In the bustling world of retail, the daily cash count is a critical process that ensures financial accuracy and integrity. The moment when the clerk and the supervisor come together to count the cash in the register is not just a routine task; it is a vital procedure that can reveal much about the business's financial health, employee performance, and operational efficiency. This article delves into the intricacies of this process, the significance of cash counts, and the insights they can provide.

Counting cash may seem like a mundane task, but it serves as the backbone of financial accountability in any retail environment. This procedure not only aids in identifying discrepancies but also plays a crucial role in preventing theft and ensuring that sales data aligns with the cash in the register. Moreover, the relationship between the clerk and supervisor during this process can greatly influence the workplace atmosphere and employee morale.

In this article, we will explore the various aspects of cash counting, from the methods used to conduct a thorough count to the implications of the results. We will discuss the best practices for cash management, the technology that can assist in the process, and how organizations can foster a culture of accountability. So, let’s dive deeper into the world of cash counting and uncover what the count reveals.

Table of Contents

Importance of Cash Counting

Cash counting is an essential process in the retail sector for several reasons:

- Financial Accuracy: Regular cash counts help ensure that the cash on hand matches sales records, reducing the risk of errors.

- Fraud Prevention: By having a supervisor involved in the count, it creates a system of checks and balances that can deter dishonest behavior.

- Operational Efficiency: Identifying discrepancies promptly allows businesses to address issues before they escalate, improving overall efficiency.

Best Practices for Cash Management

Effective cash management involves several best practices:

1. Regular Counts

Establish a routine for cash counts at the beginning and end of shifts to maintain financial accuracy.

2. Accountability

Ensure that both the clerk and supervisor are present during the counting process to promote transparency.

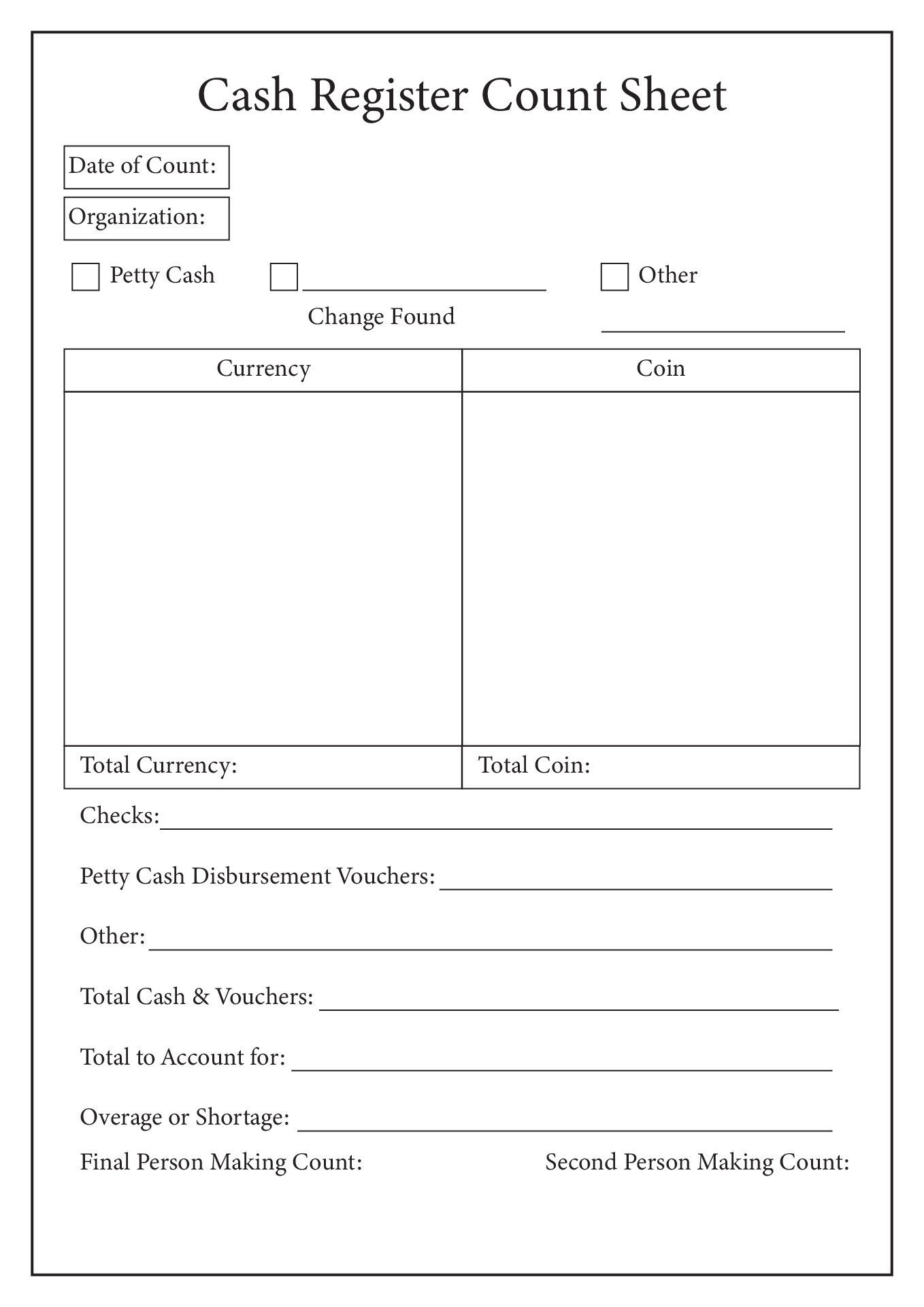

3. Documentation

Maintain detailed records of each cash count, including discrepancies and corrective actions taken.

Common Discrepancies and How to Address Them

During cash counts, several discrepancies may arise:

- Overages: When the cash on hand exceeds recorded sales, investigate potential causes such as miscounting or unrecorded sales.

- Shortages: A cash shortage can indicate theft, mismanagement, or errors in sales reporting. Implement corrective measures immediately.

The Role of Technology in Cash Counting

Technology can streamline the cash counting process significantly:

- Point of Sale (POS) Systems: Modern POS systems can automate cash tracking and reporting, reducing human error.

- Cash Management Software: Invest in software that helps manage cash flow and provides real-time reporting on cash counts.

Building a Culture of Accountability

Creating a culture of accountability within the workplace enhances the cash counting process:

- Open Communication: Encourage employees to voice concerns and report discrepancies without fear of retribution.

- Recognition: Acknowledge employees who consistently maintain accuracy and integrity during cash counts.

Training and Empowering Employees

Proper training is vital for effective cash management:

- Standard Operating Procedures (SOPs): Develop and distribute SOPs for cash handling and counting processes.

- Ongoing Training: Provide regular training sessions to keep employees updated on best practices and new technologies.

Case Studies and Real-Life Examples

Examining real-life scenarios can provide valuable insights into the cash counting process:

- Case Study 1: A retail chain that implemented daily cash counts saw a 15% reduction in discrepancies over six months.

- Case Study 2: A restaurant that incorporated digital cash management tools reported improved accuracy and reduced employee theft.

Conclusion

In conclusion, the process of counting cash in the register is far more than a simple task; it is a vital aspect of retail operations that can reveal critical insights into financial health and employee performance. By implementing best practices, leveraging technology, and fostering a culture of accountability, businesses can enhance their cash management processes. We encourage readers to reflect on their cash counting practices, share their experiences in the comments below, and explore more articles on effective retail management.

Thank you for reading! We hope you found this article informative and valuable. Don’t hesitate to return for more insights and tips on improving your business operations.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8pLjEq6JmmZ6ZerW0xGaqrqiVp8Oqv86rZJynpaPBbsDHnmScmaOdeqq6jK2fnmWimrSqv9OeqWasmJp6pLvUp6tmqpWrsqK40mefraWc