The GDP deflator is a crucial economic indicator that reflects the level of prices of all new, domestically produced, final goods and services in an economy. Understanding how various services influence this metric is essential for economists, policymakers, and business owners alike. In this comprehensive article, we will delve into the different scenarios in which services impact the GDP deflator, enhancing your understanding of the interconnectedness between services and the broader economy.

As we explore this topic, we will look into the definitions of key terms, provide examples of how services affect the GDP deflator, and discuss potential fluctuations in economic activity. This will equip you with a more robust understanding of economic principles and how they manifest in real-world scenarios.

By the end of this article, you will be well-versed in the relationship between services and the GDP deflator, enabling you to engage in informed discussions about economic performance and trends. Let's dive into the details!

Table of Contents

What is the GDP Deflator?

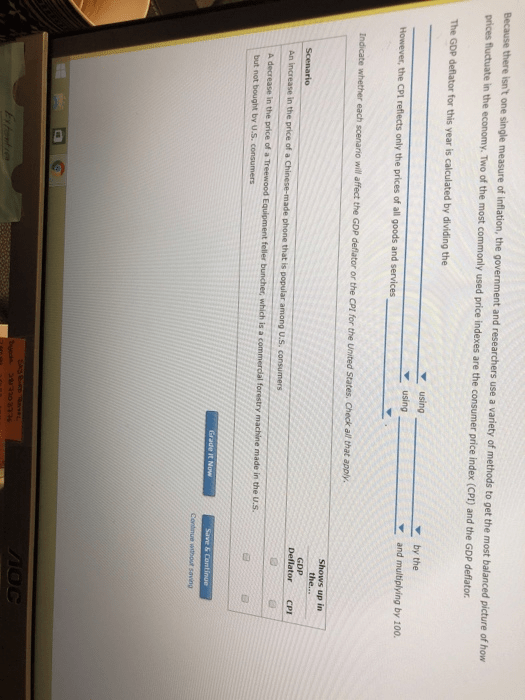

The GDP deflator is an economic measure that reflects the price changes of all goods and services produced in a country. It is calculated by dividing nominal GDP by real GDP and multiplying by 100. This makes the GDP deflator a vital tool for understanding inflation and deflation trends within an economy.

Unlike the Consumer Price Index (CPI), which focuses on consumer goods, the GDP deflator encompasses all sectors of the economy, including personal consumption, business investments, government spending, and net exports. This broad scope allows for a more comprehensive view of price movements and economic health.

The Role of Services in the Economy

Services play a significant role in modern economies, contributing to GDP in various ways. The service sector includes industries such as finance, healthcare, education, retail, and hospitality. Here are some key points on the importance of services:

- Services account for over 70% of GDP in many developed countries.

- The service sector has been a major driver of job creation.

- Services often have higher profit margins compared to goods, contributing to overall economic growth.

Scenarios Affecting the GDP Deflator

Several scenarios can influence the GDP deflator, particularly regarding the service sector. Understanding these scenarios can help stakeholders anticipate changes in economic conditions.

1. Increased Demand for Services

When there is an increase in demand for services, businesses may raise prices to balance supply and demand. This rise in service prices can directly impact the GDP deflator.

2. Technological Advancements

Technological advancements can lead to increased efficiency in service delivery, reducing costs and potentially lowering prices. This deflationary effect can influence the overall GDP deflator.

3. Changes in Consumer Preferences

Shifts in consumer preferences toward services can lead to fluctuations in pricing and availability, impacting the GDP deflator.

4. Regulatory Changes

Government regulations can either constrain or promote service pricing, thereby affecting the GDP deflator.

Impact of Services on the GDP Deflator

The impact of services on the GDP deflator can be multifaceted, with both positive and negative effects. Here are some ways that services influence this key economic indicator:

- Price Increases: Rising service costs contribute positively to the GDP deflator.

- Cost Reductions: Efficient service delivery can lead to lower costs, negatively impacting the GDP deflator.

- Service Sector Growth: An expanding service sector generally leads to increased GDP, influencing the deflator.

Examples of Services Impacting the GDP Deflator

To illustrate the impact of services on the GDP deflator, consider the following examples:

1. Healthcare Services

The healthcare sector has witnessed significant price increases due to rising demand and costs of innovation. This upward pressure on prices contributes to an increase in the GDP deflator.

2. Financial Services

Technological advancements in financial services, such as fintech, have reduced transaction costs. This decrease can lead to a deflationary effect on the GDP deflator.

3. Hospitality Industry

Pricing strategies in the hospitality sector, particularly during peak seasons, can lead to substantial fluctuations in service prices, directly impacting the GDP deflator.

Economic Implications of Service Changes

Fluctuations in service prices can have broader economic implications, including:

- Influencing monetary policy decisions by central banks.

- Affecting consumer spending and investment patterns.

- Shaping overall economic growth trajectories.

Conclusion

In summary, the relationship between services and the GDP deflator is complex yet crucial for understanding economic dynamics. Services significantly influence the GDP deflator through various scenarios, including demand shifts, technological advancements, and regulatory changes.

Call to Action

If you found this article informative, we encourage you to leave a comment below, share it with others, or explore more articles on our site to enhance your understanding of economic principles. Your engagement helps foster a community of informed individuals passionate about economics!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8tLHRr6CcnaNitq%2BwyJyYrZ1drLWmwMeeqWadkZi1br%2FCnqWaqpmkeri1y6Vkmp6WmrC1edOhnGaflKV6pbHFpZitp6JivLN6x62kpQ%3D%3D