When it comes to real estate investments, understanding the costs associated with land is crucial for maximizing returns. The question of which costs Sherman should capitalize in the cost of land is a significant one, as it can influence overall profitability and financial reporting. In this article, we will explore the various costs that can be capitalized, the rationale behind capitalizing these costs, and the potential implications for Sherman’s investment strategy.

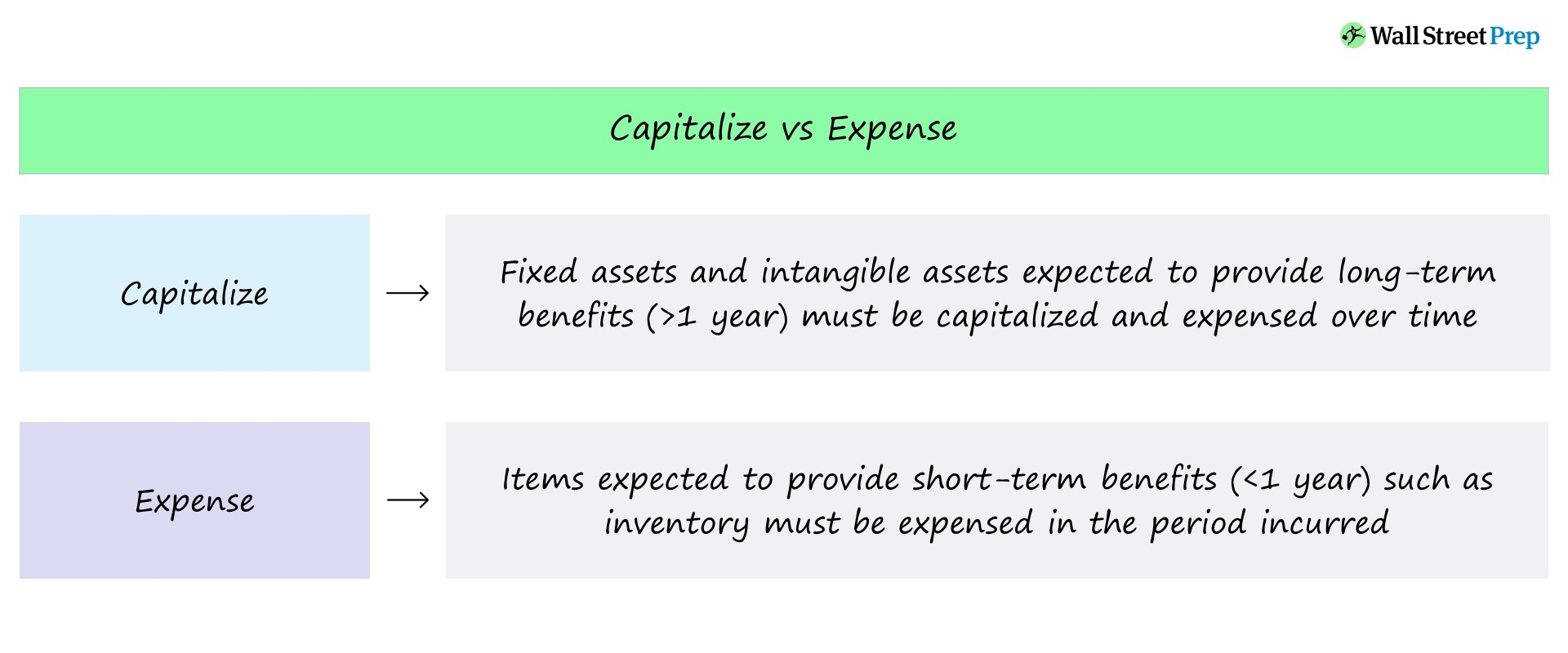

Capitalizing costs means adding them to the value of an asset rather than expensing them in the period they occurred. This approach is particularly relevant in real estate, where initial investments can significantly impact long-term financial results. By the end of this article, you will have a comprehensive understanding of the costs Sherman should consider when capitalizing land costs.

Whether you are a seasoned investor or new to the world of real estate, knowing how to properly account for land costs can provide a competitive advantage. Let’s dive into the details of what costs Sherman should capitalize and how it affects his investment portfolio.

Table of Contents

Definition of Capitalized Costs

Capitalized costs refer to expenses that are added to the value of an asset and not deducted as an expense in the current period. In the context of land investment, capitalizing costs allows investors to spread the expense over the asset's useful life, improving financial statements and tax implications.

Costs to Capitalize

When considering costs that Sherman should capitalize, it is essential to identify specific categories. Below are the primary costs that can be capitalized in the cost of land:

Land Acquisition Costs

- Purchase price of the land.

- Real estate agent commissions.

- Title insurance premiums.

- Property taxes incurred before the land is ready for use.

- Survey fees and appraisal costs.

Development Costs

- Costs for preparing the land for its intended use.

- Site development costs, including grading and drainage.

- Infrastructure costs such as roads, utilities, and landscaping.

- Permitting and inspection fees associated with the development.

Legal Fees

- Costs for legal advice regarding land acquisition.

- Fees paid for drafting contracts and deeds.

- Expenses related to resolving disputes or issues with the land title.

Financing Costs

- Interest on loans specifically taken for the development of the land.

- Loan fees and other direct financing costs.

- Costs associated with obtaining financing for land acquisition.

Implications of Capitalizing Costs

Understanding the implications of capitalizing costs is essential for Sherman. Here are some key points to consider:

- Capitalized costs increase the asset value on the balance sheet, improving financial ratios.

- By capitalizing costs, Sherman may benefit from depreciation deductions over time, reducing taxable income.

- Proper capitalization can enhance the perceived value of the investment, potentially attracting more investors or buyers.

Conclusion

In summary, Sherman should capitalize various costs associated with land acquisition and development to optimize his investment strategy. Understanding the types of costs that can be capitalized, such as land acquisition costs, development costs, legal fees, and financing costs, will aid in achieving better financial reporting and tax advantages.

We encourage readers to reflect on their investment strategies and consider how capitalizing costs can benefit their financial outlook. If you found this article helpful, please leave a comment, share it with others, or explore more insightful articles on our site.

Thank you for reading! We look forward to seeing you again soon for more engaging content on real estate and investment strategies.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8pLvSrWStoJGperS0xKukmqZdqLWwwcudZJyZoJ7BorjIs5xmoZ5iwamxjJymrKxdpLNuuMCnm2egpKK5