Are you looking to understand the financial implications of an approximate interest factor of 11.9? This article will delve into the intricacies of interest factors, their calculations, and their significance in financial planning. In today's economic landscape, understanding interest rates and their effects on finances is crucial. The approximate interest factor serves as a vital tool for individuals and businesses alike, helping them make informed decisions about loans, investments, and savings. This article aims to provide a comprehensive overview of the approximate interest factor of 11.9, ensuring you grasp its importance and application in real-world scenarios.

In the following sections, we will explore the concept of interest factors, how they are calculated, and the implications of an interest factor of 11.9. Additionally, we will provide practical examples to enhance your understanding. By the end of this article, you will be equipped with the knowledge needed to navigate financial decisions effectively.

Whether you are a student of finance, a potential borrower, or simply someone interested in better managing your finances, this article will serve as a valuable resource. Let's embark on this journey to understand the approximate interest factor of 11.9 and its significance in your financial life.

Table of Contents

What is an Interest Factor?

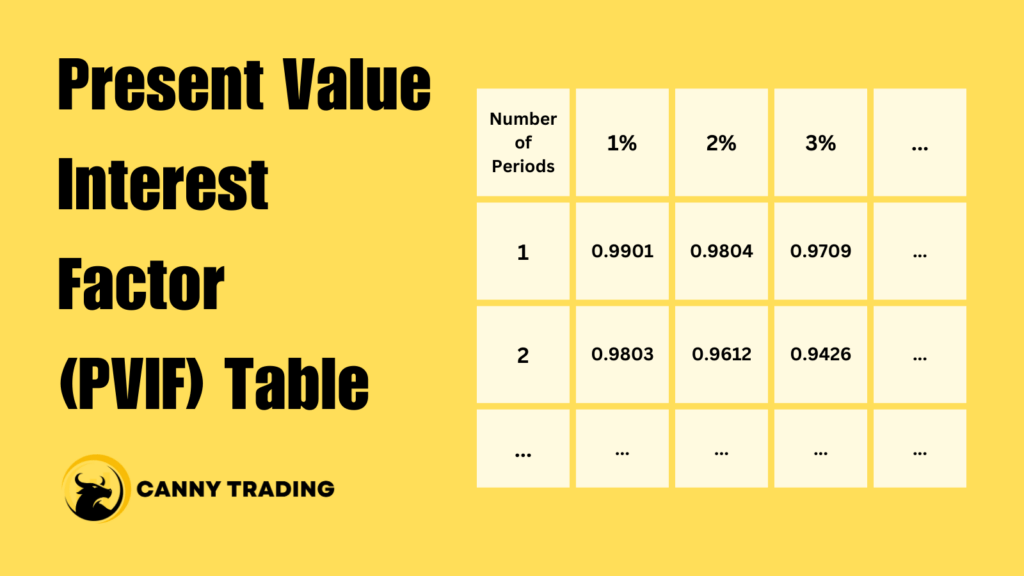

An interest factor is a numerical value that represents the cost of borrowing or the return on investment over a specific period. It is often used in financial calculations to determine the total interest payable or receivable over the life of a loan or investment. Understanding interest factors is crucial for making informed financial decisions.

Types of Interest Factors

- Simple Interest Factor: Used for loans or investments where interest is calculated only on the principal amount.

- Compound Interest Factor: Used for loans or investments where interest is calculated on the initial principal and also on the accumulated interest from previous periods.

Importance of Interest Factors in Finance

Interest factors play a significant role in personal and business finance. They help borrowers understand the cost of loans and assist investors in assessing the profitability of their investments. Some key points regarding their importance include:

- Provides clarity on loan repayments.

- Helps in budgeting and financial planning.

- Facilitates comparisons between different financial products.

How to Calculate the Interest Factor

The calculation of interest factors varies based on whether simple or compound interest is used. Below are the formulas for both:

Simple Interest Factor Formula

Simple Interest Factor (SIF) = Principal x Rate x Time

Compound Interest Factor Formula

Compound Interest Factor (CIF) = Principal x (1 + Rate)^Time

Understanding the Approximate Interest Factor of 11.9

The approximate interest factor of 11.9 is often used in financial analyses to estimate loan repayments or investment returns. This factor indicates a relatively high-interest rate, which can have significant implications for borrowers and investors alike. It's essential to understand what this factor means in practical terms.

Implications of an Interest Factor of 11.9

- Loan Repayments: A loan with an interest factor of 11.9 will result in higher monthly payments compared to lower interest rates.

- Investment Returns: Investors should be aware that a high-interest factor can limit the potential for profit if the investment does not outperform the interest rate.

Real-World Examples of 11.9 Interest Factor

To illustrate how an approximate interest factor of 11.9 works in practice, consider the following examples:

- Personal Loan: If you take a personal loan of $10,000 for 3 years at an interest factor of 11.9, your monthly payment would be significantly higher than a loan at a 6% interest factor.

- Investment Scenario: If you invest $5,000 in a venture with an expected return of 11.9%, you need to ensure that the investment can realistically achieve that return to justify the risk.

Impact of Interest Factor on Loans and Investments

The interest factor directly influences the overall cost of loans and the potential returns on investments. Here are some points to consider:

- Debt Management: High-interest factors can lead to debt accumulation, making it essential for borrowers to manage their finances carefully.

- Investment Strategy: Investors should tailor their strategies based on the interest factors to optimize their returns.

Key Takeaways

Understanding the approximate interest factor of 11.9 is crucial for anyone looking to navigate the financial landscape effectively. Remember the following points:

- Interest factors help in determining loan costs and investment returns.

- An interest factor of 11.9 indicates a high cost of borrowing.

- Effective financial management is essential to mitigate the risks associated with high-interest factors.

Conclusion

In summary, the approximate interest factor of 11.9 has significant implications for both borrowers and investors. By understanding how interest factors work, you can make informed decisions that positively impact your financial future. If you have any questions or would like to share your experiences regarding interest factors, please leave a comment below. Don't forget to share this article with others who may benefit from this information!

We hope this article has provided valuable insights into the approximate interest factor of 11.9. Stay tuned for more informative content, and we look forward to seeing you back on our site!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8r7HEnWStoJVirrG80aivoqWRqbJutc2tnKudo6l6p63CraarZZmoenJ9mGefraWc