The topic of resident status is crucial for many individuals navigating the complexities of immigration and citizenship. In the realm of legal definitions, the term "resident" can take on various meanings depending on the context—be it for taxation, immigration, or legal rights. This article will delve deep into the nuances of resident status, particularly focusing on the differences between various types of residents and addressing the intriguing case of Demitri and his inability to attain certain status. Through this exploration, readers will gain a comprehensive understanding of the implications associated with resident status.

Understanding these distinctions is critical for anyone considering a move to a new country or assessing their own legal status. The implications of being classified as a resident can affect everything from tax obligations to access to healthcare and legal rights. This article aims to clarify these concepts and provide insights that are essential for individuals in similar situations to Demitri.

This comprehensive guide will break down the different types of resident statuses, illustrating their significance through real-world examples and legal frameworks. We encourage you to engage with the content and share your thoughts or experiences related to resident status.

Table of Contents

What is Resident Status?

Resident status refers to the legal classification of an individual based on their living arrangements within a particular country or jurisdiction. This classification can impact an individual’s rights, obligations, and benefits within that country.

In general, resident status is categorized into two main types: permanent residents and temporary residents. Each category has its own set of rules, benefits, and limitations. Understanding these classifications is essential for determining one’s legal rights and responsibilities.

For instance, permanent residents often enjoy many of the same rights as citizens, such as access to healthcare and education, but they may not have the right to vote. Temporary residents, on the other hand, usually have limited rights and are often subject to visa conditions that restrict their stay.

Types of Resident Status

There are several types of resident status, each defined by specific criteria and legal frameworks. Here are the primary categories:

- Permanent Residents: Individuals who have been granted the right to live indefinitely in a country.

- Temporary Residents: Individuals who are allowed to stay in a country for a limited period, often under specific conditions.

- Student Residents: Individuals who reside in a country primarily for educational purposes.

- Work Permit Residents: Individuals who have a visa allowing them to work in the host country.

Permanent vs Temporary Residents

The distinction between permanent and temporary residents is significant, as it affects the rights and benefits available to each group.

Permanent Residents

Permanent residents hold a resident card or similar documentation that allows them to live and work in the country without time limitations. They typically enjoy rights similar to those of citizens, such as:

- Access to social services

- Ability to sponsor family members for residency

- Pathway to citizenship after fulfilling certain criteria

Temporary Residents

Temporary residents, however, are subject to certain conditions and restrictions, such as:

- A fixed duration of stay

- Restrictions on work or study

- Obligations to maintain their visa status

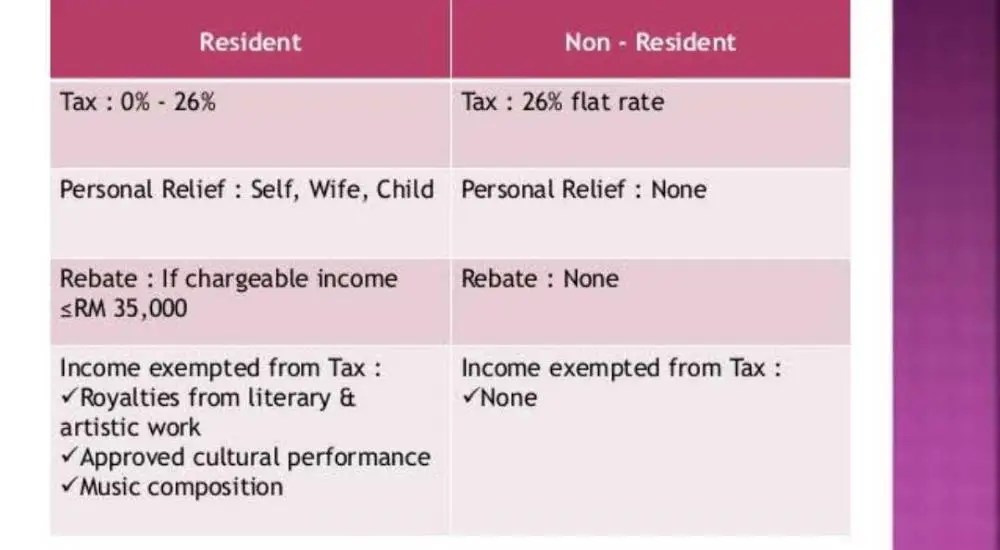

Tax Implications for Residents

Tax obligations vary significantly based on resident status. Understanding these implications is crucial for compliance and financial planning.

Permanent residents are typically taxed on their worldwide income, while temporary residents may only be taxed on income earned within the country. This distinction can lead to varying tax liabilities, making it essential for individuals to fully understand their resident status and its implications.

Demitri's Case Study

Demitri's situation serves as a compelling example of the challenges faced by individuals navigating resident status. Demitri, a temporary resident, has faced limitations in accessing certain benefits that permanent residents enjoy.

Despite his contributions to the local economy and community, he finds himself at a disadvantage due to his temporary status. Understanding the intricacies of his situation can provide valuable insights for others in similar circumstances.

Some key points from Demitri's case include:

- Limited access to healthcare services

- Challenges in securing long-term employment

- Restrictions on family reunification

Common Issues Faced by Residents

Individuals with resident status often encounter various challenges, including:

- Complex legal requirements for maintaining status

- Uncertainty regarding pathways to citizenship

- Access to social services and benefits

Navigating the Residency Process

Successfully navigating the residency process requires a clear understanding of the legal requirements, necessary documentation, and potential challenges. Here are some tips for individuals looking to secure resident status:

- Research the specific requirements for your desired status.

- Gather all necessary documentation before applying.

- Consult with immigration professionals or legal experts.

Conclusion

In summary, understanding resident status is essential for anyone considering a move to a new country or seeking to clarify their legal rights. The differences between permanent and temporary residents carry significant implications for tax obligations, access to benefits, and legal rights.

We encourage readers to share their own experiences and insights regarding resident status in the comments section below. Additionally, feel free to explore other articles on our site for more information on related topics.

Thank you for reading, and we look forward to welcoming you back for more informative content in the future!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8s7HSopuepqRixKmt02agrGWknbJusMifnZ6qlaOwpnnBnquwnZWjerW0xKKpZquklsG2v8SsZJ2dnZ7Bs7WMnJinpp%2Bpe6nAzKU%3D