Understanding the payback period is crucial for anyone involved in financial planning or investment decisions. It allows investors to assess the time required to recover their initial investment, which is vital for determining the feasibility of projects. In this article, we will explore the concept of the payback period, analyze specific cash flow scenarios, and provide valuable insights into financial decision-making.

By examining a case where the cash inflows are $5,000 for year 4, $6,000 for year 5, and $5,000, we will calculate the payback period and discuss its implications. This analysis will also include various financial metrics to give you a well-rounded understanding of the investment landscape.

This comprehensive guide aims to equip individuals and businesses with the knowledge needed to make informed financial decisions. Whether you're an investor, entrepreneur, or student of finance, understanding the payback period and its relevance to cash flow is essential for future success.

Table of Contents

What is Payback Period?

The payback period is a financial metric that calculates the time required for an investment to generate an amount of income equal to the initial investment cost. Essentially, it tells investors how long it will take to "pay back" the money they put into a project. This metric is often expressed in years.

To calculate the payback period, you add up the cash inflows generated by the investment until the total equals the initial investment amount. The payback period is particularly useful for comparing the risk and return of different investment opportunities.

Key Components of Payback Period

- Initial Investment: The total amount of money spent to start the project.

- Cash Inflows: The incoming cash generated by the investment over time.

- Payback Time: The duration it takes for cash inflows to equal the initial investment.

Importance of Payback Period

The payback period is a critical tool for financial analysis for several reasons:

- Risk Assessment: A shorter payback period generally indicates a lower risk, as investors can recover their funds more quickly.

- Investment Comparison: It allows investors to compare the profitability and risk of various investment options.

- Budgeting and Cash Flow Management: By understanding when cash inflows will occur, businesses can better plan for future expenses.

Calculating Payback Period

To calculate the payback period, follow these steps:

Case Study: Cash Flows Analysis

Let's analyze a hypothetical investment scenario where the cash inflows are as follows:

- Year 1: $0

- Year 2: $0

- Year 3: $0

- Year 4: $5,000

- Year 5: $6,000

- Year 6: $5,000

Assuming the initial investment was $10,000, we can calculate the payback period:

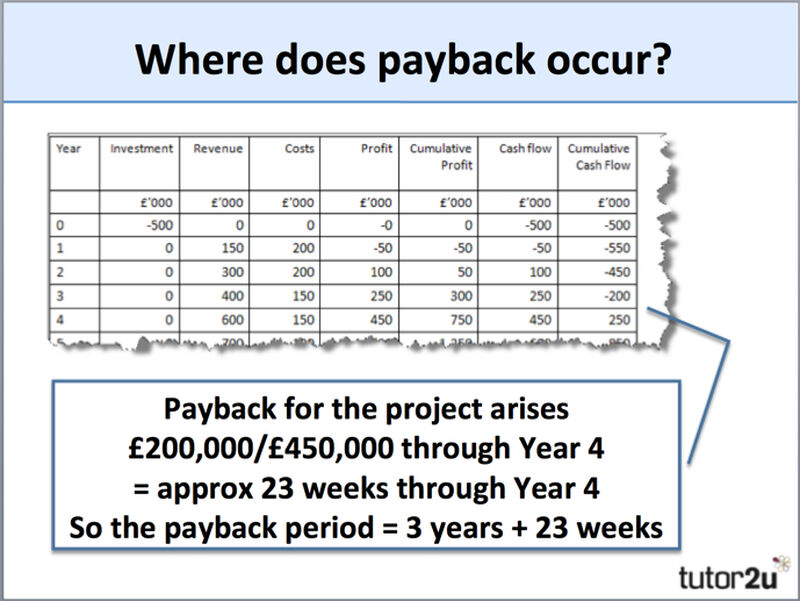

Cumulative Cash Flow Calculation

| Year | Cash Inflow ($) | Cumulative Cash Flow ($) |

|---|---|---|

| 1 | 0 | 0 |

| 2 | 0 | 0 |

| 3 | 0 | 0 |

| 4 | 5,000 | 5,000 |

| 5 | 6,000 | 11,000 |

| 6 | 5,000 | 16,000 |

In this case, the payback period is between year 4 and year 5. By the end of year 4, the cumulative cash flow is $5,000. In year 5, we receive an additional $6,000, bringing the total to $11,000, which exceeds the initial investment of $10,000. Therefore, the payback period is approximately 4.83 years, calculated as follows:

Payback Period = 4 years + (5,000 remaining balance / 6,000 cash inflow in year 5) = 4 + 0.83 = 4.83 years

Limitations of Payback Period

While the payback period is a useful metric, it has its limitations:

- Inefficiency in Long-Term Projects: It does not account for cash flows that occur after the payback period, which can be significant in long-term projects.

- Time Value of Money: The payback period does not consider the time value of money, which can skew the actual profitability of an investment.

- No Profitability Measure: It only indicates how quickly the initial investment can be recovered, not the overall profitability of the project.

Alternative Measures for Investment Analysis

To gain a more comprehensive view of an investment's potential, consider using alternative financial metrics:

- Net Present Value (NPV): This metric accounts for the time value of money and provides the difference between the present value of cash inflows and outflows.

- Internal Rate of Return (IRR): The IRR is the discount rate that makes the NPV of an investment zero, helping investors understand the profitability potential.

- Return on Investment (ROI): ROI measures the gain or loss generated relative to the investment cost, offering insights into overall profitability.

Real-World Applications of Payback Period

The payback period can be applied in various real-world scenarios, including:

- Capital Budgeting: Businesses use the payback period to evaluate potential projects and prioritize investments based on their risk profile.

- Startup Valuation: Investors often look at the payback period to assess the risk of startups and their potential for generating returns.

- Real Estate Investments: Real estate investors use the payback period to determine how quickly they can recover their initial investment in properties.

Conclusion

In conclusion, understanding the payback period is essential for making informed financial decisions. It serves as a fundamental metric for assessing the risk and return of investments. By analyzing cash flows and calculating the payback period for scenarios like our example, investors can gauge the feasibility of projects more effectively.

We encourage readers to explore more about financial metrics and consider how these concepts apply to their own investments. If you found this article helpful, please leave a comment, share it with your network, or read our other articles on financial planning and investment strategies.

Thank you for reading! We look forward to seeing you back for more insightful content on financial literacy

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8dnyPaWSynZGnenV5lWlnaWWpmq6zeZRmbGloYGLBqbGMqZiympGYuG68xKugqJxdnsBvtNOmow%3D%3D