In the world of international trade and shipping, terms like 3/10, n/90, and FOB Shipping Point play a crucial role in determining the financial and logistical responsibilities of both buyers and sellers. Understanding these terms is essential for businesses engaged in trade, as they directly impact cash flow, pricing strategies, and risk management. This article will delve into the specifics of these terms, their implications, and how they affect transactions, particularly focusing on a scenario where the goods cost $33,000 and are paid for by Sydney.

The significance of knowing the details behind terms such as 3/10, n/90, and FOB Shipping Point cannot be overstated. These terms not only influence payment structures but also clarify when ownership transfers from the seller to the buyer. In this article, we will break down each term, explore their meanings, and provide real-world examples to illustrate their application. We aim to equip you with the knowledge necessary to navigate these concepts effectively, ensuring that you can make informed decisions in your transactions.

With the increasing complexity of global trade, having a solid grasp of payment terms and shipping agreements is vital for any business. This article will serve as your comprehensive guide to understanding 3/10, n/90, FOB Shipping Point, and how they relate to the cost of goods, specifically in a case where Sydney is involved in the payment process. Let’s dive into the details!

Table of Contents

What is 3/10, n/90?

3/10, n/90 is a payment term commonly used in business transactions. It specifies the conditions under which payment is to be made:

- 3: A 3% discount is offered if payment is made within 10 days.

- n: The net amount is due within 90 days.

This structure encourages early payment by offering a discount, thus improving the seller’s cash flow. It is vital for businesses to understand these terms to optimize their financial strategies.

Example of 3/10, n/90

For instance, if a company sells goods worth $33,000 to another company, and the terms are 3/10, n/90, the buyer can pay:

- 3% discount within 10 days: $33,000 - ($33,000 * 0.03) = $32,010

- Full amount within 90 days: $33,000

Meaning of FOB Shipping Point

FOB Shipping Point (Free on Board Shipping Point) indicates that the buyer assumes ownership and responsibility for the goods as soon as they leave the seller's premises. This term has significant implications for both shipping costs and risk management.

Key Features of FOB Shipping Point

- The seller is responsible for the costs associated with delivering the goods to the shipping point.

- The buyer takes on risk and ownership once the goods are loaded for shipment.

- Insurance and freight costs are typically the buyer's responsibility after shipping.

Financial Implications of 3/10, n/90

Understanding the financial implications of these terms is crucial for effective cash flow management. Businesses must assess how these terms affect their overall financial strategy, especially when dealing with large transactions.

- Early payment discounts can enhance liquidity for sellers.

- Buyers need to weigh the benefits of taking discounts against their cash flow situation.

Impact on Cash Flow

Cash flow is the lifeblood of any business. The terms 3/10, n/90 can significantly impact a company's cash flow, influencing decisions on whether to take the discount or hold onto cash longer.

Strategies for Managing Cash Flow

- Evaluate cash reserves before deciding to take discounts.

- Implement efficient invoicing and payment processes to maximize cash flow.

Responsibilities of Seller and Buyer

The responsibilities of both the seller and the buyer vary based on the terms of the sale. Understanding these responsibilities can prevent disputes and misunderstandings.

Seller’s Responsibilities

- Deliver goods to the shipping point.

- Provide necessary documentation for shipping.

Buyer’s Responsibilities

- Assume ownership and risk upon shipment.

- Pay for goods according to agreed terms.

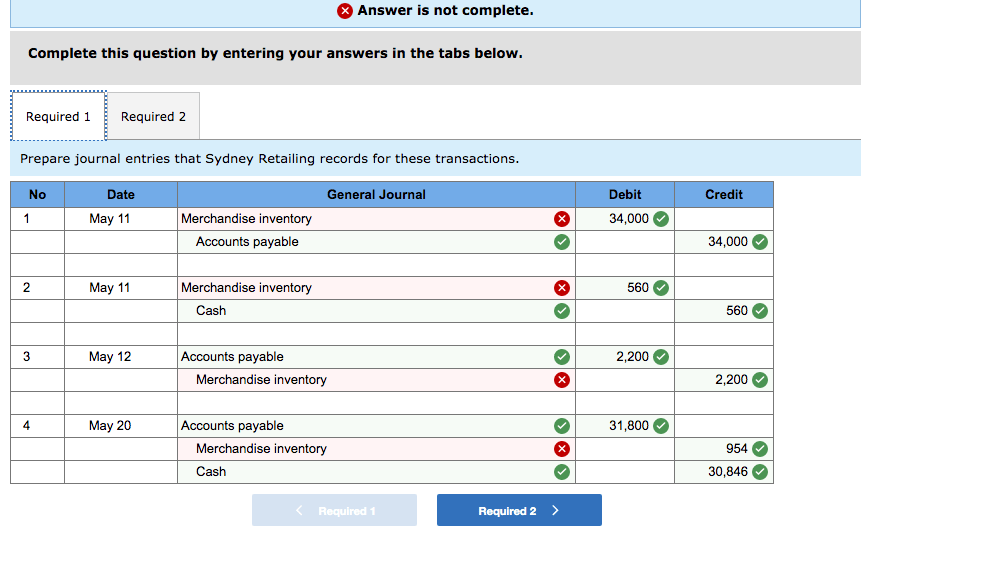

Case Study: Sydney Pays $33,000

Let's apply these concepts to a real-world scenario where the goods cost $33,000, and Sydney is the buyer. Sydney has the option to take advantage of the 3% discount by paying within 10 days or pay the full amount within 90 days.

- If Sydney pays within 10 days, the total payment would be $32,010.

- If Sydney pays within 90 days, the total payment remains $33,000.

This example illustrates how understanding these terms can lead to informed financial decisions, ultimately benefiting Sydney’s cash flow and financial management strategy.

Common Questions

Here are some frequently asked questions regarding 3/10, n/90 and FOB Shipping Point:

- What happens if the buyer skips the discount? The buyer can still pay the net amount within the stipulated time frame.

- Can terms be negotiated? Yes, both parties can negotiate terms depending on their relationship and bargaining power.

- Does FOB Shipping Point apply internationally? Yes, FOB Shipping Point is utilized in international shipping as well as domestic transactions.

Conclusion

In summary, understanding the terms 3/10, n/90, and FOB Shipping Point is essential for any business engaged in trade. These terms impact financial strategies, cash flow management, and the responsibilities of both buyers and sellers. By grasping these concepts, businesses can make informed decisions that enhance their operational efficiency and profitability.

We encourage you to share your thoughts in the comments below, discuss your experiences with these terms, or explore more articles on our site to deepen your understanding of trade finance.

Final Thoughts

Thank you for taking the time to read this comprehensive guide. We hope you found it informative and useful for your business dealings. Please return for more insightful content on finance and trade principles.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8dH2PZqVyaF2bvKN50qGgqaiZo7RuvM6ipa1lpJ2ybrPOqJusZZOkwLV506umsmVjaH1xfIyssJ2mla56sa3YrGWhrJ2h