In the realm of economics, understanding the different indexes that measure the health of an economy is crucial. Two of the most significant indexes are the Consumer Price Index (CPI) and the GDP Deflator. These indexes provide insight into inflation and economic growth, playing a pivotal role in shaping fiscal policies and influencing consumer behavior.

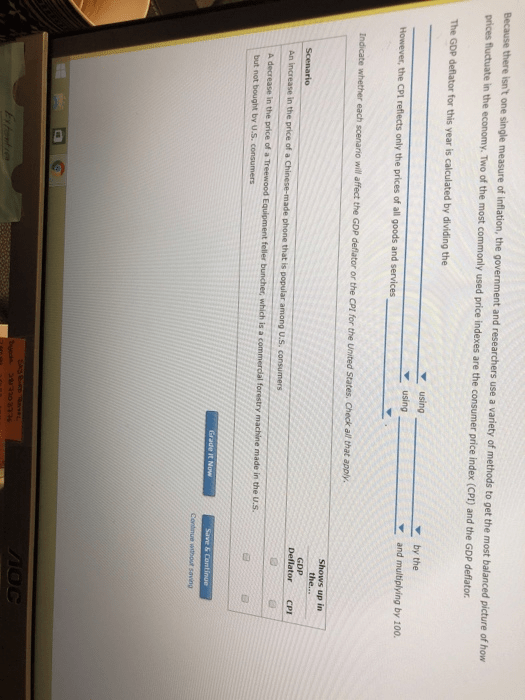

The Consumer Price Index (CPI) measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. On the other hand, the GDP Deflator reflects the level of prices for all new, domestically produced, final goods and services in an economy. Both these indexes are vital for economists, policymakers, and consumers to understand inflation trends and economic performance.

This article will delve deep into the definitions, calculations, implications, and differences between the CPI and GDP Deflator. By the end, you will have a comprehensive understanding of these essential economic indicators and their relevance in today's economic landscape.

Table of Contents

1. What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is an economic indicator that tracks the changes in prices of a specified set of goods and services over time. It reflects the cost of living for the average consumer and is one of the primary measures of inflation. The items included in the CPI basket range from food, clothing, housing, and transportation to medical care and entertainment.

1.1 Key Features of CPI

- Market Basket: The CPI is based on a fixed market basket of goods and services that are representative of typical consumption patterns.

- Urban Consumers: The CPI primarily reflects the spending habits of urban consumers.

- Monthly Updates: The CPI is published monthly, providing timely insights into inflation trends.

2. How is the Consumer Price Index Calculated?

The calculation of CPI involves several steps:

CPI = (Cost of Market Basket in Current Year / Cost of Market Basket in Base Year) x 100

3. Significance of the Consumer Price Index

The CPI is significant for several reasons:

- Inflation Measurement: It serves as a primary measure of inflation, influencing economic policies and decisions.

- Cost of Living Adjustments: The CPI is used to adjust wages, pensions, and social security benefits to maintain purchasing power.

- Economic Indicators: It acts as a barometer for economic health, guiding investment and spending decisions.

4. What is the GDP Deflator?

The GDP Deflator, also known as the implicit price deflator, is an economic measure that reflects the prices of all new, domestically produced, final goods and services in an economy. Unlike the CPI, which focuses on consumer goods, the GDP Deflator encompasses a broader range of products, including investment goods and government services.

4.1 Key Features of GDP Deflator

- Comprehensive Scope: The GDP Deflator includes all goods and services produced in an economy, making it a broader measure than the CPI.

- Nominal vs. Real GDP: It is used to convert nominal GDP into real GDP, allowing for a comparison of economic output over time.

- Quarterly Updates: The GDP Deflator is updated quarterly, reflecting more comprehensive economic changes.

5. How is the GDP Deflator Calculated?

The GDP Deflator is calculated using the following formula:

GDP Deflator = (Nominal GDP / Real GDP) x 100

Where:

- Nominal GDP: The total value of goods and services produced at current market prices.

- Real GDP: The total value of goods and services produced adjusted for inflation.

6. Significance of the GDP Deflator

The GDP Deflator holds numerous implications for economic analysis:

- Inflation Analysis: It provides insights into inflation trends over a broader economic spectrum.

- Policy Making: Policymakers use the GDP Deflator to assess the effectiveness of monetary policies.

- Investment Decisions: Investors utilize the GDP Deflator to gauge the real growth of the economy when making investment choices.

7. Comparing CPI and GDP Deflator

While both the CPI and GDP Deflator are crucial measures of inflation, they differ in several key aspects:

- Scope: The CPI focuses on consumer goods, while the GDP Deflator includes all final goods and services.

- Base Year: The CPI uses a fixed basket of goods, whereas the GDP Deflator changes its basket as the economy evolves.

- Frequency: CPI is reported monthly, while the GDP Deflator is updated quarterly.

8. Conclusion

In summary, both the Consumer Price Index (CPI) and the GDP Deflator are essential tools for understanding inflation and economic performance. The CPI measures the price changes for a fixed basket of consumer goods, while the GDP Deflator provides a broader view of price changes across all final goods and services. Recognizing the differences and applications of these indexes is vital for economists, policymakers, and consumers alike to make informed decisions.

We encourage you to leave your thoughts in the comments section below, share this article with others, or explore more of our content for further insights!

References

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8qrrDnq%2Beq12Wv6Z506GcZpufo8C2ucSrZKmqmZiybrXNnZyxZZOltm6tzZ1kraCVYrSlvIydnJ%2Bkkam8s3nToZxmn5Sle6nAzKU%3D