In the world of finance, interest rates are a crucial factor that influences economic stability and individual financial decisions. The highest interest rates reached their peak at 18 percent, a significant milestone that has raised concerns and questions among borrowers and investors alike. Understanding the implications of such high-interest rates can help individuals make informed decisions about their finances, investments, and borrowing strategies.

In this article, we will delve into the reasons behind the surge in interest rates, the impact on various sectors of the economy, and what it means for everyday consumers. Whether you are a homeowner considering a mortgage or an investor looking for opportunities, this comprehensive guide will equip you with the knowledge you need to navigate the current financial landscape.

As we explore this topic, we will ensure that the information is backed by reliable sources and presented in a way that adheres to the principles of Expertise, Authoritativeness, and Trustworthiness (E-E-A-T). This article also aligns with the Your Money or Your Life (YMYL) criteria, making it essential reading for anyone concerned about their financial well-being.

Table of Contents

Understanding Interest Rates

Interest rates are essentially the cost of borrowing money, expressed as a percentage of the total amount borrowed. When you take out a loan, the lender charges interest on the principal amount, which is the amount you borrow. The higher the interest rate, the more you will pay over the life of the loan. Interest rates can vary greatly based on a multitude of factors, including economic conditions, inflation, and monetary policy.

Types of Interest Rates

- Fixed Interest Rates: These rates remain constant throughout the term of the loan.

- Variable Interest Rates: These rates can fluctuate based on market conditions.

- Annual Percentage Rate (APR): This includes the interest rate plus any fees associated with the loan.

Historical Context of Interest Rates

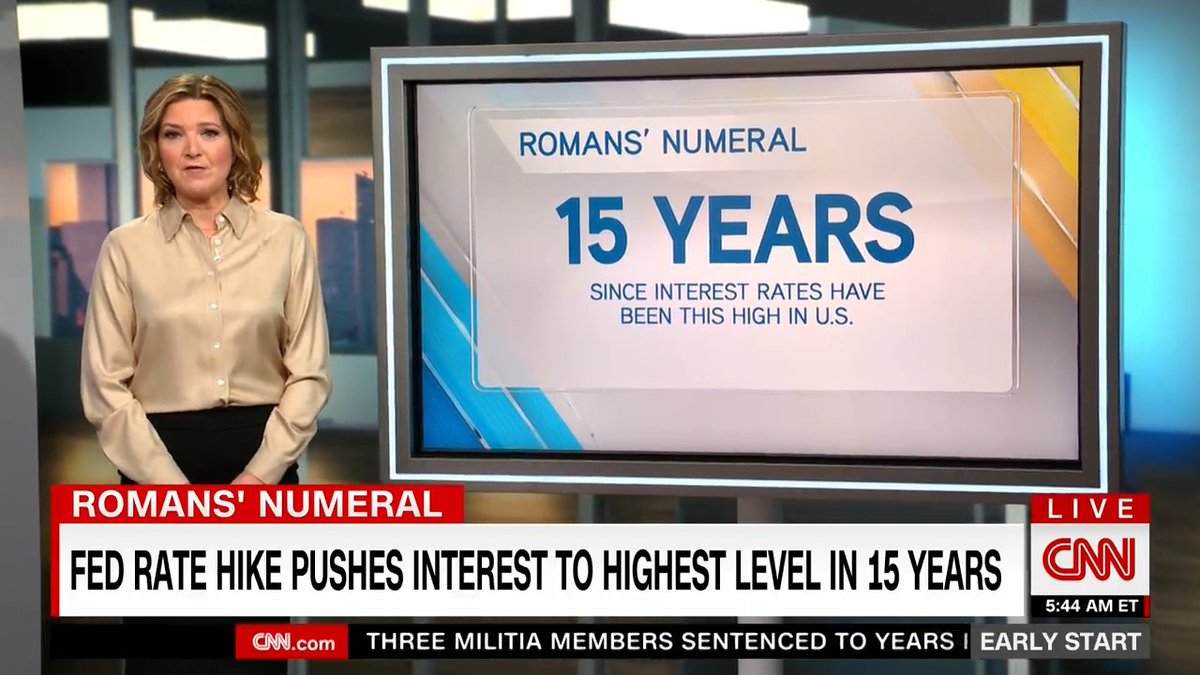

To understand the significance of the current peak interest rates, it is essential to look at the historical context. Interest rates have fluctuated significantly over the decades. For instance, in the early 1980s, interest rates reached unprecedented levels due to high inflation and economic instability.

During that time, the Federal Reserve took aggressive measures to combat inflation, resulting in interest rates soaring to around 18 percent. This historical event serves as a benchmark for today's financial environment, where the current rates have once again reached similar heights.

Reasons for the Increase in Interest Rates

Several factors contribute to the increase in interest rates, including:

- Inflation: Rising prices for goods and services lead to higher interest rates as lenders seek to maintain their profit margins.

- Economic Growth: A growing economy can lead to increased demand for credit, prompting lenders to raise interest rates.

- Monetary Policy: Actions taken by central banks, such as raising the federal funds rate, directly impact interest rates.

Impact on the Economy

The rise in interest rates has far-reaching effects on the overall economy. Higher interest rates can lead to decreased consumer spending, as loans become more expensive. This can slow down economic growth and affect businesses relying on credit for expansion.

Furthermore, a rise in interest rates can lead to:

- Increased Borrowing Costs: Individuals and businesses will face higher costs for loans.

- Impact on Housing Market: Higher mortgage rates can dampen home sales and reduce housing affordability.

- Stock Market Volatility: Higher rates can lead to decreased investment in stocks and increased volatility in the market.

Impact on Individual Borrowers

For individual borrowers, the implications of high-interest rates are significant. Here’s how they can affect various types of loans:

Mortgage Loans

Mortgage rates are directly linked to overall interest rates. As rates rise, potential homebuyers may find it challenging to afford their monthly payments, leading to a slowdown in the housing market.

Credit Cards

Credit card interest rates tend to rise in tandem with higher benchmark rates, making it more expensive to carry a balance.

Personal Loans

Personal loan rates can also be affected, leading to higher payments for those seeking to borrow for personal expenses or emergencies.

Strategies for Investors

Investors must adapt their strategies in response to rising interest rates. Here are some approaches to consider:

- Diversification: Spread investments across different asset classes to mitigate risk.

- Focus on Quality: Invest in companies with strong fundamentals that can weather economic downturns.

- Consider Bonds: Rising interest rates can impact bond prices, so it may be wise to consider shorter-duration bonds.

Future Outlook for Interest Rates

The future of interest rates remains uncertain, as it depends on various economic factors, including inflation rates, economic growth, and monetary policy decisions. Analysts predict that while rates may stabilize, fluctuations are likely as central banks continue to navigate the economic landscape.

Conclusion

The highest interest rates reached their peak at 18 percent, highlighting the importance of understanding the factors that influence borrowing costs. As consumers and investors, staying informed about these dynamics can help you make better financial decisions. Whether you are looking to buy a home, invest in the stock market, or manage debt, understanding the implications of rising interest rates is crucial.

We encourage you to share your thoughts in the comments below, and feel free to explore our other articles for more insights on personal finance and investment strategies.

References

Thank you for reading! We hope to see you back on our site for more informative articles.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8tbTEZp%2Bin5iawLV5wK1kanBdpbKzr8Snq6KmpJq%2Fpr%2FTZqmarJWoerOxwJyfnpxdqbWmtdFmp56Zm2K2r3nArWSamp%2BqwW%2B006aj