The degree of operating leverage (DOL) is a crucial financial metric that helps businesses understand how their operating income changes with respect to sales. By analyzing last year's performance, companies can gain valuable insights into their cost structure and how it impacts profitability. In this article, we will explore the concept of DOL, its significance, and how businesses can leverage this information for better financial planning.

Operating leverage is a financial concept that reflects the proportion of fixed costs in a company's cost structure. A higher degree of operating leverage indicates that a company has a larger portion of fixed costs relative to variable costs, which magnifies the impact of sales fluctuations on operating income. Understanding DOL is essential for businesses aiming to optimize their operational efficiency and enhance profitability.

In this article, we will delve into the details of the degree of operating leverage based on last year's performance. We will also provide insights into how companies can utilize this information to make informed decisions, improve financial forecasting, and ultimately drive growth. Whether you are a business owner, an investor, or a financial analyst, understanding DOL will equip you with the knowledge to navigate the complexities of financial management.

Table of Contents

What is Degree of Operating Leverage?

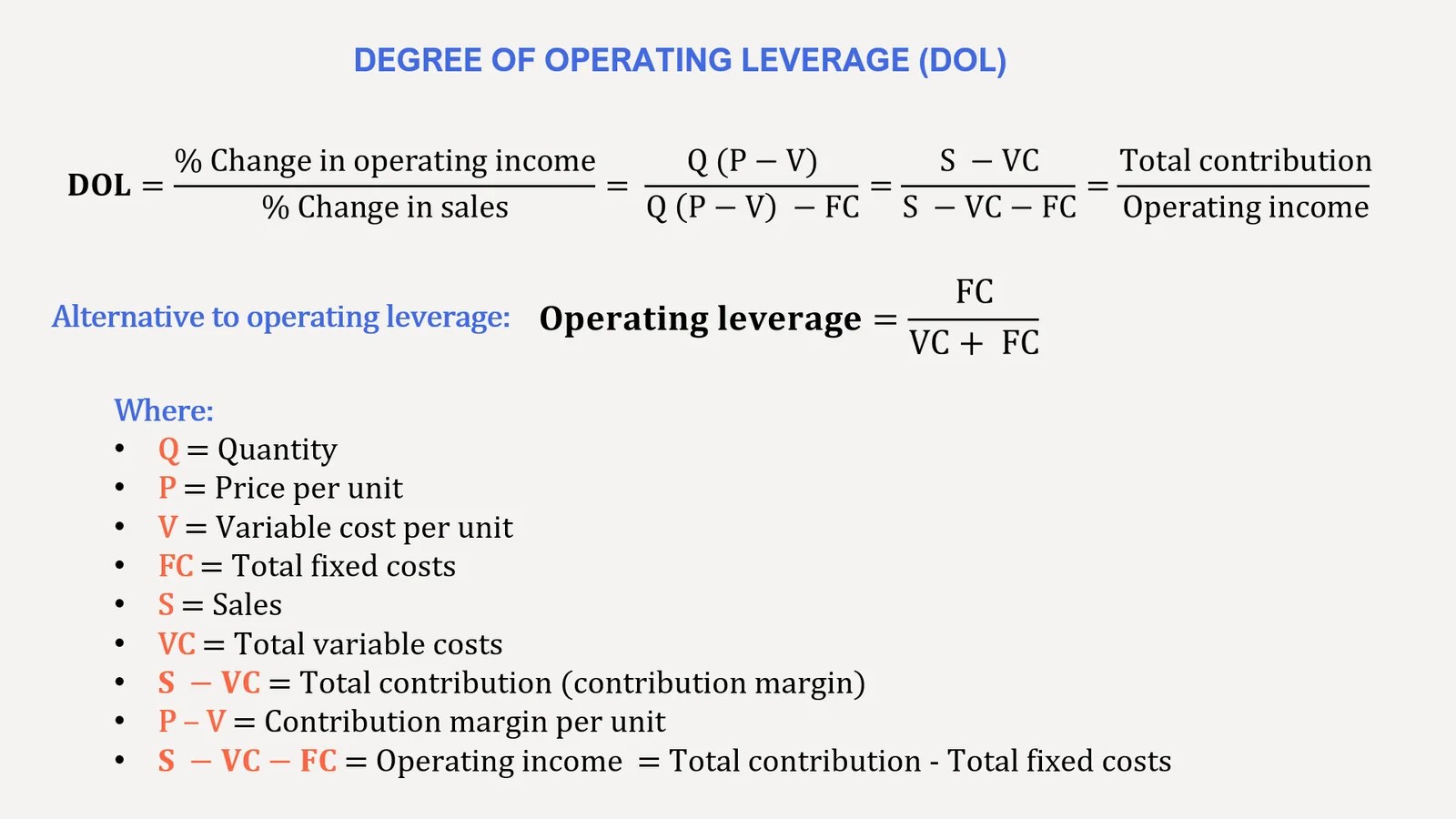

The degree of operating leverage (DOL) measures how a percentage change in sales volume will affect the operating income of a company. Specifically, it indicates the sensitivity of a company's operating income to changes in sales. The formula to calculate DOL is:

DOL = % Change in Operating Income / % Change in Sales

For example, if a company experiences a 10% increase in sales and the operating income rises by 30%, the DOL would be:

- DOL = 30% / 10% = 3

This means that for every 1% increase in sales, the operating income increases by 3%. A DOL greater than 1 indicates that the company has a higher proportion of fixed costs, which can lead to greater profitability when sales increase but also poses risks when sales decline.

Importance of Degree of Operating Leverage

Understanding DOL is vital for several reasons:

- Profitability Analysis: DOL provides insight into how profits will change with sales fluctuations, enabling businesses to assess risk and prepare for varying market conditions.

- Cost Structure Evaluation: By analyzing DOL, companies can evaluate their cost structures and make informed decisions about fixed and variable costs.

- Investment Decisions: Investors use DOL to assess the risk and return profile of businesses, influencing their investment choices.

How to Calculate Degree of Operating Leverage

Calculating DOL based on last year's data involves several steps:

For example, if last year's sales were $1,000,000 and operating income was $200,000, and this year sales are $1,100,000 with an operating income of $260,000:

- % Change in Sales = ($1,100,000 - $1,000,000) / $1,000,000 = 10%

- % Change in Operating Income = ($260,000 - $200,000) / $200,000 = 30%

- DOL = 30% / 10% = 3

Factors Affecting Degree of Operating Leverage

Several factors can influence the degree of operating leverage:

- Cost Structure: Companies with high fixed costs will have a higher DOL.

- Sales Volume: The level of sales can impact how fixed costs are spread, affecting DOL.

- Market Conditions: Economic downturns or growth phases can influence sales and operating income, thus affecting DOL.

DOL’s Impact on Financial Decision Making

Understanding DOL aids companies in making strategic financial decisions, such as:

- Pricing Strategies: Companies may adjust pricing based on their DOL to maximize profits during periods of high sales.

- Cost Management: Businesses can identify areas to reduce fixed costs or improve variable cost efficiency.

- Investment Planning: DOL helps in forecasting future profits, which is crucial for making investment decisions.

Case Study: Analyzing Last Year's DOL

To illustrate the importance of DOL, let's consider a hypothetical company, XYZ Corp, which operates in the technology sector. Last year, XYZ Corp reported:

| Metric | Last Year |

|---|---|

| Sales | $1,500,000 |

| Operating Income | $450,000 |

This year, sales increased to $1,800,000, resulting in an operating income of $600,000. Calculating DOL:

- % Change in Sales = ($1,800,000 - $1,500,000) / $1,500,000 = 20%

- % Change in Operating Income = ($600,000 - $450,000) / $450,000 = 33.33%

- DOL = 33.33% / 20% = 1.67

This DOL indicates that for every 1% increase in sales, operating income rises by approximately 1.67%, reflecting a balanced cost structure for XYZ Corp.

Limitations of Degree of Operating Leverage

While DOL is a useful metric, it has limitations:

- Static Measure: DOL is calculated based on historical data and may not accurately predict future performance.

- Ignores External Factors: DOL does not account for market changes, competition, or economic conditions that could impact sales and operating income.

Conclusion

In conclusion, the degree of operating leverage based on last year's performance serves as a vital tool for businesses to understand their cost structure and profitability dynamics. By analyzing DOL, companies can make informed decisions regarding pricing, cost management, and investment planning. As businesses navigate the complexities of the market, leveraging insights from DOL can ultimately lead to enhanced financial performance and sustainable growth.

We encourage readers to share their thoughts on the degree of operating leverage and its application in their business strategies. Feel free to leave a comment or share this article with others who may find it helpful.

Thank you for reading! We hope you found this article informative and valuable. Don't forget to explore more of our content for deeper insights into financial management and business strategies.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8pbHGq5yeZZ%2BberC8xKuYraGenHqtsdWeqZqflWKvsL%2FEnWSopl2hrrTAjLKcmqqjY7W1ucs%3D