In the world of finance and accounting, understanding the intricacies of "income from continuing operations" and "loss from discontinued operations" is crucial for investors, analysts, and business owners alike. These financial metrics provide insight into a company's ongoing profitability and the impact of strategic decisions on its overall financial health. In this article, we will delve deep into these concepts, exploring what they mean, their significance, and how they can affect a company's financial statements.

As businesses evolve, they often decide to discontinue certain operations that may no longer align with their strategic goals. This can result in recorded losses, which must be understood in context with the income generated from continuing operations. By analyzing these two components, stakeholders can gain a clearer picture of a company's financial performance and its potential for future growth.

This article aims to break down complex financial terminology into easily digestible information. We will discuss the definitions, examples, and implications of income from continuing operations and loss from discontinued operations, supported by relevant data and statistics. Let’s dive in!

Table of Contents

1. Definition of Income from Continuing Operations

Income from continuing operations refers to the profits generated from a company's core business activities that are expected to continue in the future. This metric is reported on the income statement and provides a clear picture of a company's operational efficiency.

Key features of income from continuing operations include:

- It excludes income derived from discontinued operations.

- It focuses on revenues generated from ongoing business activities.

- It serves as a crucial indicator of a company's financial health.

2. Definition of Loss from Discontinued Operations

Loss from discontinued operations refers to the financial losses incurred from business segments that a company has decided to shut down or sell off. This metric is also reported on the income statement, and it allows stakeholders to see the impact of operational changes on financial performance.

Important aspects of loss from discontinued operations include:

- It captures losses associated with segments that are no longer part of the company’s operational focus.

- It provides context for understanding the overall profitability of the continuing operations.

- It highlights the strategic decisions made by management regarding the company's direction.

3. Importance of Understanding These Concepts

Understanding income from continuing operations and loss from discontinued operations is vital for several reasons:

- **Financial Clarity**: These metrics help clarify the ongoing profitability of a business, distinguishing it from one-time or non-recurring events.

- **Investment Decisions**: Investors use these figures to assess the potential for future earnings and to make informed investment choices.

- **Strategic Planning**: Companies can analyze these operations to refine their business strategies and focus on their most profitable segments.

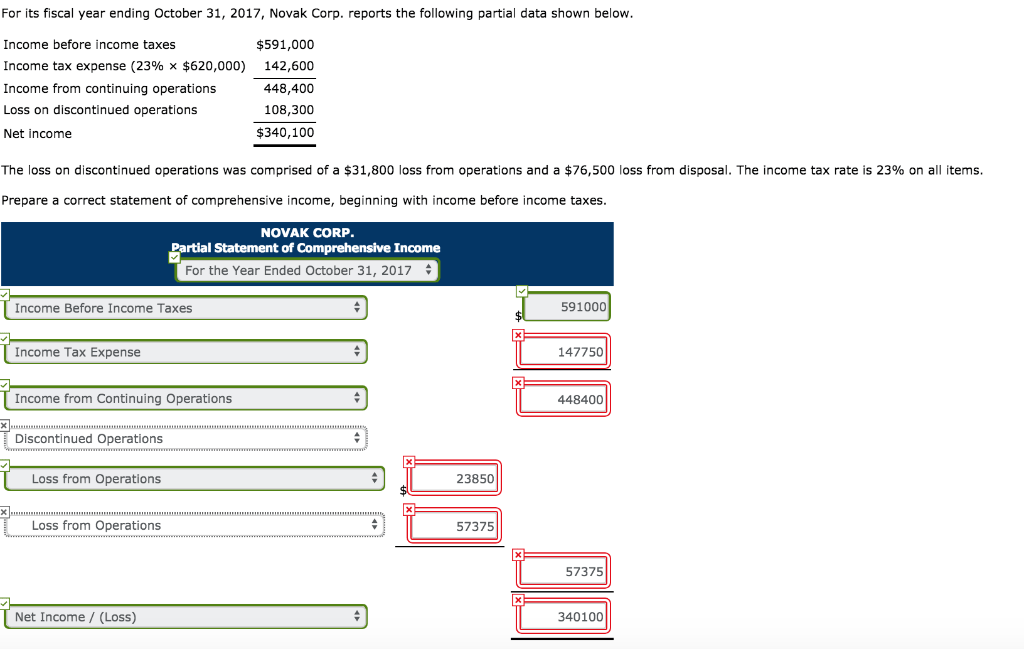

4. How These Metrics Appear in Financial Statements

Both income from continuing operations and loss from discontinued operations are reported on a company's income statement. Here’s how they typically appear:

- **Income Statement Structure**: The income statement is divided into sections, with revenues and expenses from continuing operations presented first.

- **Discontinued Operations Section**: Following the continuing operations section, a separate line item is included for loss from discontinued operations, if applicable.

- **Net Income Calculation**: The net income figure at the bottom reflects the results from both continuing and discontinued operations, providing a comprehensive view of financial performance.

5. Real-World Examples

To illustrate these concepts, let’s consider a hypothetical company:

XYZ Corporation reports:

- Income from continuing operations: $5 million

- Loss from discontinued operations: -$2 million

This means that while XYZ Corporation is generating a profit from its core business activities, it is also experiencing losses from operations that it has chosen to discontinue. The net impact on the company’s bottom line is positive, reflecting ongoing operational success despite the losses.

6. Common Misconceptions

Despite their importance, there are common misconceptions surrounding these financial metrics:

- **Discontinued Operations Always Result in Loss**: This is not necessarily true; a company can realize gains or losses depending on the circumstances of the discontinuation.

- **Income from Continuing Operations Is Always Positive**: Companies may report losses in their continuing operations, especially in challenging economic conditions.

- **Investors Should Ignore Discontinued Operations**: While these are not part of ongoing business activities, they can provide valuable insights into management's strategic decisions and market conditions.

7. Impact on Investors and Stakeholders

Investors and stakeholders closely monitor these metrics for several reasons:

- **Assessing Financial Health**: By analyzing income from continuing operations, stakeholders can evaluate the company's long-term viability.

- **Understanding Risks**: Losses from discontinued operations can signal potential risks or challenges the company may face.

- **Guiding Future Investment**: These metrics can influence investment decisions, as they reflect the company’s operational focus and profitability.

8. Conclusion

In summary, understanding income from continuing operations and loss from discontinued operations is essential for anyone involved in the financial world. These metrics provide critical insights into a company's ongoing profitability and the effects of strategic decisions on financial performance.

As an investor or stakeholder, it’s crucial to analyze these components thoroughly to make informed decisions. We encourage you to leave your comments below, share this article with others, or explore more articles on our site to deepen your understanding of financial metrics and their implications.

Sources

- Investopedia - Understanding Income from Continuing Operations

- Financial Accounting Standards Board (FASB) - Accounting Standards Codification

- Corporate Finance Institute - Discontinued Operations

Thank you for reading! We hope you found this article insightful and look forward to welcoming you back for more informative content.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8qrrCqKSeZZanvK55wqilraGeqravs4yop56qkam2sLrSZmxmpZmhuaq7zWajqKujYrOzu8xmm6Krk6S7tbXNrpydZpipuq0%3D