Preparing an income statement is a crucial task for any business looking to assess its financial performance. An income statement, also known as a profit and loss statement, provides a summary of revenue and expenses, allowing businesses to determine their profitability over a specific period. This article will guide you through the process of preparing an income statement, outlining key components, common mistakes to avoid, and tips for ensuring accuracy.

This guide is designed for business owners, accountants, and anyone interested in financial reporting. By the end of this article, you will have a thorough understanding of how to prepare an income statement that meets the standards of clarity and professionalism. Whether you are a small business owner or managing finances for a larger corporation, mastering the income statement is essential for informed decision-making.

In this article, we will delve into the essential elements of an income statement, including revenue recognition, the matching principle, and how to categorize expenses. We will also address the significance of this financial statement in the context of overall business health and performance evaluation. So, let’s get started!

Table of Contents

What is an Income Statement?

An income statement is a financial report that summarizes a company's revenues and expenses over a specific period, typically quarterly or annually. It provides insight into the business's operational efficiency and profitability. The primary purpose of the income statement is to convey how much money the business has made or lost during the reporting period, making it a crucial tool for stakeholders, including management, investors, and creditors.

Key Features of an Income Statement

- Revenue: Total income generated from sales of goods or services.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of the goods sold by the company.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs incurred in the normal course of business operations.

- Net Income: Total revenue minus total expenses, representing the profit or loss for the period.

Importance of the Income Statement

The income statement serves several key purposes in the financial management of a business:

- Performance Evaluation: It enables stakeholders to assess the profitability of the business over time.

- Financial Planning: Businesses can use income statements to forecast future performance and set budgets.

- Investment Decisions: Investors analyze income statements to determine the financial health and growth potential of a company.

- Tax Compliance: Income statements are essential for preparing tax returns and ensuring compliance with tax regulations.

Components of an Income Statement

An income statement is typically divided into several key sections:

- Revenue: The total income generated from sales.

- Cost of Goods Sold (COGS): The direct costs of producing the goods sold.

- Gross Profit: Calculated as Revenue minus COGS.

- Operating Expenses: Includes selling, general, and administrative expenses.

- Operating Income: Gross Profit minus Operating Expenses.

- Other Income and Expenses: Non-operating revenues and expenses, such as interest and taxes.

- Net Income: The final profit or loss after all expenses have been deducted from revenue.

How to Prepare an Income Statement

Preparing an income statement involves several steps:

Common Mistakes to Avoid

When preparing an income statement, be mindful of the following common mistakes:

- Inaccurate Revenue Recognition: Ensure revenue is recorded when earned, not necessarily when cash is received.

- Overlooking Expenses: Include all relevant expenses to avoid understating costs.

- Failing to Categorize Properly: Accurate categorization of revenues and expenses is crucial for clarity.

- Neglecting Non-Recurring Items: Include significant non-recurring items to provide a complete picture of financial performance.

Examples of Income Statements

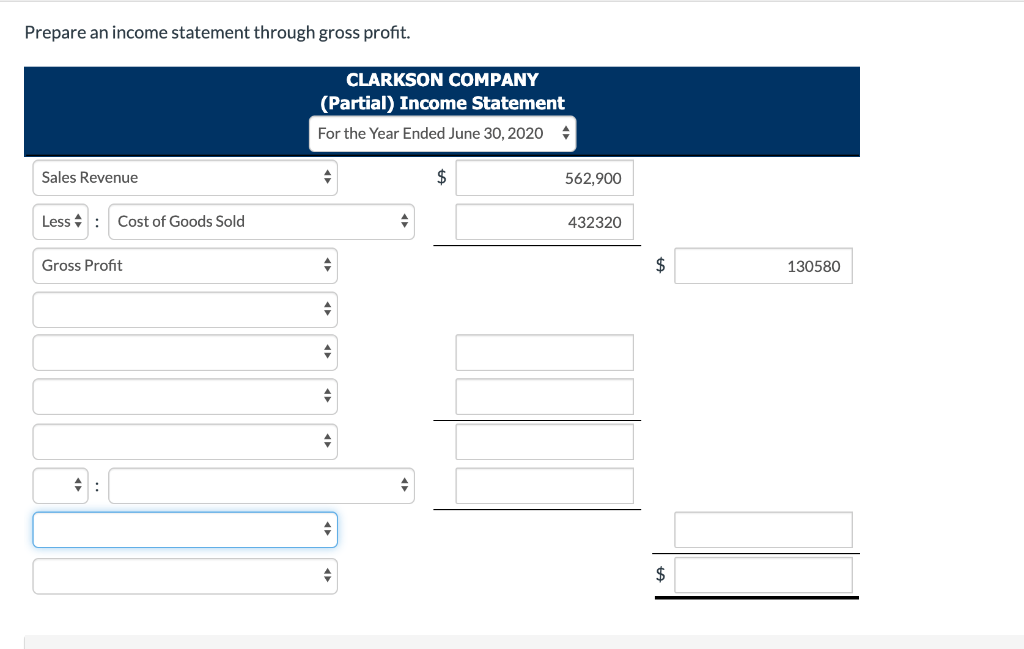

Here are two simplified examples of income statements for different types of businesses:

Example 1: Retail Business

| Item | Amount |

|---|---|

| Total Revenue | $100,000 |

| Cost of Goods Sold | $60,000 |

| Gross Profit | $40,000 |

| Operating Expenses | $20,000 |

| Net Income | $20,000 |

Example 2: Service Business

| Item | Amount |

|---|---|

| Total Revenue | $80,000 |

| Operating Expenses | $50,000 |

| Net Income | $30,000 |

Using Income Statements for Decision Making

Income statements are invaluable for making informed business decisions, including:

- Budgeting: Use historical income statements to forecast future revenue and expenses.

- Performance Analysis: Compare income statements over multiple periods to identify trends.

- Investor Relations: Present income statements to stakeholders to convey financial health.

Conclusion

Preparing an income statement is a vital skill for business owners and financial professionals alike. By following the steps outlined in this guide and avoiding common pitfalls, you can create accurate and informative income statements that reflect your business's financial performance. Consider using these statements as tools for strategic planning and decision-making.

We encourage you to leave comments with your thoughts or questions, share this article with others, and explore more resources on financial management on our website.

Thank You for Reading!

We hope you found this article helpful and informative. Please return to our site for more insightful articles and resources aimed at enhancing your financial knowledge and business acumen.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8sb7EqZirnV2Wu261zZympp1dqMGiwMSmnKesXp3Brrg%3D