Retained earnings are a crucial aspect of a company's financial health, representing the portion of net income that is kept within the company rather than distributed as dividends to shareholders. This financial metric reflects the company’s ability to reinvest in its operations, pay down debt, or save for future use. Understanding retained earnings between the beginning and end of a period is essential for investors, analysts, and business owners alike. This article will delve into the intricacies of retained earnings, how they are calculated, and their significance in financial reporting.

In this comprehensive guide, we will explore the concept of retained earnings, how they fluctuate over time, and the factors that influence these changes. We will also provide practical examples, relevant data, and insights into how retained earnings can impact a company's valuation and overall financial strategy. By the end of this article, you will have a deeper understanding of retained earnings and their role in corporate finance.

Whether you are a seasoned investor or a business owner looking to improve your financial literacy, this article aims to provide valuable information that can aid in making informed financial decisions. Let us embark on this detailed exploration of retained earnings and their importance in the business landscape.

Table of Contents

Definition of Retained Earnings

Retained earnings refer to the cumulative amount of net income that a company retains after paying out dividends to shareholders. This figure is reflected on the company's balance sheet under shareholders' equity. Retained earnings can be seen as a reinvestment of profits in the business, allowing it to grow and expand.

Key Characteristics of Retained Earnings

- It is a component of shareholders' equity.

- It is calculated from the net income of the company.

- It can be used for reinvestment, debt repayment, or saving for future needs.

Calculation of Retained Earnings

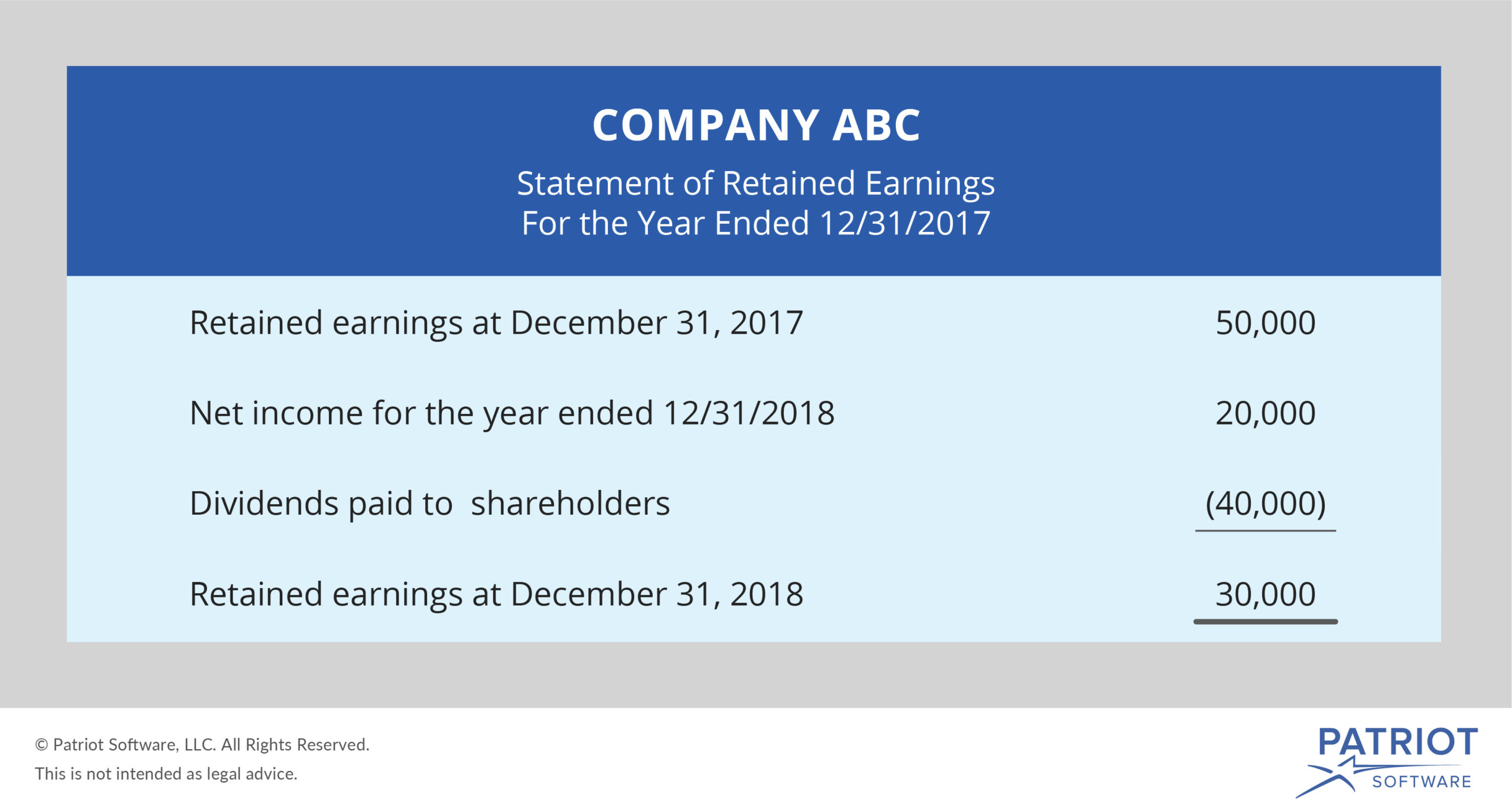

The calculation of retained earnings is straightforward. It can be summarized by the following formula:

Retained Earnings = Beginning Retained Earnings + Net Income - Dividends

To illustrate, let’s consider a hypothetical company:

| Period | Beginning Retained Earnings | Net Income | Dividends Paid | Ending Retained Earnings |

|---|---|---|---|---|

| Year 1 | $50,000 | $20,000 | $5,000 | $65,000 |

In this example, the company started with $50,000 in retained earnings, earned $20,000 in net income, and paid out $5,000 in dividends, resulting in ending retained earnings of $65,000.

Components of Retained Earnings

Retained earnings consist of various components that contribute to its overall value. Understanding these components is vital for analyzing a company's financial health.

1. Net Income

Net income is the profit a company makes after deducting all expenses. It is the primary driver of retained earnings, as higher net income leads to increased retained earnings.

2. Dividends

Dividends are payments made to shareholders from a company’s profits. When dividends are paid, they reduce the retained earnings. Companies must balance between distributing dividends and retaining earnings for growth.

The Role of Net Income

Net income plays a pivotal role in the calculation of retained earnings. It reflects the company’s operational efficiency and profitability. A company with consistently high net income can reinvest more into its operations, leading to potential growth and expansion.

Factors Influencing Net Income

- Sales Revenue: Increased sales lead to higher profits.

- Operating Expenses: Lower expenses contribute to a higher net income.

- Taxation: Effective tax management can improve net income.

Impact of Dividends on Retained Earnings

Dividends directly affect retained earnings, as they represent a portion of profits that is distributed to shareholders. Companies must consider their dividend policies carefully, as excessive dividend payouts can deplete retained earnings and limit growth opportunities.

Types of Dividends

- Cash Dividends: Direct payments to shareholders.

- Stock Dividends: Additional shares issued to shareholders instead of cash.

Retained Earnings in Financial Statements

Retained earnings are prominently featured in financial statements, particularly the balance sheet and the statement of changes in equity. Understanding how retained earnings are reported is essential for financial analysis.

1. Balance Sheet

On the balance sheet, retained earnings are listed under shareholders' equity. It provides a snapshot of the company's retained profits at a specific point in time.

2. Statement of Changes in Equity

This statement outlines the changes in retained earnings over a reporting period, detailing the impact of net income and dividends on the retained earnings balance.

Importance of Retained Earnings

Retained earnings are a significant indicator of a company's financial health and long-term sustainability. They provide insights into how well a company is managing its profits and reinvesting in its future.

Benefits of Strong Retained Earnings

- Capital for Expansion: Higher retained earnings mean more funds available for growth initiatives.

- Improved Financial Stability: Companies with strong retained earnings are better positioned to weather economic downturns.

- Attracting Investors: Investors often favor companies with healthy retained earnings as they indicate sound financial management.

Conclusion

In summary, retained earnings are a crucial aspect of a company's financial health, reflecting the cumulative profits retained for reinvestment. Understanding how retained earnings fluctuate between the beginning and end of a period provides valuable insights into a company’s financial strategy and operational efficiency. As an investor or business owner, recognizing the significance of retained earnings can aid you in making informed decisions that promote long-term success.

We encourage you to leave your thoughts in the comments section below, share this article with others who may benefit from it, and explore more resources on our site to enhance your financial knowledge.

Thank you for reading, and we look forward to having you back for more insightful articles on finance and investment.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8s7HTmqCnnZRisqK%2BzaKloKtdl7K1w8SepWasmJp6o7HGoqWnoZ6ceqK6w2acp5xdpLNuwMeeZKmdop68pXrHraSl