The real estate market is a complex and dynamic field, with numerous legal intricacies that can often leave individuals feeling overwhelmed. One such scenario that can arise is when a property owner, referred to here as Charlie, signs a new deed for a property they already own, which can lead to various legal implications. In this article, we will explore the concept of property deeds, the potential motivations behind signing a new deed, and the implications of such actions on ownership rights and financial responsibilities. This comprehensive guide aims to clarify these complex issues while ensuring readers are well-informed about their rights and obligations in property transactions.

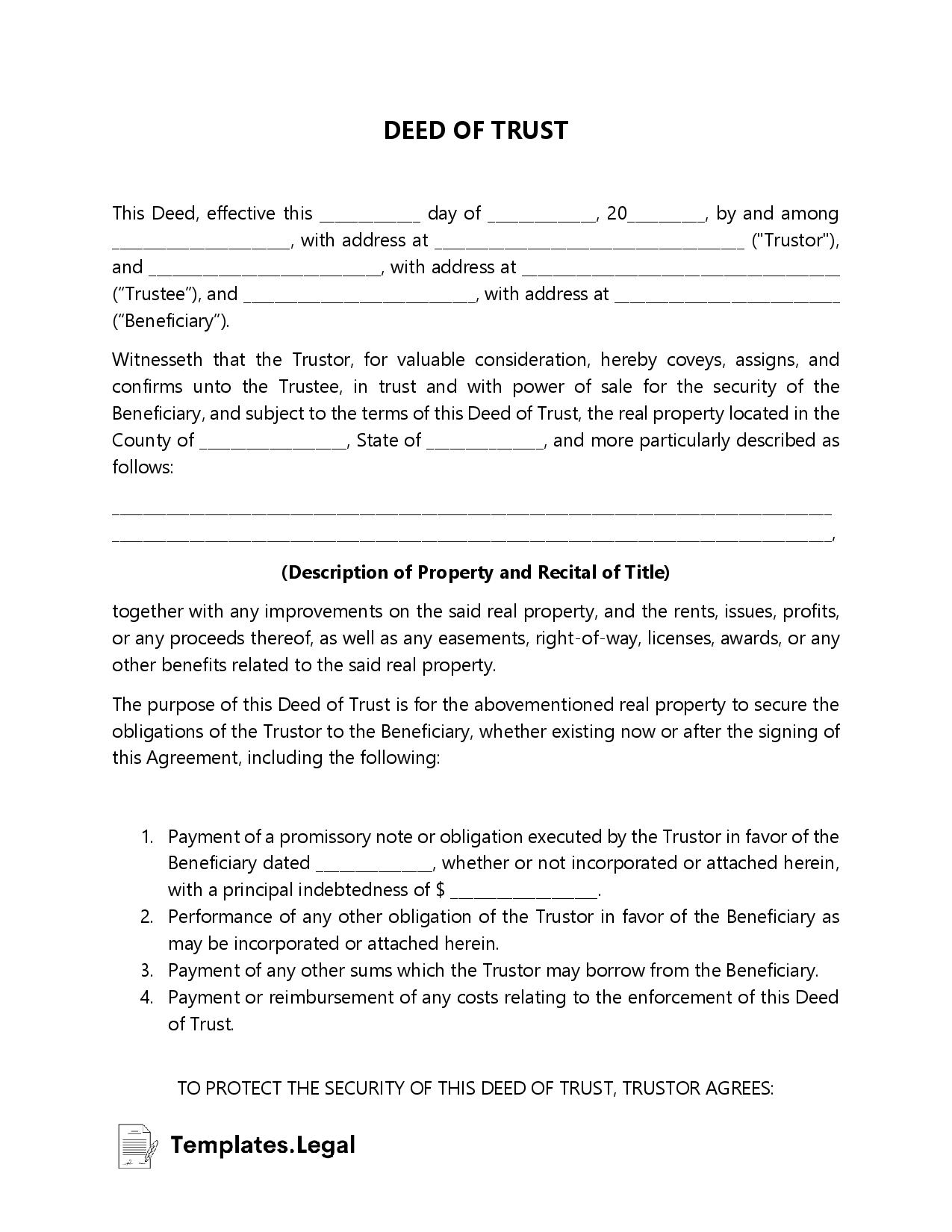

Understanding property deeds is essential for anyone involved in real estate, whether as a buyer, seller, or investor. A deed is a legal document that conveys ownership of real property from one party to another. It contains vital information about the property, including its description, the parties involved, and any conditions or restrictions related to the transfer. However, situations can arise where an individual like Charlie may sign a new deed for the same property, leading to questions about the validity of ownership and potential financial implications.

In this article, we will delve into the various reasons someone might sign a new deed for a property, the potential legal ramifications, and how to navigate these waters effectively. By the end of this guide, readers will have a clearer understanding of the implications of signing a new deed and will be better equipped to make informed decisions regarding property ownership and transactions.

Table of Contents

What is a Deed?

A deed is a formal document that serves as evidence of a person's right to own, use, or transfer property. It is a critical component of real estate transactions and plays a fundamental role in establishing ownership. The primary functions of a deed include:

- Transfer of Title: A deed effectively transfers title or ownership from one party (the grantor) to another (the grantee).

- Legal Description: It includes a legal description of the property, ensuring clarity about what is being transferred.

- Signatures: A deed must be signed by the grantor to be valid, and in some cases, it may need to be notarized.

Types of Deeds

There are several types of deeds, each serving different purposes in property transactions. Some common types include:

- Warranty Deed: Offers the highest level of protection to the buyer, guaranteeing that the seller holds clear title to the property.

- Quitclaim Deed: Transfers whatever interest the grantor has in the property without any guarantees or warranties.

- Grant Deed: Similar to a warranty deed but with fewer guarantees, primarily ensuring the seller has not transferred the property to anyone else.

- Special Purpose Deeds: Used for specific situations, such as foreclosure or tax deeds.

Why Sign a New Deed?

There are various reasons why someone like Charlie might choose to sign a new deed for a property they already own:

- Updating Ownership Information: If there has been a change in ownership status, such as marriage or divorce, a new deed may be necessary to reflect the current ownership.

- Transferring Property to Another Party: A property owner may wish to transfer ownership to a family member or business partner.

- Clarifying Title Issues: If there are disputes regarding the title or ownership, a new deed can help clarify and resolve these issues.

- Tax Considerations: In some cases, signing a new deed may have tax advantages or implications.

Legal Implications of Signing a New Deed

Signing a new deed can have several legal implications that property owners must be aware of:

- Potential for Fraud: If the new deed is signed without the knowledge of the original owner, it could be considered fraudulent.

- Clouded Title: A new deed may create confusion regarding property ownership, leading to disputes between parties.

- Requirement for Notarization: In many jurisdictions, a deed must be notarized to be legally binding, and failure to do so can render the deed invalid.

- Impact on Mortgages: If the property has an existing mortgage, signing a new deed may trigger the due-on-sale clause, requiring full payment of the outstanding loan.

Financial Implications of Signing a New Deed

Beyond legal considerations, there are financial implications to consider when signing a new deed:

- Transfer Taxes: Many states impose transfer taxes on property sales, which may apply when signing a new deed.

- Liabilities for Liens: If there are any liens on the property, the new owner may inherit those liabilities.

- Insurance Considerations: Changing ownership may affect the property insurance policy, requiring updates or changes to coverage.

Navigating Property Transactions

Understanding the complexities of property transactions is crucial for avoiding potential pitfalls. Here are a few tips for successfully navigating these waters:

- Consult with Professionals: Seek advice from real estate attorneys, agents, and financial advisors to ensure compliance with laws and regulations.

- Review All Documents: Carefully review any deeds, contracts, and agreements before signing to ensure clarity and understanding.

- Keep Records: Maintain detailed records of all property transactions, including deeds and correspondence, for future reference.

Case Study: Charlie's Situation

To further illustrate the complexities involved, let's consider a hypothetical case study involving Charlie:

| Data Personal | Details |

|---|---|

| Name | Charlie Smith |

| Property Address | 123 Main St, Springfield |

| Original Deed Date | January 1, 2020 |

| New Deed Date | October 1, 2023 |

In this scenario, Charlie originally purchased the property in January 2020. However, due to a recent marriage, he decided to sign a new deed in October 2023 to include his spouse as a co-owner. While this action may seem straightforward, it is essential for Charlie to consider the legal and financial implications of this decision, including potential tax liabilities and mortgage considerations.

Conclusion

In conclusion, the act of signing a new deed for a property can have significant legal and financial implications. Understanding the purpose of deeds, the reasons behind signing a new one, and the potential consequences is crucial for anyone involved in real estate transactions. If you find yourself in a situation similar to Charlie's, it is essential to consult with professionals to ensure that your rights and interests are protected. We encourage our readers to leave comments, share their experiences, and explore additional articles on our site for further insights into property ownership and real estate transactions.

Thank you for reading! We hope this article has provided valuable insights into the complexities of property deeds and the implications of signing a new deed. We invite you to return for more informative content on real estate and financial matters.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8rrvNnrBmnqKkum6vx5qppaGVYq6vsIysoKCmlZl6onnNnq5mnJWasW6yzqtkraCVYsCiucRmp6unoJq%2FtcWMqayrqJ%2Bnwaq6xmefraWc