Cash flows are a fundamental concept in finance that refers to the movement of money into and out of a business. They play a crucial role in determining the financial health of any organization, influencing everything from investment decisions to operational efficiency. Understanding cash flows is essential for business owners, investors, and financial professionals alike, as it helps them to make informed decisions that can lead to sustainable growth and profitability.

In this article, we will delve into the intricacies of cash flows, exploring their significance, types, and the methods used to manage them effectively. We will also discuss the impact of cash flow on business operations and decision-making processes. By the end of this comprehensive guide, you will have a solid understanding of cash flows and their critical role in financial management.

Whether you are a seasoned finance professional or just starting your journey in the world of business, this article aims to equip you with the knowledge you need to navigate the complex landscape of cash flows. So, let's embark on this informative journey!

Table of Contents

What Are Cash Flows?

Cash flows represent the inflow and outflow of cash within a business during a specific period. These transactions can arise from various activities, including operating, investing, and financing activities. Understanding cash flows is vital as they indicate how well a company generates cash to pay its debts and fund its operating expenses.

Key Components of Cash Flows

- Operating Activities: Cash generated or used in the core business operations.

- Investing Activities: Cash used for investments in assets or securities.

- Financing Activities: Cash received from or paid to investors and creditors.

The Importance of Cash Flows

Cash flows are often described as the lifeblood of a business. Here are several reasons why understanding cash flows is essential:

- Liquidity Management: Ensures that a company can meet its short-term obligations.

- Investment Decisions: Helps determine the ability to invest in growth opportunities.

- Profitability Assessment: Provides insights into operational efficiency and profitability.

- Risk Assessment: Identifies potential financial risks that could impact the business.

Types of Cash Flows

Understanding the different types of cash flows is crucial for effective financial management. The three primary types of cash flows are:

1. Operating Cash Flows

Operating cash flows are generated from the core business activities, including the sale of goods and services. These cash flows are critical for daily operations and are often considered a key indicator of business health.

2. Investing Cash Flows

Investing cash flows arise from the purchase and sale of long-term assets, such as property, equipment, and investments. Positive cash flow from investing activities indicates that a business is effectively managing its investments.

3. Financing Cash Flows

Financing cash flows relate to transactions involving equity and debt. This includes cash received from issuing shares or loans and cash paid for dividends and loan repayments. Understanding these cash flows is vital for assessing a company's capital structure.

Managing Cash Flows Effectively

Effective cash flow management is essential for business sustainability. Here are some strategies to consider:

- Forecasting: Regularly forecast cash flows to anticipate shortfalls and surpluses.

- Budgeting: Create a cash flow budget to manage inflows and outflows effectively.

- Monitoring: Continuously monitor cash flow statements to identify trends and anomalies.

- Contingency Planning: Develop contingency plans for unexpected cash flow disruptions.

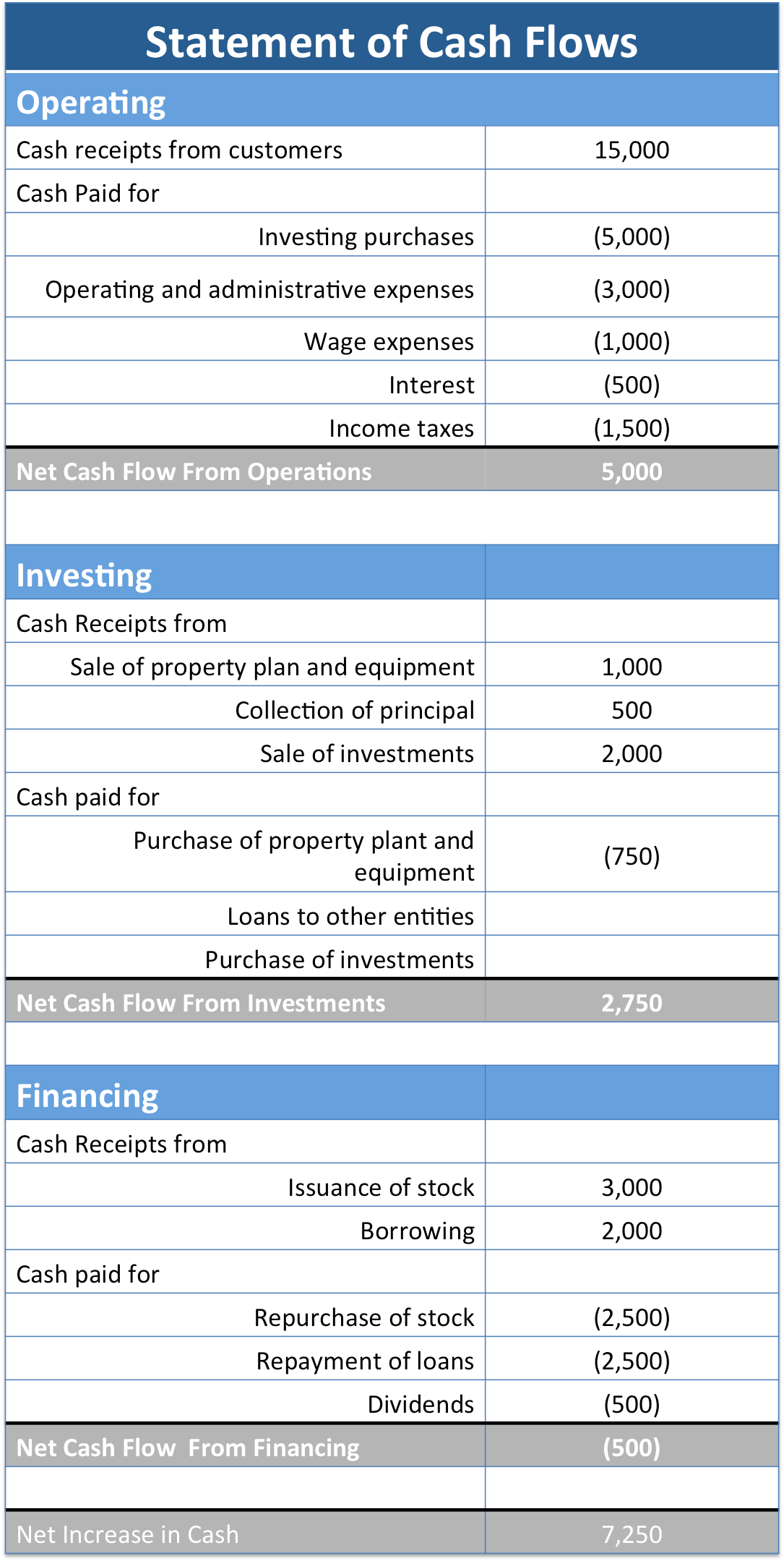

Understanding Cash Flow Statements

A cash flow statement is a financial document that provides a detailed breakdown of cash inflows and outflows during a specific period. It is divided into three sections that correspond to the types of cash flows discussed earlier.

Components of a Cash Flow Statement

- Cash Flow from Operating Activities: Shows how much cash is generated from core business operations.

- Cash Flow from Investing Activities: Details cash spent on investments and cash received from asset sales.

- Cash Flow from Financing Activities: Provides information on cash raised through debt or equity and payments made.

Common Misconceptions About Cash Flows

There are several misconceptions regarding cash flows that can lead to poor decision-making:

- Profit Equals Cash Flow: Profitability does not always equate to positive cash flow.

- Cash Flow Management is Unnecessary: Every business needs effective cash flow management to survive.

- Positive Cash Flow Means Business is Healthy: A business can have positive cash flow but still face financial challenges.

Cash Flow Analysis Techniques

Analyzing cash flows can provide critical insights into a business's financial health. Here are some techniques to consider:

- Cash Flow Ratios: Use ratios like the cash flow margin and cash flow to debt ratio to assess performance.

- Trend Analysis: Observe cash flow trends over time to identify patterns and areas for improvement.

- Scenario Analysis: Evaluate how different scenarios may impact cash flow.

Conclusion

In conclusion, understanding cash flows is crucial for effective financial management and decision-making. By recognizing the different types of cash flows and implementing effective management strategies, businesses can ensure their long-term sustainability and success. We encourage you to reflect on your cash flow practices and take action to optimize them for better financial health.

If you found this article informative, please leave a comment below, share it with your network, or explore more articles on our website for further insights into financial management.

Thank you for reading, and we look forward to seeing you back on our site for more valuable financial insights!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8pK3SoWSfpJ%2BswG%2B006aj