve into the various aspects of FHA loans, providing you with the knowledge you need to navigate the application process smoothly.

Let's explore the requirements for an FHA loan, including credit score, down payment, debt-to-income ratio, and more. By the end of this article, you will have a clear understanding of what it takes to qualify for an FHA loan and how to prepare for the application process.

Table of Contents

Overview of FHA Loans

The Federal Housing Administration (FHA) was established in 1934 to promote homeownership among Americans, especially in the wake of the Great Depression. FHA loans are designed to lower the barriers for homebuyers, making it easier for individuals with lower credit scores or limited savings to qualify for a mortgage. Here are some key features of FHA loans:

- Lower down payment requirements (as low as 3.5%)

- Flexible credit score criteria

- Assumable mortgages

- Higher debt-to-income ratio allowances

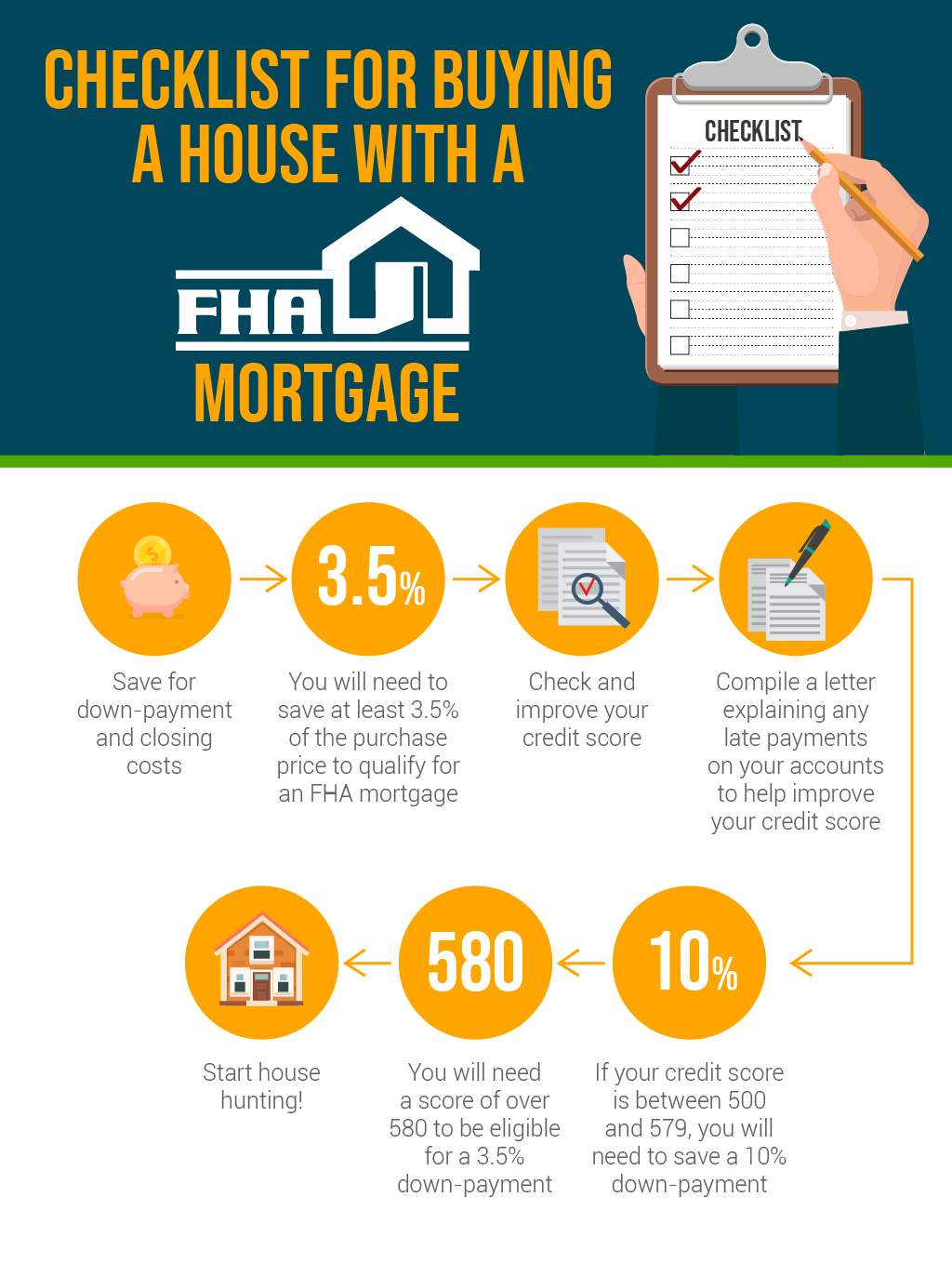

Credit Score Requirements

One of the primary requirements for an FHA loan is the borrower's credit score. Unlike conventional loans, which may require a higher score, FHA loans have more lenient criteria:

- A minimum credit score of 580 is required for a 3.5% down payment.

- If your credit score is between 500 and 579, you may still qualify, but a 10% down payment is required.

It's important to note that lenders may have their own additional requirements, so it's advisable to shop around to find the best terms.

Down Payment Requirements

One of the most appealing aspects of FHA loans is the low down payment requirement. Here’s a breakdown of what you need to know:

- 3.5% down payment for borrowers with a credit score of 580 or higher.

- 10% down payment for those with a credit score between 500 and 579.

- The down payment can come from various sources, including gifts from family or grants.

Additionally, FHA loans allow for the use of down payment assistance programs, making it easier for first-time homebuyers to enter the market.

Debt-to-Income Ratio

Another critical factor in qualifying for an FHA loan is the debt-to-income (DTI) ratio. This ratio helps lenders evaluate your ability to manage monthly payments. Here’s what you should know:

- The FHA generally allows a DTI ratio of up to 43%.

- In certain cases, a DTI of up to 50% may be permissible with compensating factors.

To calculate your DTI ratio, add up all monthly debt payments (including your mortgage, car loans, student loans, and credit card payments) and divide that total by your gross monthly income.

Employment History

Having a stable employment history is essential when applying for an FHA loan. Lenders typically look for the following:

- A minimum of two years of steady employment in the same field.

- Any gaps in employment should be explained.

- Self-employed individuals may need to provide additional documentation, such as tax returns.

Property Requirements

FHA loans can only be used to purchase properties that meet specific criteria. Here are some key property requirements:

- The property must be the borrower's primary residence.

- It must meet FHA minimum property standards, including safety and habitability.

- FHA loans can be used for single-family homes, multi-family homes (up to four units), and some condominiums.

Closing Costs

Closing costs can add a significant expense to your home purchase. For FHA loans, borrowers should be aware of the following:

- Closing costs typically range from 2% to 5% of the loan amount.

- FHA allows sellers to contribute up to 6% of the sale price toward closing costs.

It’s crucial to budget for these costs and discuss them with your lender during the application process.

Applying for an FHA Loan

Now that you understand the requirements for an FHA loan, here are some tips for a successful application:

- Gather necessary documentation, including income statements, bank statements, and tax returns.

- Check your credit report and address any discrepancies.

- Consider getting pre-approved to streamline the home-buying process.

Working with a knowledgeable lender who specializes in FHA loans can also help navigate the application process effectively.

Conclusion

In summary, understanding the requirements for an FHA loan is crucial for potential homebuyers. With lower credit score thresholds, minimal down payment options, and flexible debt-to-income ratios, FHA loans provide an accessible pathway to homeownership. By preparing adequately and working with experienced professionals, you can increase your chances of securing an FHA loan and achieving your dream of owning a home.

We encourage you to leave a comment below with any questions or share your experiences regarding FHA loans. Don’t forget to explore our other articles for more helpful insights on home financing!

Final Thoughts

Thank you for taking the time to read our comprehensive guide on the requirements for an FHA loan. We hope you found it informative and helpful. Please visit our site again for more valuable content and resources to assist you in your home-buying journey.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8s7HQrqCrnZ2au7W%2FjJ%2Bmq2WRo3qntMBmo6iZnmO1tbnL