In today's financial landscape, the topic of interest rates is crucial for understanding economic growth and investment potential. Interest rates, which represent the cost of borrowing money, play a pivotal role in shaping the economy. They influence consumer spending, business investment, and ultimately, the overall economic health of a nation. In this article, we will explore the intricate relationship between interest rates and various economic indicators, providing insights that can help individuals and businesses make informed financial decisions.

As we delve into the nuances of interest rates, we will analyze how changes in these rates can affect economic growth, inflation, and employment levels. Additionally, we will discuss the implications of a rising or falling interest rate environment, and how it can impact different sectors of the economy. With a focus on data and statistics, this article aims to provide a comprehensive understanding of interest rates and their significance in the financial world.

By the end of this article, you will have a clearer picture of how interest rates function within the broader economic context and why they are a critical factor for both policymakers and investors. Let’s embark on this journey to uncover the dynamics of interest rates and their impact on economic growth.

Table of Contents

1. The Basics of Interest Rates

Interest rates are typically expressed as a percentage of the principal amount, which is the amount borrowed or lent. They can vary depending on a number of factors including the economic climate, inflation expectations, and central bank policies. The two main types of interest rates include:

- Nominal Interest Rates: The stated interest rate without adjustment for inflation.

- Real Interest Rates: The interest rate adjusted for inflation, providing a more accurate reflection of the purchasing power of money.

1.1 Factors Influencing Interest Rates

Several key factors can influence interest rates, including:

- Central Bank Policies: Decisions made by central banks, such as the Federal Reserve, directly impact interest rates.

- Inflation: Higher inflation typically leads to higher interest rates as lenders demand more return on their loans.

- Economic Growth: Strong economic growth can lead to increased demand for credit, resulting in higher interest rates.

2. How Interest Rates Affect Economic Growth

The relationship between interest rates and economic growth is complex. Generally, lower interest rates tend to stimulate economic growth by making borrowing cheaper for consumers and businesses. Here’s how:

- Increased Consumer Spending: Lower rates can encourage consumers to take out loans for big-ticket items, boosting overall spending.

- Business Investment: Companies are more likely to invest in expansion and new projects when borrowing costs are low.

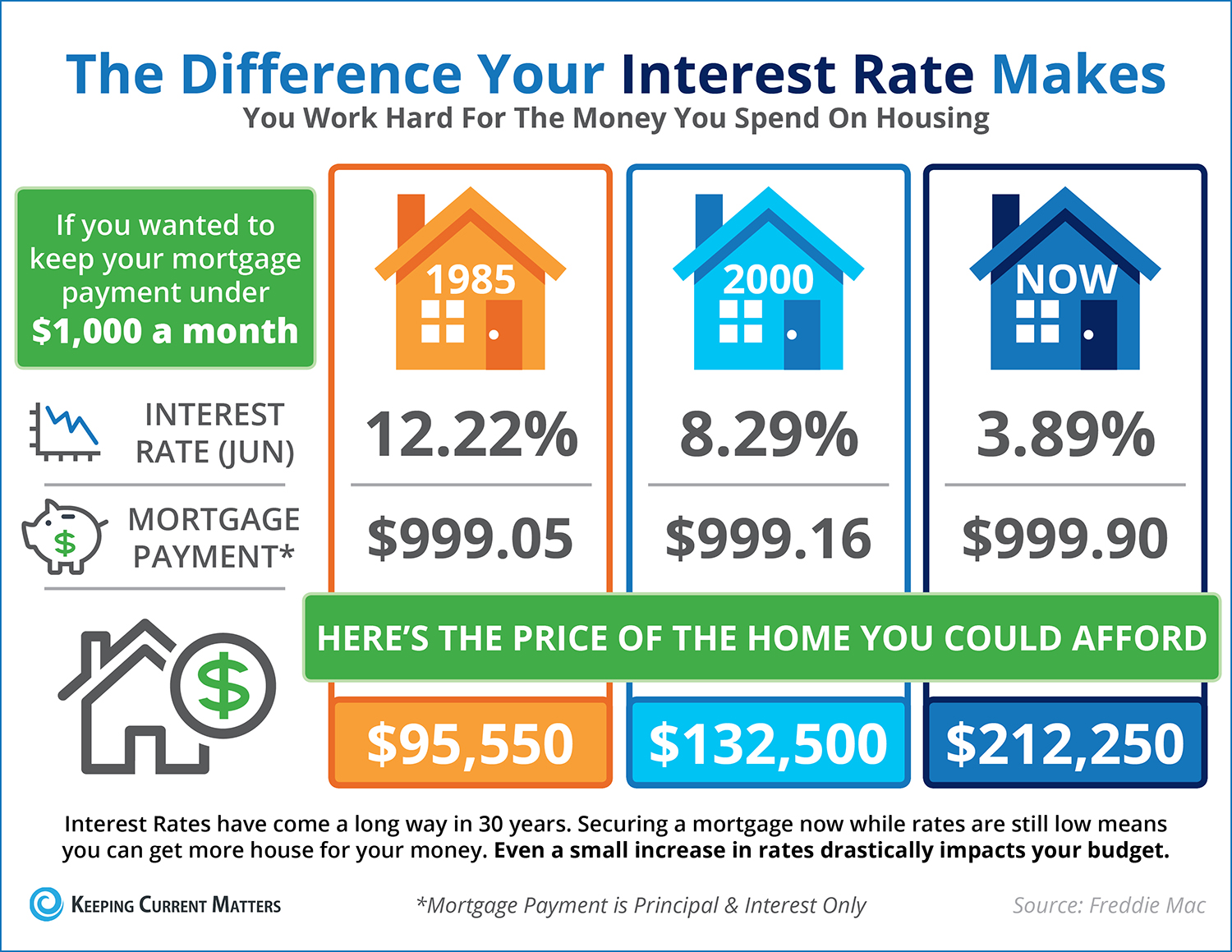

- Housing Market: Lower interest rates can lead to increased home buying, which drives demand in the housing market.

2.1 The Multiplier Effect

When interest rates are reduced, the money supply increases, leading to a multiplier effect on economic growth:

- Increased spending leads to higher production levels.

- Higher production results in more employment opportunities.

- More jobs lead to increased income, which further stimulates spending.

3. The Role of Central Banks

Central banks, such as the Federal Reserve in the United States, play a crucial role in setting interest rates. They adjust rates to influence economic activity and control inflation. Key tools used by central banks include:

- Open Market Operations: Buying and selling government securities to influence the money supply.

- Discount Rate: The interest rate charged to commercial banks for loans obtained from the central bank.

- Reserve Requirements: Regulations on the minimum amount of reserves that banks must hold against deposits.

4. Interest Rates and Inflation

Interest rates are intricately tied to inflation rates. When inflation rises, central banks often respond by increasing interest rates to keep inflation in check. Here are some key points to consider:

- Higher interest rates can curb consumer spending and business investment, potentially slowing economic growth.

- Conversely, low-interest rates can lead to increased borrowing and spending, which may further fuel inflation.

4.1 The Phillips Curve

The Phillips Curve illustrates the inverse relationship between inflation and unemployment, suggesting that low unemployment can lead to higher inflation. This relationship is key for central banks as they navigate interest rate adjustments.

5. Impact on Employment

Employment levels are significantly influenced by interest rates. Lower interest rates can lead to:

- Increased hiring as businesses expand.

- Higher consumer spending, which supports job growth in various sectors.

5.1 Job Creation and Economic Stability

When interest rates are favorable, job creation tends to increase, contributing to economic stability and growth. Conversely, rising rates can lead to layoffs and higher unemployment rates.

6. Sectoral Impact of Interest Rates

Different sectors of the economy respond differently to changes in interest rates. Here’s how key sectors react:

- Real Estate: Sensitive to interest rate changes, with lower rates typically boosting housing demand.

- Consumer Goods: Lower rates can increase consumer spending on non-essential goods.

- Financial Services: Banks benefit from higher interest margins during periods of rising rates.

7. Historical Trends

Examining historical trends in interest rates provides valuable insights into their impact on the economy. For example:

- The 2008 financial crisis led to unprecedented low interest rates to stimulate recovery.

- The subsequent years saw a gradual increase in rates as the economy strengthened.

8. Conclusion and Call to Action

In conclusion, understanding the relationship between interest rates and economic growth is essential for making informed financial decisions. Interest rates impact consumer behavior, business investment, and overall economic health. As we move forward, it is important to stay informed about interest rate trends and their implications for your financial future.

We encourage you to leave your thoughts in the comments below, share this article with others, and explore more of our content to enhance your financial knowledge.

Thank you for reading, and we look forward to seeing you again on our site!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8orrDZqCnrJWnsrTAjKuYrZ1dnsBuu81mq6GdXa56osTIrGSfqp%2BienZ506hka2hdnrtutc2cqZ6llaPBtHnOn2RuZaSdsm%2B006aj