Starting a business can be a daunting task, especially when considering the financial implications involved. In 2024, one entrepreneur found that his business venture cost $212,000, raising important questions about the taxable income generated from such an investment. Understanding the costs associated with running a business, as well as the tax obligations that come with it, is crucial for any business owner. This article will delve into the details surrounding the costs, revenues, and ultimately the taxable income of a business that incurred a significant initial investment. We will explore how to calculate taxable income, the importance of keeping accurate financial records, and the implications of taxation in relation to business profitability.

As we navigate through this topic, we will also provide practical insights and tips for entrepreneurs who may be facing similar situations. By breaking down the components of business expenses, income generation, and taxation, we aim to equip you with the knowledge needed to manage your financial obligations effectively. Whether you are a seasoned business owner or just starting out, understanding these concepts can significantly impact your financial success.

Let’s embark on this journey to uncover the intricacies of business costs, taxable income, and the financial responsibilities that come with entrepreneurship. By the end of this article, you will have a clearer understanding of how to approach your business finances in light of tax regulations and best practices.

Table of Contents

Understanding Business Costs

Before diving into specific numbers, it’s essential to understand what constitutes business costs. Business costs can be categorized into two main types: fixed costs and variable costs.

- Fixed Costs: These are expenses that do not change with the level of goods or services produced. Examples include rent, salaries, and insurance.

- Variable Costs: These costs vary directly with the level of production. Examples include raw materials, production supplies, and commission-based salaries.

For any business, especially one that has incurred a significant cost like $212,000, managing these expenses is crucial. Understanding the breakdown of these costs helps in forecasting and budgeting effectively.

The Initial Investment of $212,000

The initial investment of $212,000 represents a substantial commitment. This investment may cover a range of expenses, including but not limited to:

- Equipment and machinery purchases

- Leasehold improvements

- Inventory acquisition

- Marketing and advertising expenses

- Operational costs for the first few months

Each of these components plays a vital role in setting the stage for profitability. It is crucial to analyze how each dollar spent contributes to the overall business strategy.

Revenue Generation Strategies

Generating revenue is the ultimate goal of any business. Here are a few strategies that can help increase revenue:

- Diversification: Offering a variety of products or services can attract a broader customer base.

- Marketing: Invest in effective marketing strategies to reach potential customers.

- Customer Engagement: Building a loyal customer base through excellent service and engagement.

- Online Presence: Developing an online platform can expand market reach and convenience.

Implementing these strategies effectively can lead to increased revenue, thereby improving the taxable income of the business.

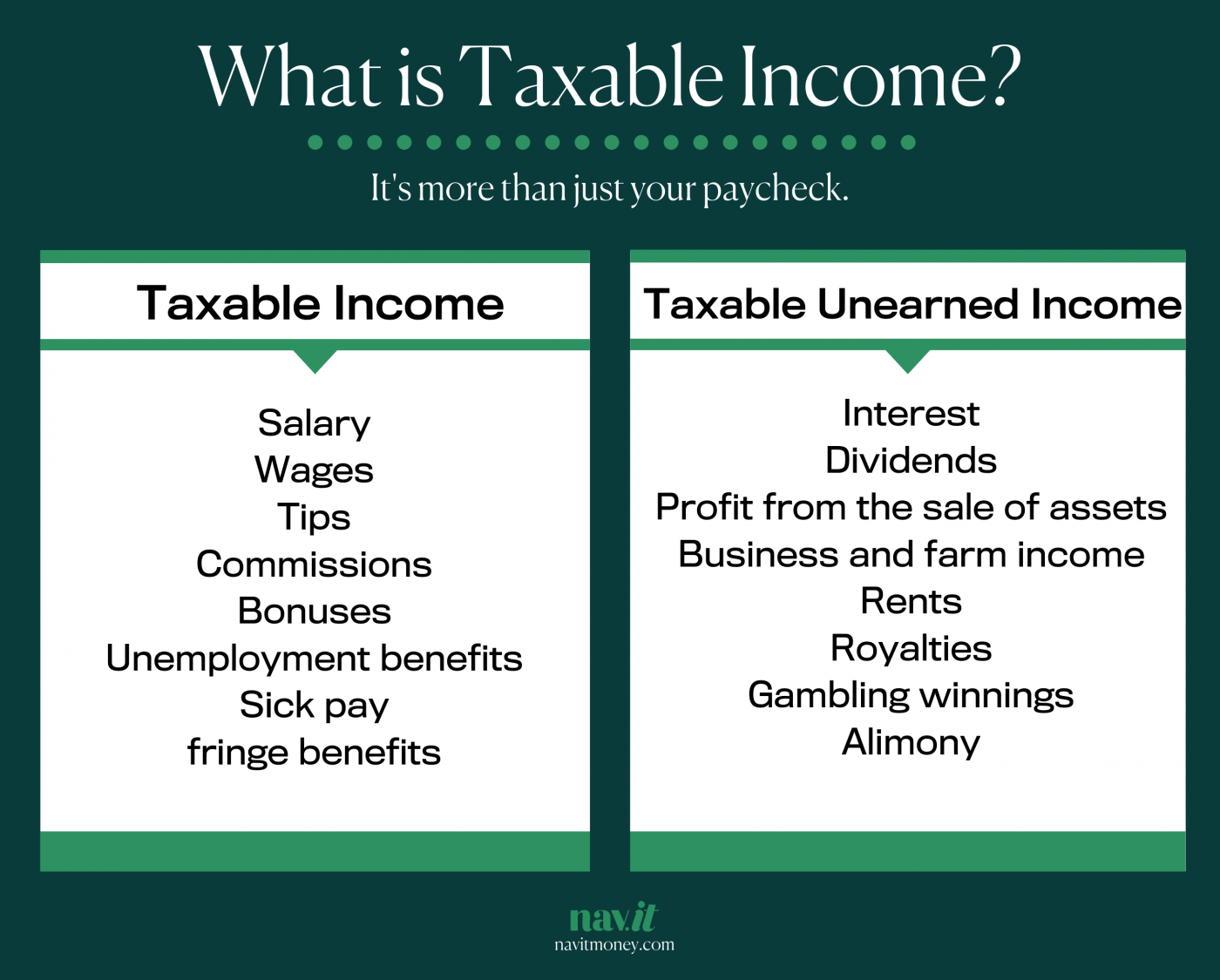

Calculating Taxable Income

Taxable income is calculated by subtracting allowable business expenses from gross income. The formula can be summarized as follows:

Taxable Income = Gross Income - Allowable Business Expenses

Components of Taxable Income Calculation

To accurately calculate taxable income, consider the following components:

- Gross Income: This includes all revenue generated before any deductions.

- Allowable Business Expenses: These are the expenses that can be deducted from the gross income, including operational costs, salaries, and marketing expenses.

By carefully tracking these figures, business owners can ensure they are reporting accurate taxable income.

Importance of Accurate Financial Records

Maintaining accurate financial records is essential for several reasons:

- Tax Compliance: Accurate records ensure compliance with tax regulations.

- Financial Analysis: Detailed records allow for better analysis of business performance.

- Informed Decision-Making: Access to precise data helps in making informed business decisions.

Utilizing accounting software can greatly assist in maintaining these records efficiently.

Tax Implications for Businesses

Understanding tax implications is crucial for any business owner. Taxes can significantly impact the bottom line. Here are a few key points to consider:

- Types of Taxes: Businesses may be subject to income tax, sales tax, payroll tax, and self-employment tax.

- Tax Deductions: Knowing which expenses are deductible can help reduce taxable income.

- Tax Credits: Exploring available tax credits can provide additional savings.

Navigating Business Tax Regulations

Business tax regulations can be complex and vary by location. Here are some tips for navigating these regulations:

- Stay Informed: Keep up to date with local, state, and federal tax laws.

- Consult Professionals: Hiring a tax professional can ensure compliance and optimize tax strategies.

- Utilize Resources: Many resources are available online and through local business organizations to help navigate tax regulations.

Conclusion

In summary, understanding the costs and taxable income of a business that incurred an investment of $212,000 in 2024 is crucial for any entrepreneur. By grasping the components of business costs, employing revenue generation strategies, and accurately calculating taxable income, business owners can navigate their financial responsibilities effectively. Additionally, maintaining accurate records and understanding tax implications are vital for long-term success.

We invite you to share your thoughts in the comments below, or feel free to explore more articles on our site that can help enhance your business knowledge. Together, let’s build a community of informed and successful entrepreneurs!

Thank you for reading, and we hope to see you back here for more insightful content!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8qbXSZpmuq5mjsrS%2FjK2fmqxdmLy0wIxraGtoYGV6qrqMa2drbF2ptaZ505qvmpqcmnqqusKopJ5ln5t6tbTEZpmuq5mjsrS%2FjaGrpqQ%3D