In today's dynamic financial landscape, a well-structured budget allocation plan is essential for both individuals and organizations aiming for financial stability and growth. This plan serves as a roadmap for managing resources efficiently, ensuring that funds are allocated to the most critical areas that align with financial goals. Understanding how to create and implement a budget allocation plan can be a game-changer in achieving financial success.

In this article, we will delve deep into the components of an effective budget allocation plan, its significance, and practical steps to develop one. Whether you are managing personal finances, running a small business, or overseeing a large corporation, this guide will provide you with the insights needed to optimize your financial resources.

We will explore various strategies, tools, and best practices that can enhance your budget allocation efforts. By the end of this comprehensive guide, you will be equipped with the knowledge to create a budget allocation plan that meets your unique financial needs.

Table of Contents

What is Budget Allocation?

Budget allocation refers to the process of distributing financial resources among various departments, projects, or activities based on strategic priorities and financial goals. It is a critical component of financial management that ensures funds are used efficiently and effectively.

There are two main types of budget allocation:

- Static Allocation: Fixed amounts are allocated regardless of changing circumstances.

- Dynamic Allocation: Funds are allocated based on real-time data and changing needs.

Importance of Budget Allocation

A well-executed budget allocation plan is vital for several reasons:

- Resource Optimization: Ensures that resources are utilized where they are most needed.

- Financial Control: Helps in monitoring spending and avoiding overspending.

- Strategic Alignment: Aligns financial resources with organizational goals and priorities.

- Risk Management: Assists in identifying potential financial risks and mitigating them.

Components of a Budget Allocation Plan

Creating an effective budget allocation plan involves several key components:

1. Financial Goals

Define clear, measurable financial goals that the budget aims to achieve. This could include saving for a specific project, reducing debt, or increasing revenue.

2. Historical Data Analysis

Analyze past financial data to understand spending patterns. This information will help in making informed decisions about future allocations.

3. Income Sources

Identify all sources of income, including salaries, investments, and other revenue streams. Understanding your income is crucial for creating a sustainable budget.

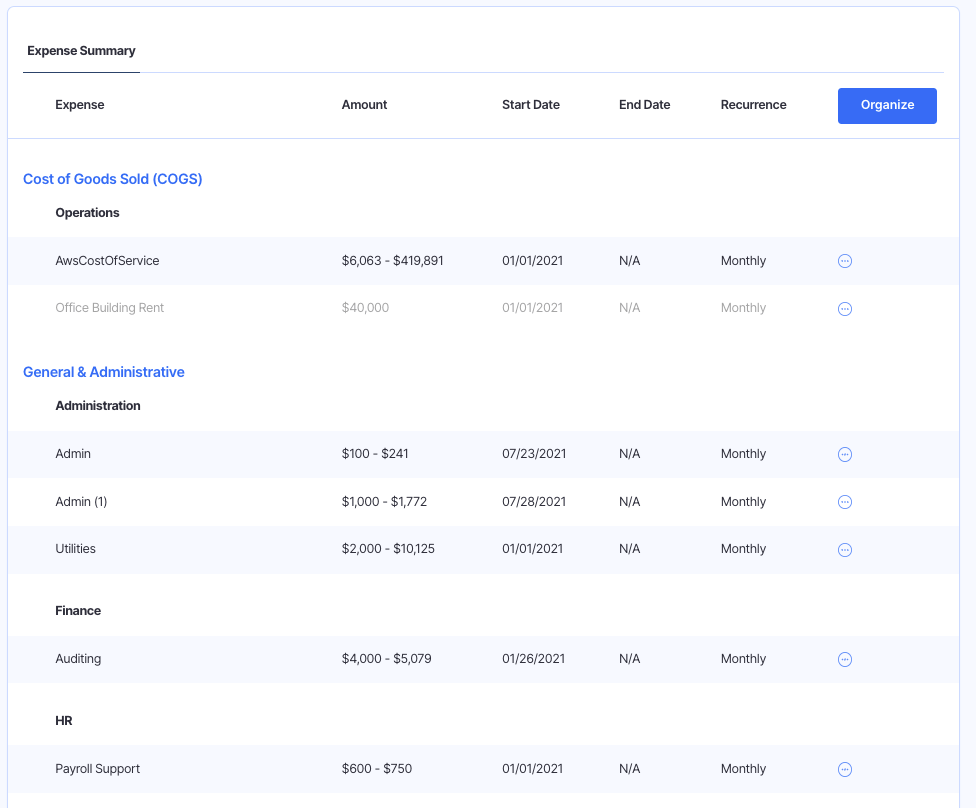

4. Expense Categories

Break down expenses into categories such as fixed, variable, and discretionary expenses. This categorization will facilitate better tracking of spending.

Steps to Create a Budget Allocation Plan

Follow these steps to develop an effective budget allocation plan:

Step 1: Set Clear Objectives

Determine what you want to achieve with your budget allocation plan. Be specific about your goals.

Step 2: Gather Financial Information

Collect all relevant financial data, including income statements, balance sheets, and cash flow statements.

Step 3: Analyze Your Data

Evaluate your historical spending patterns and income trends to identify areas for improvement.

Step 4: Allocate Funds

Distribute your available funds based on priority areas, ensuring that essential needs are met first.

Step 5: Monitor and Adjust

Regularly review your budget allocation plan to ensure it remains aligned with your financial goals and make adjustments as necessary.

Several tools can assist in creating and managing a budget allocation plan:

- Spreadsheet Software: Tools like Microsoft Excel or Google Sheets allow for detailed tracking and analysis.

- Budgeting Apps: Applications such as Mint or YNAB (You Need A Budget) provide user-friendly interfaces for managing personal budgets.

- Accounting Software: Programs like QuickBooks can help businesses manage their finances more effectively.

Common Challenges in Budget Allocation

While creating a budget allocation plan, you may face several challenges, including:

- Changing Priorities: Financial goals may change, requiring adjustments to the budget.

- Limited Resources: Constraints on income can hinder the ability to allocate funds effectively.

- Lack of Data: Insufficient historical data can lead to poor decision-making.

Best Practices for Budget Allocation

Implement these best practices to enhance your budget allocation efforts:

- Involve Stakeholders: Engage relevant parties in the budget allocation process to gain insights and buy-in.

- Be Flexible: Allow for adjustments as circumstances change to maintain alignment with financial goals.

- Regular Review: Conduct periodic reviews to assess the effectiveness of the budget and make necessary changes.

Conclusion

In summary, a budget allocation plan is crucial for financial stability and growth. By understanding the components, steps, and best practices involved in creating this plan, you can optimize your financial resources effectively. Remember to continuously monitor your budget and adjust as necessary to stay aligned with your objectives.

If you found this article helpful, consider leaving a comment, sharing it with others, or exploring more articles on financial management on our site.

Final Thoughts

Thank you for taking the time to read this comprehensive guide on budget allocation plans. We hope you found valuable insights that will aid you in your financial journey. Please visit us again for more informative content!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8o8HDoJytZZGhubCvwK2gqKZdpbmiuo2hq6ak