The John D. Rockefeller Trust represents a significant aspect of American financial history, impacting philanthropy and wealth management. Established by one of the wealthiest individuals in history, this trust encapsulates the principles of wealth preservation, responsible giving, and societal impact. As we delve deeper into the intricacies of the John D. Rockefeller Trust, we uncover not just the mechanisms of trust management but also the overarching legacy that John D. Rockefeller left behind.

In this article, we will explore the foundational aspects of the Rockefeller Trust, including its structure, purpose, and the philanthropic initiatives it has supported over the years. Understanding this trust is essential for anyone interested in wealth management, philanthropy, or the broader implications of financial legacies on society. Additionally, we will examine the trust's relevance in today's financial landscape, given the growing interest in socially responsible investments and charitable giving.

Join us as we navigate through the historical context, the operational framework of the trust, and its continuing influence on modern philanthropy and financial practices. Whether you are a financial professional, a philanthropist, or simply someone interested in the dynamics of wealth and its societal implications, this exploration of the John D. Rockefeller Trust promises valuable insights.

Table of Contents

John D. Rockefeller: A Brief Biography

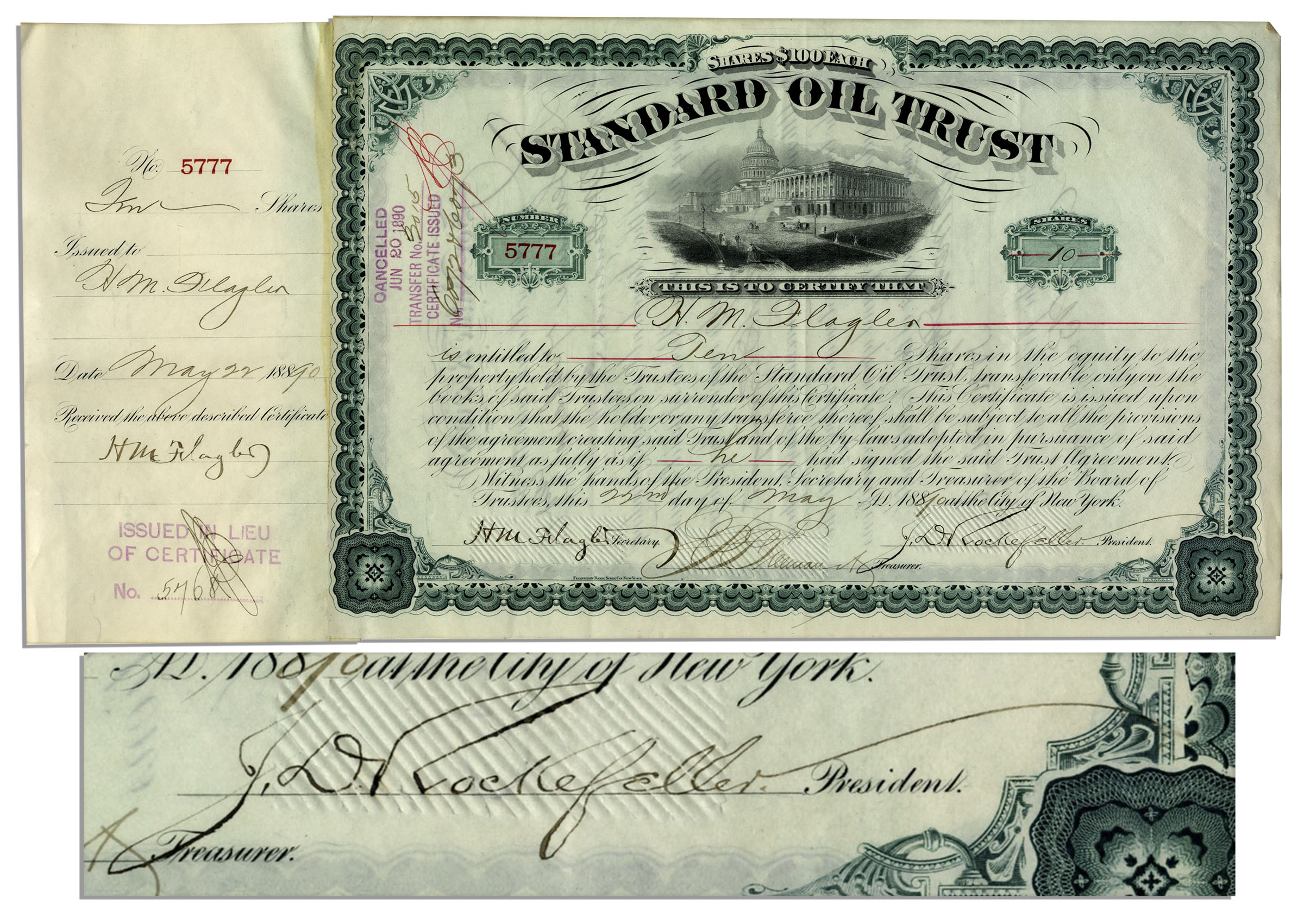

John D. Rockefeller was born on July 8, 1839, in Richford, New York. He grew up in a modest family, which instilled in him the values of hard work and frugality. He began his career in the oil industry, co-founding Standard Oil in 1870, which would become one of the largest and most influential companies in history.

Throughout his life, Rockefeller was known for his innovative business practices and his philanthropic efforts. He believed in the responsibility of the wealthy to give back to society. This belief laid the groundwork for the establishment of the Rockefeller Trust, which aimed to manage his vast wealth responsibly while contributing to various societal causes.

| Data Pribadi | Detail |

|---|---|

| Nama Lengkap | John Davison Rockefeller |

| Tanggal Lahir | 8 Juli 1839 |

| Tempat Lahir | Richford, New York, AS |

| Tanggal Meninggal | 23 Mei 1937 |

| Pekerjaan | Industriwan, Filantropis |

The Structure of the John D. Rockefeller Trust

The John D. Rockefeller Trust was designed to ensure the long-term preservation and growth of Rockefeller's wealth while enabling philanthropic initiatives. The trust is structured to provide financial support to various causes without compromising its principal amount.

Key Components of the Trust Structure

- Trustees: The trust is managed by a board of trustees, typically composed of family members and financial experts who oversee its operations.

- Investment Portfolio: The trust maintains a diverse investment portfolio, which includes equities, fixed income, and alternative investments to ensure stable returns.

- Distribution Policies: The trust has established policies that dictate how and when funds can be distributed to philanthropic initiatives.

Major Philanthropic Initiatives Funded by the Trust

One of the most significant aspects of the John D. Rockefeller Trust is its commitment to philanthropy. Over the years, the trust has funded numerous initiatives that have had a profound impact on society.

Notable Philanthropic Contributions

- Education: The trust has supported various educational institutions, including the establishment of the University of Chicago.

- Public Health: Funding for public health initiatives, such as the establishment of the Rockefeller Foundation, which focuses on global health issues.

- Environmental Conservation: Contributions to environmental conservation efforts aimed at protecting natural resources.

Investment Strategies Employed by the Trust

The investment strategy of the John D. Rockefeller Trust is crucial for achieving its financial goals while fulfilling its philanthropic mission. The trust employs a diversified investment approach to mitigate risk and enhance returns.

Core Investment Principles

- Diversification: The trust invests across various asset classes to reduce risk.

- Long-Term Focus: Investments are made with a long-term horizon to align with the trust's goals.

- Socially Responsible Investing: The trust increasingly considers environmental, social, and governance (ESG) factors in its investment decisions.

Impact on Society and Philanthropy

The impact of the John D. Rockefeller Trust extends far beyond financial contributions. Its initiatives have influenced various sectors, including education, health, and environmental conservation.

Through its philanthropic endeavors, the trust has set a precedent for responsible giving and has encouraged other wealthy individuals and organizations to follow suit. The Rockefeller legacy emphasizes the importance of using wealth as a tool for positive societal change.

The Modern Relevance of the Rockefeller Trust

In today’s financial landscape, the principles established by the John D. Rockefeller Trust remain highly relevant. The growing trend of socially responsible investing and the emphasis on corporate social responsibility (CSR) highlight the trust's forward-thinking approach.

Wealthy individuals and corporations are increasingly recognizing the importance of integrating social impact into their investment strategies, echoing Rockefeller's original vision of philanthropy and wealth management.

Lessons Learned from the Rockefeller Trust

The John D. Rockefeller Trust offers several key lessons for current and future generations regarding wealth management and philanthropy.

- Long-Term Vision: Establishing a long-term vision for wealth preservation and social impact is crucial.

- Responsibility of Wealth: Wealth comes with the responsibility to give back to society.

- Diversification is Key: A diversified investment portfolio helps mitigate risks and ensures sustainable growth.

Conclusion

In summary, the John D. Rockefeller Trust serves as a vital example of how wealth can be managed and utilized for the greater good. Its legacy in philanthropy, investment strategy, and societal impact continues to influence contemporary practices in wealth management and charitable giving.

As we reflect on the lessons learned from the Rockefeller Trust, it's important to consider how we can apply these principles in our own lives and communities. We invite you to share your thoughts in the comments below or explore other articles on our site related to wealth management and philanthropy.

Thank you for reading, and we hope to see you back here for more insightful content on financial history and its modern implications.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmpJ2cocZur86lpqurX5%2B8qbqMnWSrp5Ogsqexy6Wcq2Wkp8K0wI2hq6ak