The rate on a bond is the rate used to determine the interest payments made to bondholders over the life of the bond. Understanding this concept is crucial for investors, as it directly affects their returns. In this article, we will dive deep into what the bond rate entails, how it works, and its implications for both individual investors and the broader financial market.

When investors purchase bonds, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. The bond rate, also known as the coupon rate, is pivotal in determining these interest payments, which can significantly influence an investor's decision to buy or sell a bond. Throughout this article, we will explore various aspects of bond rates, including their calculation, types of rates, and current trends in the bond market.

This comprehensive guide aims to equip you with essential knowledge about bond rates, providing you with the tools you need to make informed investment decisions. Whether you're a seasoned investor or new to the world of bonds, understanding the rate on a bond is vital for optimizing your investment portfolio.

Table of Contents

What is a Bond Rate?

The bond rate, also referred to as the coupon rate, is the interest rate that the issuer of the bond agrees to pay bondholders. It is expressed as a percentage of the bond's face value, which is the amount the issuer must repay at maturity. For example, if a $1,000 bond has a coupon rate of 5%, the bondholder will receive $50 in interest payments each year until maturity.

Understanding the Basics

The bond rate is a critical factor in determining the attractiveness of a bond as an investment. A higher coupon rate generally indicates a more attractive investment, as it provides a greater return relative to the face value of the bond. Conversely, if the bond rate is lower than prevailing market rates, the bond may be less appealing to investors.

Importance of Bond Rates

- Determines cash flow for investors.

- Influences the pricing of the bond in the secondary market.

- Affects the overall interest rate environment.

How Bond Rates are Calculated

Calculating the bond rate involves considering the bond's face value, the total interest payments, and the duration of the bond. The basic formula for calculating the coupon rate is as follows:

Coupon Rate (%) = (Annual Interest Payment / Face Value) x 100

For example, if a bond has a face value of $1,000 and pays $50 annually, the coupon rate would be:

Coupon Rate = ($50 / $1,000) x 100 = 5%

Yield to Maturity (YTM)

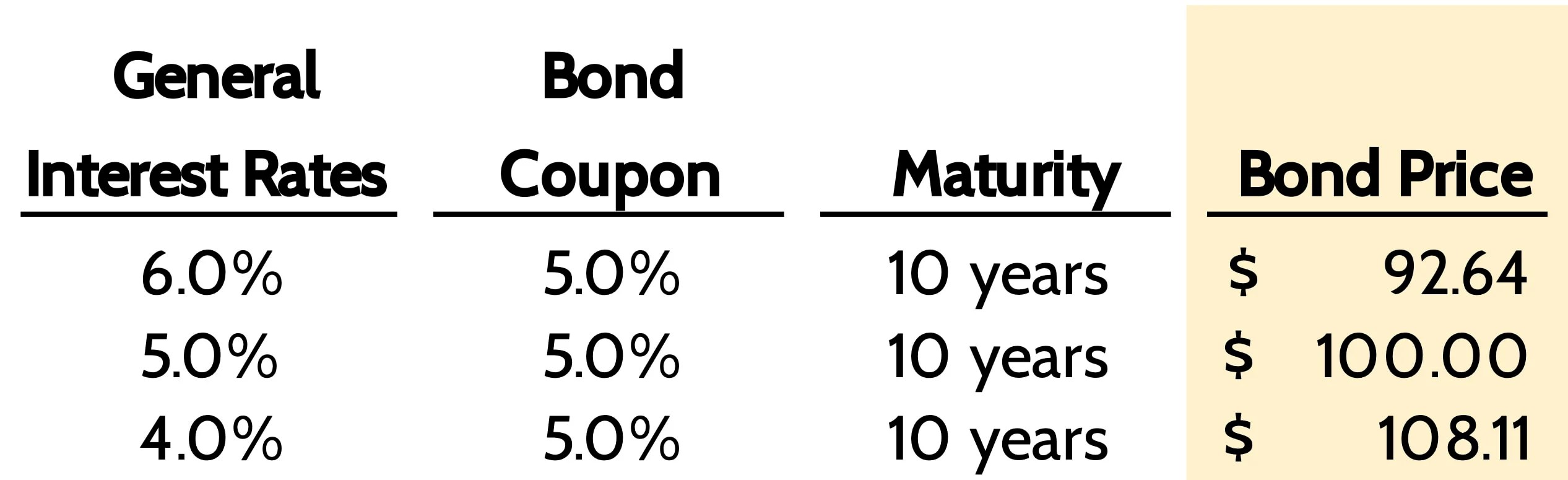

Another important concept related to bond rates is Yield to Maturity (YTM), which represents the total return an investor can expect to earn if the bond is held until maturity. YTM takes into account the bond's current market price, coupon payments, and the time remaining until maturity.

Types of Bond Rates

There are several different types of bond rates that investors should be aware of. Understanding these can help investors make informed decisions when purchasing bonds.

Fixed Rate Bonds

Fixed rate bonds have a set coupon rate that remains constant throughout the life of the bond. This type of bond provides predictable income, making it a popular choice for conservative investors.

Variable Rate Bonds

Variable rate bonds, on the other hand, have interest payments that can fluctuate based on market conditions. This type of bond may appeal to investors looking for potentially higher returns, but it also carries increased risk.

Factors Affecting Bond Rates

Several factors can influence bond rates, including economic conditions, inflation, and monetary policy. Understanding these factors can help investors anticipate changes in bond rates and adjust their strategies accordingly.

Economic Conditions

Economic growth typically leads to rising interest rates as demand for capital increases. Conversely, during economic downturns, interest rates may fall, impacting bond rates.

Inflation

- Higher inflation can erode the purchasing power of fixed interest payments.

- Investors may demand higher rates to compensate for inflation risk.

Current Trends in Bond Rates

As of 2023, bond rates have been influenced by various global events, including changes in monetary policy by central banks and shifts in economic growth projections. Investors should stay informed about these trends to make educated investment decisions.

Market Volatility

Recent market volatility has led to fluctuations in bond rates, prompting investors to reassess their portfolios and strategies.

Interest Rate Environment

The current interest rate environment, shaped by central bank actions and macroeconomic indicators, plays a significant role in determining bond rates and thus impacts investment decisions.

Impact of Bond Rates on Investment

Understanding the impact of bond rates on investment is essential for optimizing a portfolio. Bond rates can influence an investor's decision to buy or sell bonds, as well as their overall investment strategy.

Investment Strategy

Investors may choose to adjust their strategies based on changes in bond rates, including reallocating assets or diversifying their portfolios.

Investing in Bonds: A Guide

Investing in bonds can be a valuable addition to any investment portfolio. Here are some key tips for investing in bonds:

- Consider your investment objectives and risk tolerance.

- Diversify your bond holdings across different sectors and maturities.

- Stay informed about market trends and economic indicators.

Conclusion

In conclusion, the rate on a bond is a fundamental aspect of bond investing that directly affects interest payments and overall returns. Understanding how bond rates work, the factors that influence them, and current market trends can empower investors to make informed decisions. We encourage you to share your thoughts in the comments below, and don't hesitate to explore more articles on our site to enhance your financial knowledge.

Thank you for reading, and we look forward to welcoming you back for more insightful content on investing and finance!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8tbTEZqmarJVivK95wGaZqKaUYra0edOhnGaqkamybsHSnptmrJ9isabAxKukoqaVYsGpsYyipa2doprAtXnPmrCmnZ6pwG%2B006aj