In today’s financial landscape, understanding the value of money and its implications is more crucial than ever. One common scenario that many individuals encounter is the $10,000 benchmark, which often serves as a reference point for various financial calculations. Whether you are budgeting for a significant purchase, planning for savings, or analyzing investments, knowing how to find the percentage of $10,000 can provide valuable insights and help you make informed decisions.

In this article, we will delve into the concept of percentages, particularly focusing on how to calculate various percentages of $10,000. This knowledge is essential for anyone looking to enhance their financial literacy or make smarter financial choices. We will also explore the importance of this figure in personal finance and investment strategies, highlighting real-world applications and implications.

Furthermore, we will provide a comprehensive breakdown of the steps involved in calculating percentages, supported by practical examples and relevant statistics. By the end of this article, you will have a clearer understanding of how to work with $10,000 in various financial contexts and how to apply this knowledge effectively. Let’s embark on this financial journey together!

Table of Contents

Understanding Percentages

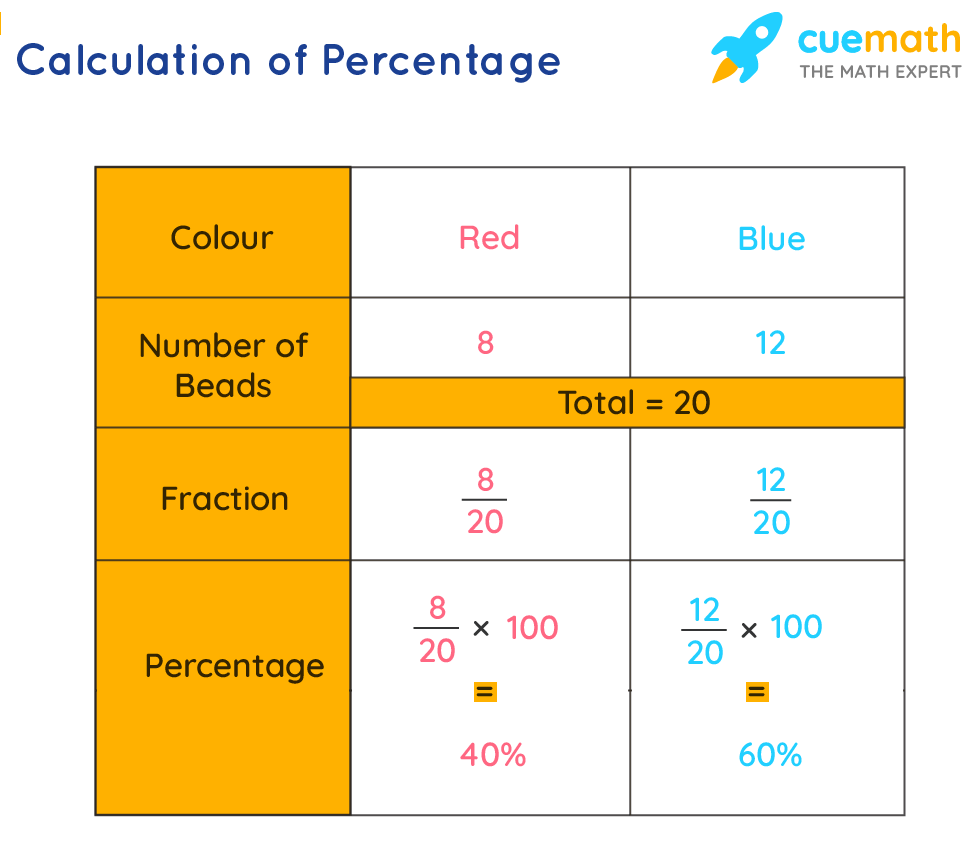

To grasp the significance of $10,000 in financial calculations, it is essential to first understand what percentages represent. A percentage is a way of expressing a number as a fraction of 100. It is commonly used in finance to assess changes in value, compare amounts, and evaluate financial performance.

How Percentages Work

Percentages work by taking a portion of a whole and expressing it in relation to 100. For instance, if you have $10,000, and you want to find out what 25% of that amount is, you would perform the following calculation:

- Formula: (Percentage / 100) x Total Amount

- Example: (25 / 100) x 10,000 = $2,500

This basic formula is essential for calculating various financial scenarios and can be applied in numerous contexts.

Calculating Percent of $10,000

To calculate a specific percentage of $10,000, follow these simple steps:

Examples of Calculating Percentages

Here are a few examples of calculating different percentages of $10,000:

- 10% of $10,000: (10 / 100) x 10,000 = $1,000

- 20% of $10,000: (20 / 100) x 10,000 = $2,000

- 50% of $10,000: (50 / 100) x 10,000 = $5,000

Real-World Examples of $10,000 Percentages

Understanding how to calculate percentages of $10,000 can be applied in various real-world situations:

- Budgeting: When planning a budget, you might allocate specific percentages of your income toward savings, expenditures, and investments.

- Loans: If you take out a loan of $10,000, you might want to know how much interest you will pay over time based on different percentage rates.

- Investments: Investors often evaluate potential returns based on percentages of their initial investments.

Financial Planning with $10,000

Having a solid financial plan is crucial, and knowing how to allocate your $10,000 effectively can set the foundation for future financial success. Here are some tips on financial planning with this amount:

- Emergency Fund: Consider setting aside a portion of your $10,000 as an emergency fund to cover unexpected expenses.

- Debt Repayment: If you have outstanding debts, using part of this amount to pay off high-interest loans can be a wise decision.

- Investing: Explore investment opportunities that can yield returns over time, such as stocks, bonds, or mutual funds.

Investment Strategies Using $10,000

Investing $10,000 wisely can lead to significant growth over time. Here are some potential strategies:

- Stock Market: Consider buying shares in reputable companies or exchange-traded funds (ETFs) that align with your financial goals.

- Real Estate: Explore real estate investment trusts (REITs) or consider saving for a down payment on a property.

- Retirement Accounts: Invest in tax-advantaged accounts like IRAs or 401(k)s to secure your financial future.

Statistics and Data on $10,000

According to recent studies, the average American household has savings of approximately $10,000. This amount can significantly influence financial stability and investment opportunities.

Furthermore, research shows that individuals who invest wisely can expect an average annual return of 7-10% over the long term. This highlights the importance of understanding how to manage and grow your $10,000 investment.

Common Questions About $10,000

Here are some frequently asked questions regarding $10,000 and its financial implications:

- How can I maximize my $10,000 investment? – Diversifying your portfolio and seeking advice from financial advisors can help maximize returns.

- Is it better to pay off debt or invest? – It often depends on the interest rates of your debt; paying off high-interest debt can be more beneficial in the short term.

- What are some safe investment options for $10,000? – Consider bonds, high-yield savings accounts, or CDs for safer investment choices.

Conclusion

In conclusion, understanding how to find the percentage of $10,000 is a valuable skill that can enhance your financial literacy and decision-making capabilities. By applying the principles discussed in this article, you can make informed decisions regarding budgeting, saving, and investing.

We encourage you to take action by assessing your financial situation and considering how you can effectively utilize your own $10,000. Share your thoughts in the comments below, and feel free to explore more articles on financial literacy to further enhance your knowledge!

Thank you for reading, and we hope to see you back on our site for more insightful articles!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8cnyPaWdmmpGosqV5zqdkraCZqHqlrdOaZJ%2Bhnpl6tbTEZp2opJykxKq6xppkn6GemXq1tMRmp56qk5q7tXnOn2WhrJ2h