When analyzing a company's financial health, understanding the balance sheet is crucial. One of the key components of the balance sheet is the liabilities section, which reflects what the company owes to creditors and other parties. If a company owes $100,000, it is essential to determine where this figure would appear on the balance sheet to accurately assess the company's financial obligations.

In this article, we will delve into the balance sheet's structure, specifically focusing on the liabilities section, and explain how various types of debts are categorized. We will also explore the implications of these debts on a company's overall financial standing and decision-making processes. By the end of this article, you will have a comprehensive understanding of balance sheets and the significance of liabilities.

Whether you are an investor, a financial analyst, or a business owner, grasping how and where liabilities are recorded on the balance sheet will enhance your ability to interpret financial statements effectively. Let's begin our exploration of the balance sheet and the treatment of liabilities.

Table of Contents

1. Balance Sheet Overview

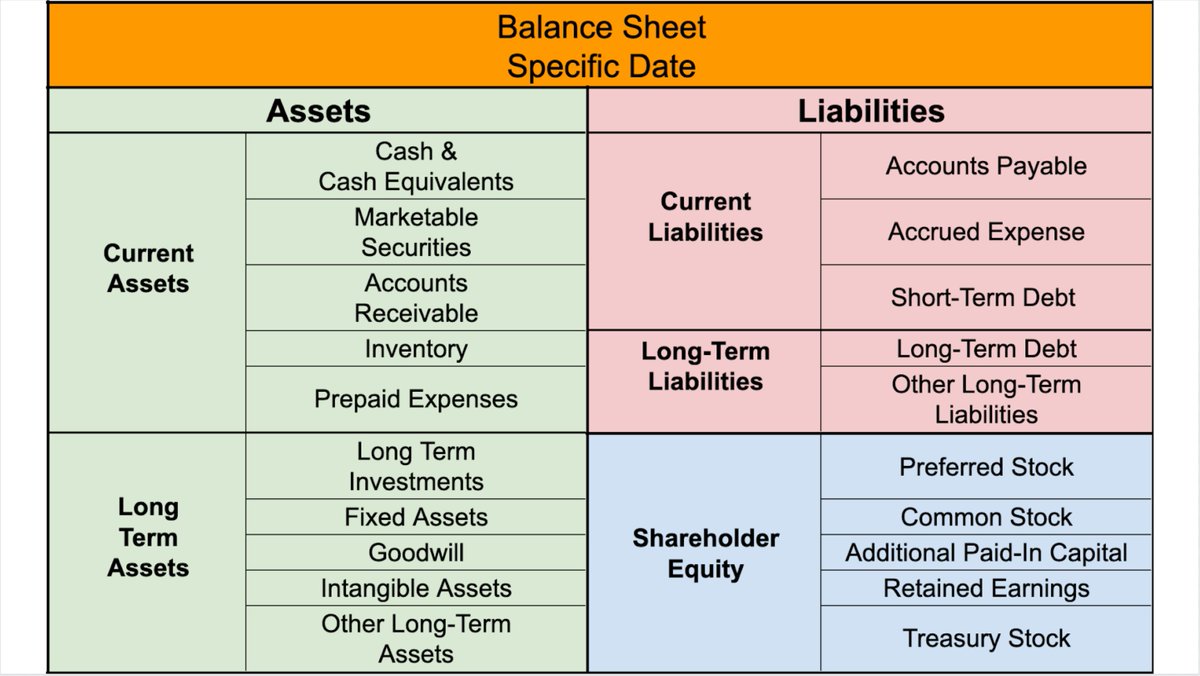

The balance sheet is one of the three fundamental financial statements used to assess a company's financial position at a given point in time, alongside the income statement and cash flow statement. It provides a snapshot of what the company owns (assets), what it owes (liabilities), and the residual interest of the shareholders (equity).

Components of the Balance Sheet

Each balance sheet consists of three primary components:

- Assets: Resources owned by the company.

- Liabilities: Obligations that the company must settle in the future.

- Equity: The residual interest in the assets of the company after deducting liabilities.

2. Understanding Liabilities

Liabilities are classified as current or long-term based on their due dates. They represent claims against the company's assets and can arise from various transactions, such as borrowing funds, purchasing goods on credit, or incurring expenses that have not yet been paid.

Importance of Liabilities

Understanding liabilities is essential for several reasons:

- They provide insights into the company's financial obligations.

- They affect the company's liquidity and ability to meet short-term obligations.

- They influence investment decisions and assessments of financial health.

3. Types of Liabilities

Liabilities are generally divided into two main categories: current liabilities and long-term liabilities.

Current Liabilities

Current liabilities are obligations that are due within one year. They include:

- Accounts payable

- Short-term loans

- Accrued expenses

- Unearned revenue

Long-term Liabilities

Long-term liabilities are obligations that extend beyond one year. They may include:

- Long-term loans

- Bonds payable

- Deferred tax liabilities

4. Current vs. Long-term Liabilities

Understanding the distinction between current and long-term liabilities is vital for assessing a company's liquidity and risk profile. Current liabilities are crucial for managing day-to-day operations, while long-term liabilities may affect the company's financial strategy and capital structure.

5. Impact of Liabilities on Financial Health

Liabilities play a significant role in determining a company's financial health and risk profile. High levels of debt can lead to increased interest expenses and financial strain, while manageable levels of debt can facilitate growth and expansion.

6. Case Study: Analyzing a Company with $100,000 Debt

Let’s consider a hypothetical company that owes $100,000. This amount would typically be recorded under current liabilities if it is due within the year. It may appear as accounts payable, short-term debt, or other current obligations on the balance sheet.

Biodata of the Hypothetical Company

| Company Name | Industry | Total Assets | Total Liabilities | Equity |

|---|---|---|---|---|

| Hypothetical Corp | Technology | $500,000 | $100,000 | $400,000 |

7. Common Misconceptions about Liabilities

There are several misconceptions regarding liabilities that can lead to confusion:

- All debt is bad: While excessive debt can be detrimental, manageable debt can be beneficial for growth.

- Liabilities only refer to loans: Liabilities encompass a broader range of obligations, including accounts payable and accrued expenses.

8. Conclusion

In conclusion, if a company owes $100,000, this amount would typically be categorized under current liabilities on the balance sheet, reflecting its obligations to creditors. Understanding the structure of the balance sheet and the nature of liabilities is crucial for investors, analysts, and business owners alike. By gaining insights into liabilities, stakeholders can make informed decisions regarding the company's financial health.

If you found this article helpful, please leave a comment below, share it with others, or explore more articles on our site for additional insights into financial management and analysis.

Thank you for reading, and we hope to see you back here for more informative content!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8qrKMmmScp52lrq%2FFjKiunqtdZn1xfI9pZLCgkal6tLHCraCopl2ks27Ax55km5mclruksYysn56dpGLEsMHLnWStoJmoe6nAzKU%3D