How to Get Out of Debt Fast: The Ultimate Guide

Getting out of debt fast is a common financial goal, but it can be a daunting task. By following a few simple steps, however, you can make significant progress towards becoming debt-free.

There are several benefits to getting out of debt fast, including:

- Reduced financial stress

- Improved credit score

- Increased savings

- Greater financial freedom

This article will provide you with a comprehensive overview of how to get out of debt fast. We'll cover everything from creating a budget to negotiating with creditors.

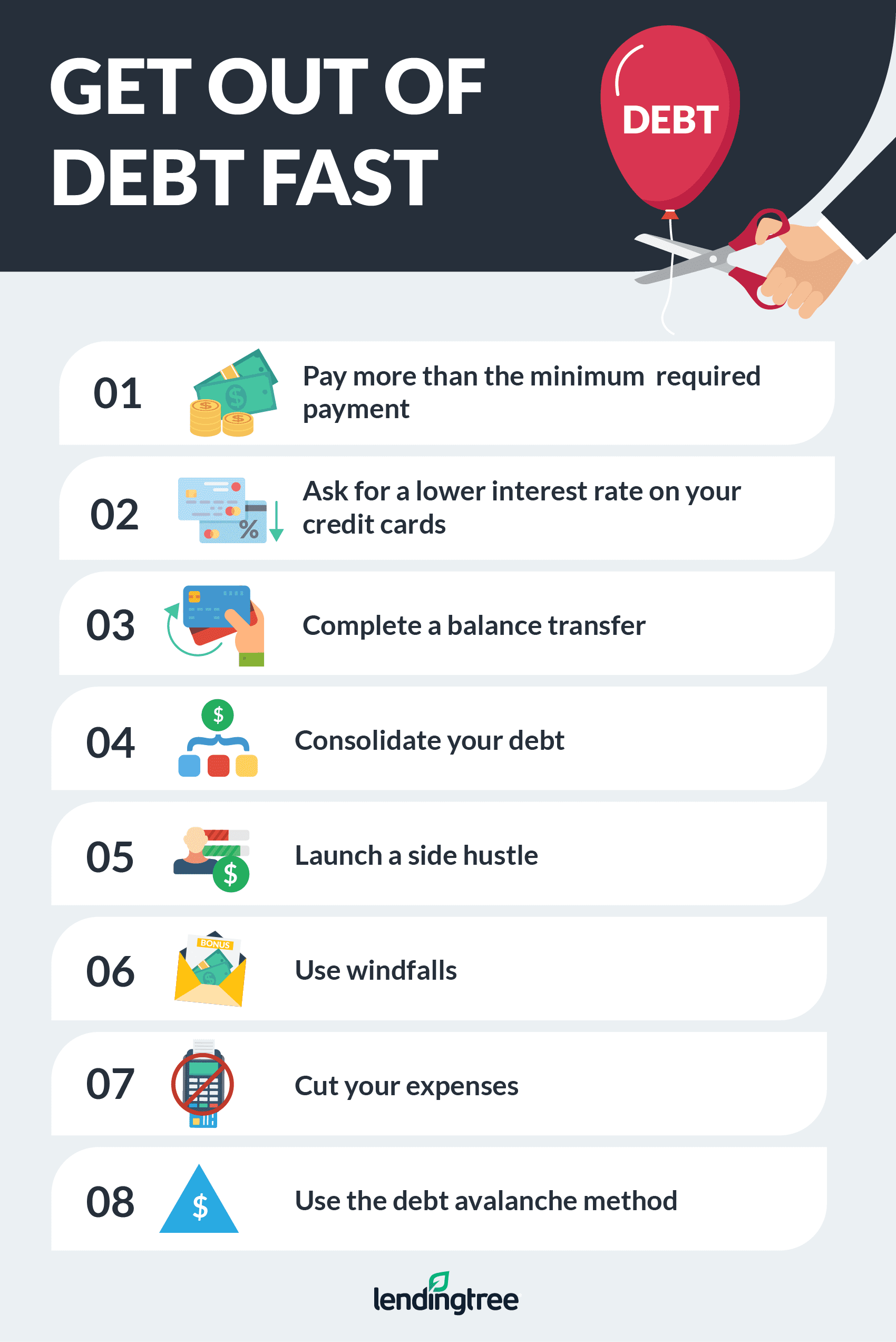

How to Get Out of Debt Fast

There are many different ways to get out of debt fast. The best approach for you will depend on your individual circumstances. However, there are some general steps that you can follow to get started:

The Importance of Getting Out of Debt Fast

There are many reasons why it's important to get out of debt fast. First, debt can be a major source of stress. When you're in debt, you may feel like you're constantly living paycheck to paycheck. This can lead to anxiety, depression, and other health problems.

Second, debt can damage your credit score. A low credit score can make it difficult to get approved for loans, credit cards, and other forms of credit. This can make it difficult to buy a home, rent an apartment, or even get a job.

Third, debt can eat into your savings. When you're making debt payments, you're not able to save as much money for your future. This can make it difficult to reach your financial goals, such as buying a home or retiring comfortably.

The Benefits of Getting Out of Debt Fast

There are many benefits to getting out of debt fast. First, you'll have more money to spend on the things you want and need. This can lead to a higher quality of life.

Second, you'll have less stress. When you're not worried about making debt payments, you'll be able to relax and enjoy your life more.

Third, you'll have a better credit score. A good credit score can make it easier to get approved for loans, credit cards, and other forms of credit. This can save you money on interest and fees.

Fourth, you'll be able to save more money for your future. When you're not making debt payments, you'll be able to put more money away for retirement, emergencies, and other financial goals.

Conclusion

Getting out of debt fast is a great way to improve your financial health. By following the steps outlined in this article, you can make significant progress towards becoming debt-free.

How to Get Out of Debt Fast

Getting out of debt fast requires a multifaceted approach that encompasses various financial strategies. Here are six key aspects to consider:

- Budgeting: Creating a budget is essential for tracking income and expenses, identifying areas for savings, and allocating funds effectively.

- Income Increase: Exploring ways to increase income, such as a side hustle or career advancement, can provide additional funds to accelerate debt repayment.

- Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate can simplify repayment and potentially save money.

- Creditor Negotiation: Contacting creditors to negotiate lower interest rates or extended repayment terms can reduce monthly payments and make debt repayment more manageable.

- Credit Counseling: Seeking professional guidance from a credit counselor can provide personalized advice, debt management plans, and support.

- Lifestyle Changes: Adjusting spending habits, reducing expenses, and making sacrifices can free up funds for debt repayment.

These aspects are interconnected and can be tailored to individual circumstances. Budgeting helps identify areas for expense reduction, which can then be allocated towards debt repayment. Increasing income provides additional resources to accelerate debt payoff. Debt consolidation and creditor negotiation can reduce the overall cost of debt. Credit counseling offers personalized support and guidance, while lifestyle changes demonstrate commitment to becoming debt-free. Each aspect contributes to a comprehensive strategy for getting out of debt fast and achieving financial well-being.

Budgeting

Budgeting is the foundation for getting out of debt fast. By creating a budget, you can get a clear picture of your financial situation, including how much money you earn, how much you spend, and where you can cut back.

- Tracking income and expenses: A budget helps you track your income and expenses so that you can see where your money is going. Once you know where your money is going, you can start to make changes to reduce your spending and save more money.

- Identifying areas for savings: A budget can help you identify areas where you can save money. For example, you may be able to save money on groceries, entertainment, or transportation.

- Allocating funds effectively: A budget helps you allocate your funds effectively so that you can make sure that you are putting your money towards the most important things. For example, you may want to allocate more money towards debt repayment or savings.

By following these steps, you can create a budget that will help you get out of debt fast and achieve your financial goals.

Income Increase

Increasing your income is a powerful way to get out of debt fast. The additional funds you earn can be used to pay down your debt faster, freeing you from debt sooner.

There are many different ways to increase your income. Some popular options include:

- Getting a side hustle: A side hustle is a part-time job or freelance work that you do in addition to your regular job. Side hustles can be a great way to earn extra money that can be used to pay down debt.

- Asking for a raise: If you've been with your company for a while and you're consistently exceeding expectations, you may be able to negotiate a raise. A raise can give you a significant boost in income that can be used to pay down debt faster.

- Starting your own business: Starting your own business can be a great way to increase your income and get out of debt fast. However, it's important to do your research and make sure that you have a solid business plan before you get started.

No matter how you choose to increase your income, the additional funds you earn can be used to pay down your debt faster and achieve your financial goals.

Here are some real-life examples of how people have used increased income to get out of debt fast:

- One woman increased her income by getting a part-time job as a waitress. She used the extra money she earned to pay down her credit card debt in just 6 months.

- Another man increased his income by starting his own landscaping business. He used the extra money he earned to pay off his student loans in just 2 years.

These are just a few examples of how increasing your income can help you get out of debt fast. If you're struggling to make ends meet, consider exploring ways to increase your income. The additional funds you earn can make a big difference in your ability to get out of debt and achieve your financial goals.

Debt Consolidation

In the context of "how to get out of debt fast," debt consolidation can play a significant role in streamlining the repayment process and reducing overall costs. By combining multiple debts into a single loan, individuals can secure a lower interest rate, which translates into reduced monthly payments and substantial savings over the life of the loan.

- Simplified Repayment

Debt consolidation simplifies the repayment process by consolidating multiple debts into a single monthly payment. This eliminates the need to keep track of multiple due dates and payment amounts, reducing the risk of missed payments and potential damage to credit scores.

- Reduced Interest Rates

Debt consolidation often involves securing a lower interest rate than what is charged on individual debts. This is particularly beneficial for individuals with high-interest debts, such as credit card balances. By consolidating these debts into a single loan with a lower interest rate, individuals can significantly reduce the overall cost of borrowing.

- Extended Repayment Terms

Debt consolidation loans typically offer longer repayment terms than individual debts. This can be advantageous for individuals who are struggling to make high monthly payments. By extending the repayment period, monthly payments can be reduced, making debt repayment more manageable and freeing up cash flow for other essential expenses.

- Improved Credit Score

Debt consolidation can positively impact credit scores by reducing credit utilization and demonstrating responsible debt management. When multiple debts are consolidated into a single loan, the total amount of debt owed decreases, which lowers the credit utilization ratio. Additionally, making regular payments on a single loan can help improve payment history and overall creditworthiness.

In summary, debt consolidation can be a valuable strategy for individuals seeking to get out of debt fast. By simplifying repayment, reducing interest rates, extending repayment terms, and improving credit scores, debt consolidation can provide a clear path to financial recovery and debt freedom.

Creditor Negotiation

Creditor negotiation plays a pivotal role in accelerating debt repayment. By contacting creditors and initiating negotiations, individuals can potentially secure reduced interest rates and extended repayment terms. These adjustments can significantly lower monthly payments, making debt repayment more manageable and freeing up cash flow for other essential expenses.

Negotiating with creditors requires assertiveness, communication skills, and a clear understanding of one's financial situation. It involves presenting a compelling case to creditors, explaining the challenges faced, and proposing a revised payment plan that is both realistic and beneficial to both parties.

Successful creditor negotiations can yield substantial benefits. Lower interest rates reduce the overall cost of borrowing, leading to significant savings over the life of the loan. Extended repayment terms provide greater flexibility, allowing individuals to spread out payments over a longer period, reducing the burden of high monthly payments.

Here's an example of how creditor negotiation can help get out of debt fast:

John had accumulated significant credit card debt with high interest rates. He contacted his creditors and explained his financial situation. After several rounds of negotiation, he was able to secure a lower interest rate and an extended repayment period. As a result, his monthly payments were reduced by 20%, allowing him to allocate more funds towards debt repayment and become debt-free faster.

Creditor negotiation is not always successful, and outcomes may vary depending on individual circumstances and creditor policies. However, it is a valuable strategy that can potentially reduce monthly payments, improve cash flow, and accelerate debt repayment.

Credit Counseling

Credit counseling offers a valuable resource for individuals seeking to get out of debt fast. By partnering with a certified credit counselor, individuals gain access to personalized guidance, tailored debt management plans, and ongoing support throughout their debt repayment journey.

- Customized Debt Assessment and Plan

Credit counselors conduct a thorough analysis of an individual's financial situation, including income, expenses, and debt obligations. Based on this assessment, they develop a personalized debt management plan that outlines a clear roadmap for debt repayment, prioritizing high-interest debts and exploring potential debt consolidation options.

- Negotiation and Communication with Creditors

Credit counselors can assist in negotiating with creditors on behalf of their clients. They leverage their expertise and relationships with creditors to secure lower interest rates, reduced monthly payments, and extended repayment terms. This can significantly reduce the overall cost of debt and expedite the debt repayment process.

- Budgeting and Financial Management Education

Credit counselors provide comprehensive financial education, empowering individuals with the knowledge and skills to manage their finances effectively. They help clients create realistic budgets, identify areas for spending reduction, and develop strategies for long-term financial stability.

- Emotional Support and Accountability

Getting out of debt can be an emotionally challenging process. Credit counselors offer ongoing support and encouragement, providing a sense of accountability and motivation. They help clients stay on track with their debt repayment plan and address any setbacks or challenges that may arise along the way.

By leveraging the services of a credit counselor, individuals can gain a comprehensive and personalized approach to debt repayment. With professional guidance, tailored strategies, and ongoing support, credit counseling empowers individuals to overcome debt challenges and achieve financial freedom faster.

Lifestyle Changes

Making lifestyle changes is a crucial component of getting out of debt fast. By adjusting spending habits, reducing expenses, and making sacrifices, individuals can free up significant funds that can be allocated towards debt repayment. This approach involves identifying areas where discretionary spending can be curtailed and implementing strategies to minimize non-essential expenses.

For instance, reducing entertainment expenses, dining out less frequently, and opting for generic brands over name brands can lead to substantial savings over time. Additionally, exploring cheaper alternatives for transportation, such as carpooling or public transit, can further reduce monthly expenses. Making sacrifices, such as downsizing to a smaller home or apartment, can also free up a substantial amount of money that can be used to pay down debt.

By embracing a more frugal lifestyle and prioritizing debt repayment, individuals can accelerate the process of becoming debt-free. It is important to note that making lifestyle changes can be challenging, requiring discipline and commitment. However, the long-term benefits of achieving financial freedom make these sacrifices worthwhile.

FAQs on How to Get Out of Debt Fast

Getting out of debt fast requires a multifaceted approach and often raises common questions. This section addresses some frequently asked questions to provide concise and informative answers.

Question 1: Is it possible to get out of debt fast without making any sacrifices?

Getting out of debt fast typically requires some level of sacrifice. Whether it's reducing unnecessary expenses, negotiating lower interest rates, or increasing income, there are often adjustments that need to be made. While it may not be easy, the long-term benefits of financial freedom make these sacrifices worthwhile.

Question 2: What is the best debt repayment method?

The best debt repayment method depends on individual circumstances. Some common methods include the debt avalanche method, debt snowball method, and debt consolidation. It's important to assess your situation, consider the interest rates on your debts, and choose the method that aligns with your financial goals and repayment capacity.

Summary: Getting out of debt fast requires a combination of strategies, including budgeting, increasing income, and making lifestyle changes. While it may involve sacrifices, the ultimate reward of financial freedom makes it a worthwhile endeavor. Choosing the right debt repayment method and seeking professional guidance when needed can accelerate the process and provide support along the way.

Conclusion

Getting out of debt fast is a significant financial accomplishment that requires a strategic and disciplined approach. By implementing the strategies outlined in this article, individuals can overcome debt challenges and achieve financial freedom sooner rather than later. Whether it's creating a budget, increasing income, negotiating with creditors, or making lifestyle changes, there are numerous avenues to explore.

Remember, the journey to becoming debt-free may not be easy, but it is incredibly rewarding. The financial stability and peace of mind gained are invaluable. Embrace the challenge, stay committed to your goals, and seek professional guidance when needed. With determination and a comprehensive plan, you can overcome debt and unlock a brighter financial future.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmpJ2cocZuwsibnKxnmKTEbsDOZp6erF2kwrV5zp9knZ2SqXqnrdKtZaGsnaE%3D