In today’s economic landscape, understanding various indexes is crucial for both consumers and policymakers. Two of the most prominent indexes are the Consumer Price Index (CPI) and the GDP Deflator. These indexes play a significant role in measuring inflation and economic performance, providing insights that affect financial decisions at all levels. This article delves into the intricacies of CPI and GDP Deflator, exploring their definitions, calculations, differences, and implications for the economy.

The Consumer Price Index (CPI) serves as a vital indicator of inflation, reflecting the changes in price levels of a basket of consumer goods and services over time. On the other hand, the GDP Deflator measures the price change of all goods and services produced in an economy, offering a broader perspective on inflation. Understanding these two indexes is essential for interpreting economic indicators and making informed financial choices.

Throughout this article, we will explore the methodologies behind these indexes, their significance in economic policy, and how they can influence personal finance decisions. Whether you are a student of economics, a financial analyst, or a curious consumer, this comprehensive guide will provide valuable insights into CPI and GDP Deflator.

Table of Contents

1. Definition of Consumer Price Index (CPI)

The Consumer Price Index (CPI) measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It includes categories such as food, clothing, housing, transportation, and medical care, making it a comprehensive reflection of consumer spending habits.

Key Components of CPI

- Market Basket: A fixed set of goods and services used to track price changes.

- Base Year: A year used for comparison; CPI is often expressed relative to this year.

- Urban Consumers: The index primarily reflects the spending habits of urban households.

2. How is CPI Calculated?

The calculation of CPI involves several steps:

- Selection of a base year and market basket of goods.

- Collection of price data for the selected goods and services.

- Calculation of the total cost of the market basket in the current year and the base year.

- Using the formula: CPI = (Cost of Market Basket in Current Year / Cost of Market Basket in Base Year) x 100

Example of CPI Calculation

If the cost of a market basket was $100 in the base year and $120 in the current year, the CPI would be:

CPI = (120 / 100) x 100 = 120

3. Significance of CPI in the Economy

CPI is crucial for several reasons:

- Inflation Measurement: It helps in assessing the inflation rate, which is vital for economic planning.

- Policy Making: Governments and central banks use CPI to formulate monetary policies.

- Cost-of-Living Adjustments: Many contracts and social security benefits are adjusted based on CPI changes.

4. Definition of GDP Deflator

The GDP Deflator, unlike CPI, measures the price change of all goods and services produced in an economy. It reflects the prices of domestic production and is often considered a more comprehensive measure of inflation.

Key Features of GDP Deflator

- Broad Scope: It includes all goods and services produced rather than just a basket of consumer goods.

- Nominal vs. Real GDP: It is used to convert nominal GDP into real GDP to account for inflation.

5. How is GDP Deflator Calculated?

The GDP Deflator is calculated using the following formula:

GDP Deflator = (Nominal GDP / Real GDP) x 100

Example of GDP Deflator Calculation

If nominal GDP is $1,200 billion and real GDP is $1,000 billion, the GDP Deflator would be:

GDP Deflator = (1200 / 1000) x 100 = 120

6. Significance of GDP Deflator in Economic Analysis

The GDP Deflator serves essential functions in economic analysis:

- Overall Economic Health: It provides insights into the inflationary pressures on the entire economy.

- Policy Implications: It aids policymakers in determining appropriate fiscal and monetary policies.

- Investment Decisions: Investors use it to assess the economic environment and make informed investments.

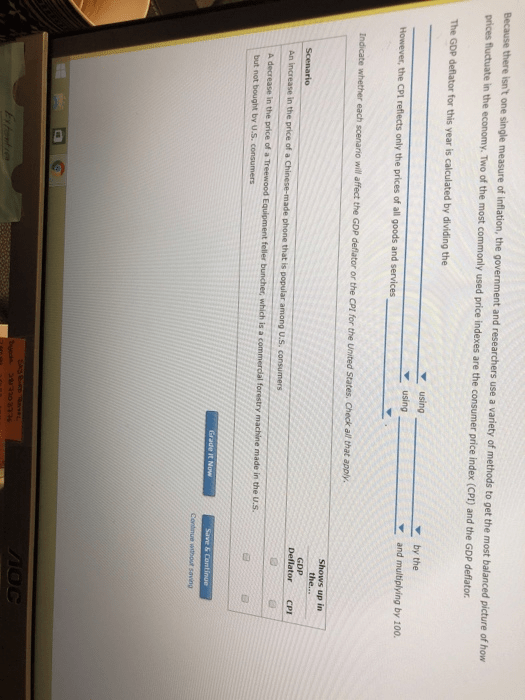

7. Comparing CPI and GDP Deflator

While both CPI and GDP Deflator measure inflation, they differ significantly:

- Scope: CPI focuses on consumer goods, while GDP Deflator encompasses all produced goods and services.

- Base Year: CPI is fixed to a base year, whereas the GDP Deflator is updated continuously.

- Use Cases: CPI is more relevant for cost-of-living adjustments, while GDP Deflator is better for economic analysis.

8. Conclusion

In conclusion, understanding the Consumer Price Index (CPI) and the GDP Deflator is essential for grasping the dynamics of inflation and economic performance. Both indexes play crucial roles in economic analysis, policy-making, and personal finance decisions. By recognizing their differences and applications, individuals and policymakers can make better-informed decisions.

We encourage readers to engage with this topic further by leaving comments, sharing this article, or exploring other informative content available on our site.

Thank you for reading! We look forward to seeing you again for more insightful articles.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8qrrDnq%2Beq12Wv6Z506GcZpufo8C2ucSrZKmqmZiybrXNnZyxZZOltm6tzZ1kraCVYrSlvIydnJ%2Bkkam8s3rHraSl