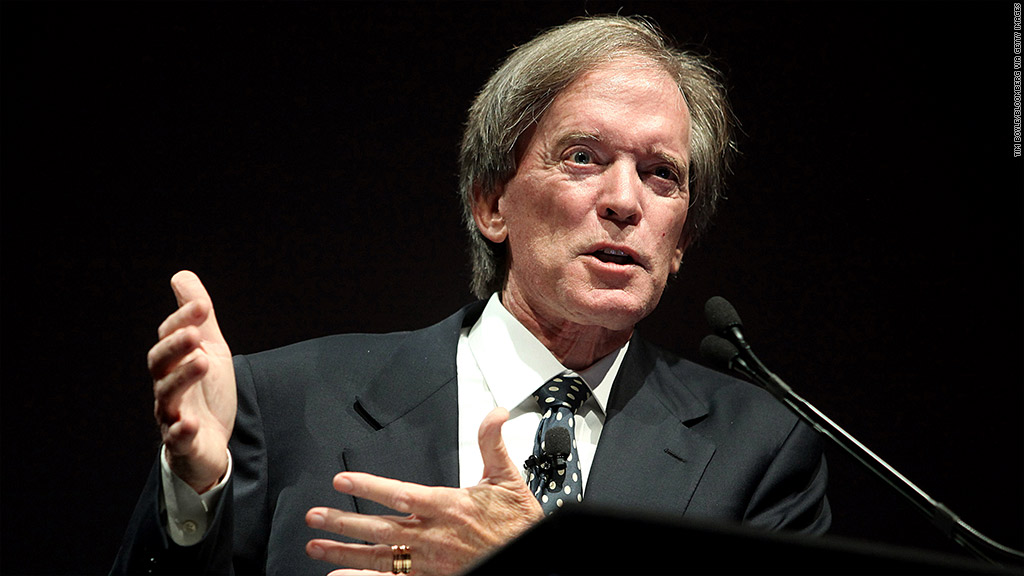

Bill Gross, often referred to as the "Bond King," is a prominent figure in the world of finance, particularly known for his expertise in bond investing. His career spans several decades, during which he has made significant contributions to the investment landscape. With a reputation for both brilliance and controversy, Gross's insights and strategies have influenced countless investors and shaped financial markets globally.

This article will delve into the life, career, and investment philosophies of Bill Gross, exploring how his decisions have impacted the bond market and the broader financial world. By examining his strategies and the principles he advocates, we aim to provide valuable insights for both novice and seasoned investors alike.

Furthermore, we will discuss the significance of Gross's work in the context of Your Money or Your Life (YMYL) principles, emphasizing the importance of reliable financial advice. Understanding Gross's approach can help individuals make informed decisions about their investments.

Table of Contents

1. Biography of Bill Gross

| Full Name | William Hunt Gross |

|---|---|

| Born | April 13, 1944 |

| Nationality | American |

| Education | University of California, Los Angeles (UCLA) |

| Occupation | Investor, Fund Manager |

| Known For | Co-founder of PIMCO |

Bill Gross was born on April 13, 1944, in Middletown, New York. He attended the University of California, Los Angeles (UCLA), where he obtained a degree in Economics. His career began in the 1970s, and he co-founded Pacific Investment Management Company (PIMCO) in 1971, which quickly became one of the largest investment management firms specializing in fixed-income securities.

Under Gross's leadership, PIMCO's Total Return Fund became one of the most successful bond funds in history, attracting billions in assets and solidifying Gross’s reputation as a leading figure in bond investing.

2. Early Life and Education

Bill Gross grew up in a modest household, where his family instilled the values of hard work and education. He was an avid student, excelling in mathematics and economics, which laid the groundwork for his future career in finance. After completing his undergraduate studies at UCLA, Gross pursued an MBA at the same institution, where he began to develop his investment philosophy.

3. Career Highlights

Throughout his career, Gross achieved numerous milestones that cemented his status in the financial industry. Some key highlights include:

- Co-founding PIMCO in 1971, which grew to manage over $2 trillion in assets.

- Managing the PIMCO Total Return Fund, which became the largest bond fund in the world.

- Frequent appearances on financial news networks, where he shared his market insights.

- Authoring several influential investment publications and essays.

- Receiving numerous accolades, including the Morningstar Fixed Income Manager of the Year award.

4. Investment Philosophy

Bill Gross's investment philosophy is characterized by a keen understanding of macroeconomic trends and interest rate movements. He has often emphasized the importance of:

- Diversification: Gross advocates for a diversified portfolio to mitigate risk.

- Market Timing: He believes that understanding market cycles is crucial for successful investing.

- Interest Rate Predictions: Gross has a reputation for accurately predicting interest rate changes, which can significantly impact bond prices.

His approach combines technical analysis with fundamental economic indicators, enabling him to make informed investment decisions.

5. Impact on the Bond Market

Bill Gross's influence on the bond market is profound. His strategies and decisions have often led to significant shifts in bond prices and yields. For instance, his bold predictions regarding interest rate movements have garnered attention and often influenced market sentiment.

Moreover, Gross's management of the PIMCO Total Return Fund set benchmarks for other bond funds and established best practices within the industry. His ability to attract large amounts of capital to bond investments helped to legitimize fixed-income securities as a viable investment class.

6. Controversies and Challenges

While Gross is celebrated for his contributions to the finance world, he has also faced controversies and challenges throughout his career. Some notable instances include:

- His abrupt departure from PIMCO in 2014, which raised questions about his leadership style.

- Criticism for making bold market predictions that did not materialize, leading to losses for investors.

- Legal disputes with PIMCO after his exit, which highlighted tensions within the firm.

Despite these controversies, Gross remains a respected figure in finance, and his insights continue to be sought after.

7. Legacy and Influence

Bill Gross's legacy is marked by his innovative approaches to bond investing and his significant impact on the financial industry. He has inspired countless investors and fund managers to adopt a more analytical approach to fixed-income investments.

Moreover, Gross's willingness to share his knowledge through publications and media appearances has contributed to a greater understanding of bond markets among the general public. His influence extends beyond PIMCO, as his strategies have been studied and emulated by many in the finance world.

8. Conclusion

In conclusion, Bill Gross's journey from a young student to the "Bond King" is a testament to his expertise and dedication to the field of finance. His investment philosophy, marked by a deep understanding of macroeconomic trends, has transformed the bond market and influenced countless investors. Despite facing challenges and controversies, Gross's contributions to finance remain significant.

As you explore your investment options, consider the principles that Gross has championed throughout his career. We invite you to share your thoughts in the comments below, and feel free to explore more articles on our site for further insights into the world of finance.

Thank you for reading! We hope to see you back here soon for more engaging content.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmmqaUpH50e8Gio6Vll6e8tL%2BNoaumpA%3D%3D