In the world of business, managing finances efficiently is crucial for success, and understanding working capital needs is a significant part of that equation. One common scenario that many businesses face is the requirement of additional funds to cover working capital needs. This article will dive deep into the implications of needing an additional $5,000, exploring why this amount is often necessary, how it affects operations, and what businesses can do to ensure they maintain healthy working capital levels.

Working capital is essentially the funds available for day-to-day operations. It is calculated by subtracting current liabilities from current assets. If a business finds itself in a position where it requires an additional $5,000 for working capital, it typically indicates that there are underlying issues or opportunities that need to be addressed. This article will explore those factors in detail.

By the end of this article, you will have a clearer understanding of the importance of working capital, how to manage it effectively, and the steps you can take if your business finds itself in need of additional funds. Let’s begin by breaking down the concept of working capital.

Table of Contents

What is Working Capital?

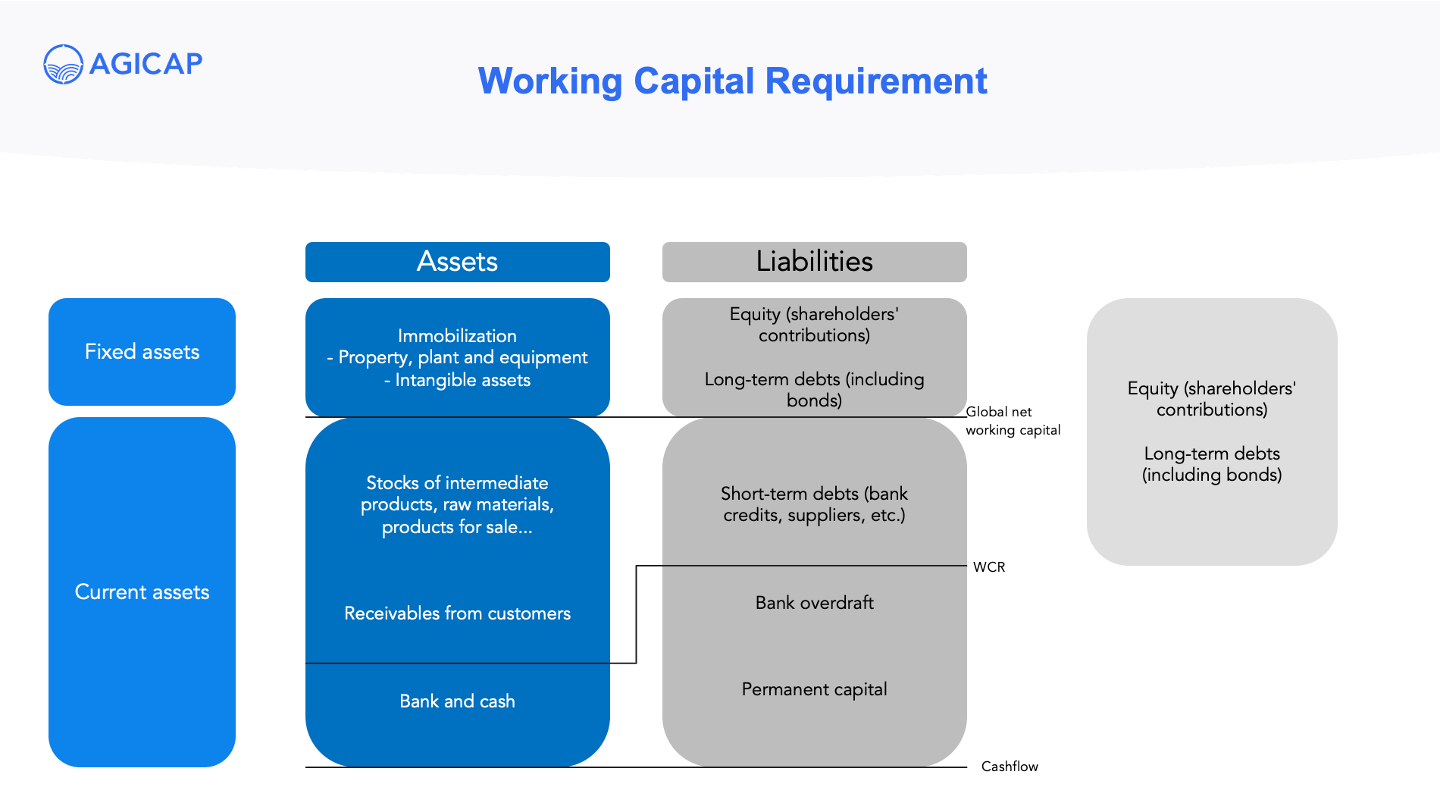

Working capital represents the short-term liquidity of a business, which is essential for covering operational costs and maintaining smooth business operations. It is calculated using the formula:

Working Capital = Current Assets - Current Liabilities

Current assets typically include cash, accounts receivable, and inventory, while current liabilities include accounts payable and short-term loans. A positive working capital indicates that a company can meet its short-term obligations, while a negative working capital means the opposite.

Importance of Working Capital

Maintaining adequate working capital is vital for several reasons:

- Operational Efficiency: Sufficient working capital ensures that a business can cover day-to-day expenses without interruption.

- Financial Stability: It provides a buffer against unexpected expenses or downturns in revenue.

- Investment Opportunities: With adequate working capital, businesses can invest in growth opportunities as they arise.

Common Reasons for Needing Additional Funding

There are several reasons why a business might find itself needing an additional $5,000 to cover working capital needs:

- Seasonal Fluctuations: Many businesses experience seasonal variations in income, which can lead to short-term cash flow issues.

- Inventory Purchases: The need to purchase inventory before peak sales periods can strain working capital.

- Unexpected Expenses: Unforeseen expenses, such as equipment repairs, can deplete working capital reserves.

- Slow-paying Customers: If customers delay payments, this can create cash flow challenges.

How to Manage Working Capital Effectively

Effective management of working capital is essential for ensuring that a business remains solvent and operational. Here are some strategies:

- Monitor Cash Flow: Regularly track cash inflows and outflows to identify potential shortfalls early.

- Optimize Inventory Levels: Maintain optimal inventory levels to avoid overstocking or stockouts.

- Negotiate Payment Terms: Work with suppliers to extend payment terms, giving the business more time to generate revenue.

- Encourage Prompt Payments: Implement strategies to encourage customers to pay invoices promptly.

Ways to Secure Additional Funding

When businesses find themselves in need of additional working capital, there are several avenues they can explore:

- Business Loans: Traditional loans from banks or credit unions can provide the required funds.

- Lines of Credit: A line of credit offers flexible funding that can be used as needed.

- Invoice Financing: This involves selling unpaid invoices to a third party for immediate cash.

- Crowdfunding: Platforms like Kickstarter or GoFundMe can help businesses raise funds from the public.

Impact of Inadequate Working Capital

Failing to maintain adequate working capital can have serious consequences:

- Inability to Meet Obligations: Businesses may struggle to pay suppliers or employees.

- Loss of Creditworthiness: Poor cash flow can lead to a decline in credit ratings, making future borrowing more difficult.

- Stunted Growth: Lack of funds can prevent businesses from seizing growth opportunities.

Case Study: A Business Needing $5,000

Consider a small retail business that experiences seasonal fluctuations in sales. As summer approaches, the owner realizes that they need an additional $5,000 to purchase inventory for the peak season. Without this funding, they risk losing sales opportunities and disappointing customers. By securing a short-term loan, they can cover their working capital needs and ensure that they are stocked adequately for the busy months ahead.

Conclusion

In conclusion, the need for an additional $5,000 to cover working capital needs is a critical issue that many businesses face. Understanding the importance of working capital, the reasons behind its fluctuations, and the strategies for managing it effectively can help businesses navigate financial challenges. If you find yourself in a similar situation, consider exploring various funding options and take proactive steps to maintain healthy working capital levels.

We encourage you to leave your thoughts in the comments below, share this article with others who may find it useful, and explore more resources on our site for additional insights into managing your business finances.

Thank you for reading, and we hope to see you back here for more valuable content!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8sLKMmqVmmZSZtrW1zqeYpWVlZX1xedaorKWcXZeybr7EqqyiqpWZerW7jJymr52iYsSwvsqipaBlk5a9qsDApWSnnZWZwG%2B006aj