Gross profit equals the revenue from sales minus the cost of goods sold (COGS), a fundamental concept for any business. Understanding this metric is essential for evaluating a company’s financial health and operational efficiency. In this article, we will delve into what gross profit is, how it is calculated, and its significance for businesses of all sizes.

Gross profit serves as a crucial indicator of a company's profitability and efficiency. By assessing the gross profit, business owners and investors can gain insights into how well a company is managing its production costs and pricing strategies. This understanding not only helps in making informed decisions but also aids in strategic planning for future growth.

Moreover, a solid grasp of gross profit allows businesses to set realistic financial goals and benchmarks. In an increasingly competitive marketplace, utilizing gross profit data can offer a substantial advantage, enabling companies to identify trends, optimize operations, and enhance overall profitability.

Table of Contents

What is Gross Profit?

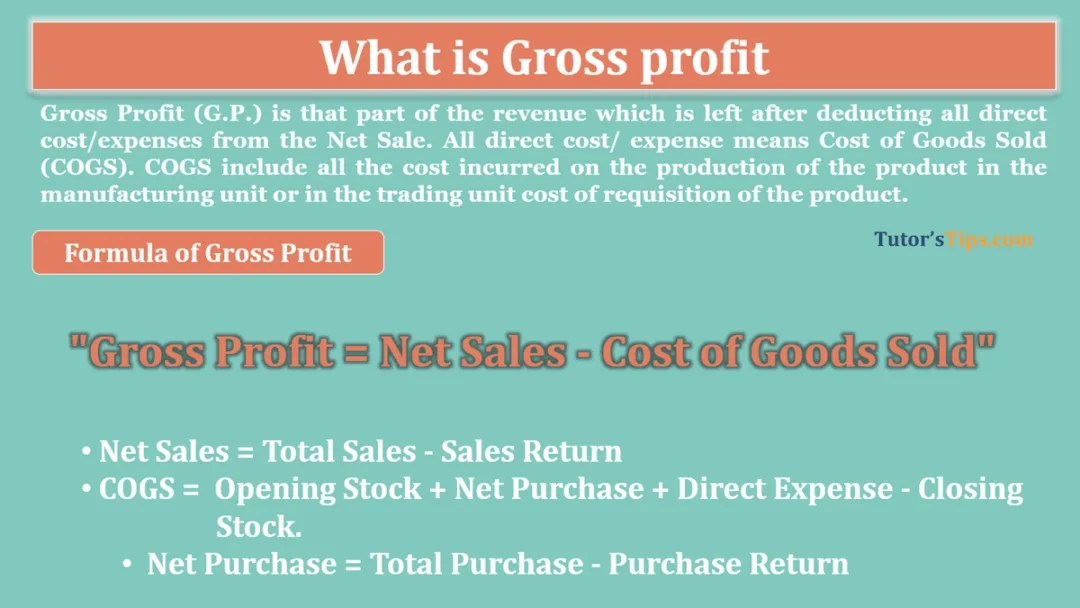

Gross profit is the amount of money a company makes after deducting the costs associated with producing its goods or services. It does not take into account operational expenses, taxes, or interest on debt. Understanding gross profit is crucial for analyzing the basic profitability of a company's core operations.

Components of Gross Profit

- Revenue: The total income generated from sales of goods or services.

- Cost of Goods Sold (COGS): The direct costs attributable to the production of the goods sold in a company.

Formula for Gross Profit

The formula to calculate gross profit is straightforward:

Gross Profit = Revenue - Cost of Goods Sold (COGS)

For example, if a business generates $500,000 in revenue and incurs $300,000 in COGS, the gross profit would be:

Gross Profit = $500,000 - $300,000 = $200,000

Importance of Gross Profit

Understanding gross profit is vital for several reasons:

- Performance Measurement: Gross profit is a key indicator of a company's operational efficiency and pricing strategies.

- Investment Decisions: Investors often look at gross profit to assess a company's profitability potential.

- Budgeting and Forecasting: Businesses can use gross profit data to create more accurate financial forecasts and budgets.

Gross Profit Margin

The gross profit margin is a financial metric that shows the percentage of revenue that exceeds the cost of goods sold. It is calculated using the following formula:

Gross Profit Margin = (Gross Profit / Revenue) x 100

A higher gross profit margin indicates a more profitable company. For instance, if a business has a gross profit of $200,000 and revenue of $500,000, the gross profit margin would be:

Gross Profit Margin = ($200,000 / $500,000) x 100 = 40%

Factors Affecting Gross Profit

Several factors can influence a company's gross profit:

- Sales Volume: Higher sales can lead to increased gross profit, provided that the costs remain controlled.

- Production Costs: Reducing COGS through efficient production processes can enhance gross profit.

- Pricing Strategy: Effective pricing strategies can increase revenue without significantly raising costs.

Gross Profit vs Net Profit

While gross profit focuses solely on the revenue and direct costs associated with production, net profit takes into account all expenses, including operational costs, taxes, and interest. Here’s a simple breakdown:

- Gross Profit: Revenue - COGS

- Net Profit: Gross Profit - Operating Expenses - Taxes - Interest

How to Improve Gross Profit

Improving gross profit can be achieved through various strategies, including:

- Cost Control: Regularly review and optimize your cost of goods sold.

- Increase Prices: If the market allows, consider raising prices to boost revenue.

- Improve Sales Strategies: Enhance marketing efforts to drive sales volume.

Conclusion

In conclusion, gross profit equals the revenue from sales minus the cost of goods sold, making it a critical metric for evaluating a company's financial health. Understanding this concept can help both business owners and investors make informed decisions. By focusing on improving gross profit, businesses can enhance their overall profitability and achieve sustainable growth.

Feel free to leave a comment, share this article, or explore more insightful articles on our site.

Thank you for reading, and we hope you return for more valuable financial insights!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8qL7OrKpmqKKks6rAjJ6orpmcqHupwMyl