In today's world, planning for the future has never been more crucial, and buying insurance and investing wisely are key components of that plan. Many individuals often find themselves caught in a cycle of spending that leaves little room for savings and investments. However, with strategic financial management and an understanding of how to prioritize spending, anyone can secure their financial future while still enjoying the present. This article will explore the importance of insurance and investment, the relationship between spending habits and financial security, and practical tips on how to spend less while maximizing your financial growth.

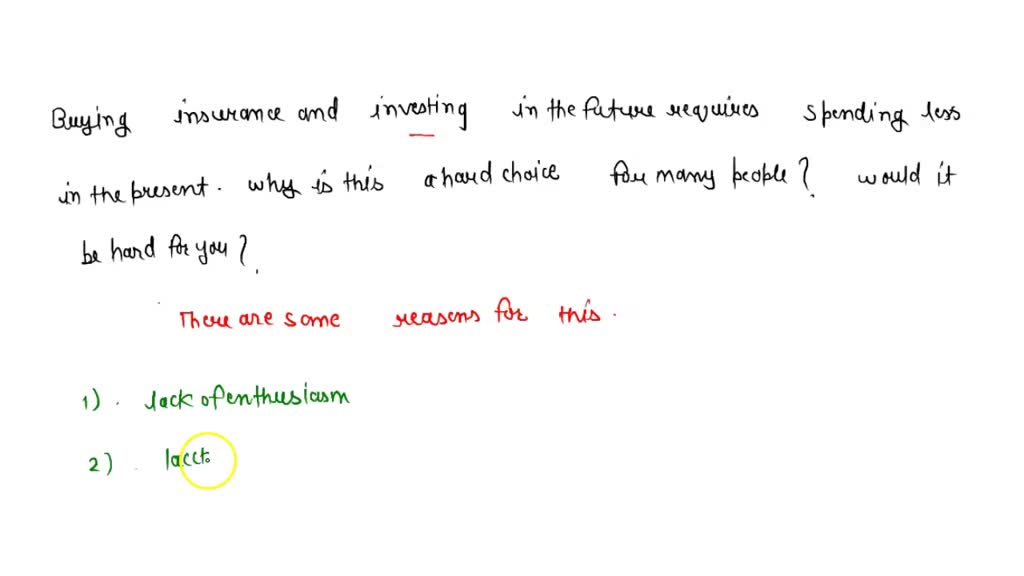

When it comes to financial planning, the decisions we make today significantly impact our tomorrow. The two primary avenues for ensuring a secure financial future are insurance and investment. Insurance protects us from unforeseen events that could lead to financial distress, while investments grow our wealth over time. However, both require a commitment to spending less on non-essential items, allowing for the allocation of funds towards these critical areas.

In this article, we will discuss various strategies to help you cut back on unnecessary expenses, thereby freeing up resources for insurance premiums and investment contributions. We will also delve into the types of insurance available, the different investment options, and how they can work together to build a robust financial safety net.

Table of Contents

The Importance of Insurance

Insurance plays a vital role in financial planning as it provides a safety net during unexpected events. Without insurance, an accident, illness, or disaster could lead to significant financial strain. Here are some reasons why insurance is essential:

- Financial Protection: Insurance protects your assets and income from unforeseen circumstances.

- Peace of Mind: Knowing you're covered allows you to focus on other aspects of your life without the constant worry of financial insecurity.

- Legal Requirements: Certain types of insurance, like auto insurance, are legally required in many areas.

Types of Insurance You Should Consider

There are various types of insurance available, each serving a specific purpose. Understanding these can help you choose the right coverage for your needs:

1. Health Insurance

Health insurance covers medical expenses, ensuring you receive necessary care without incurring crippling debt.

2. Life Insurance

Life insurance provides financial security to your dependents in the event of your death, helping them maintain their standard of living.

3. Auto Insurance

Auto insurance protects against financial loss in the event of a car accident or theft.

4. Homeowner's or Renter's Insurance

This type of insurance protects your home and personal belongings against damage or theft.

The Benefits of Investing

Investing is a crucial component of building wealth and securing financial independence. Here are some benefits of investing:

- Wealth Growth: Investments can yield returns that outpace inflation, helping your money grow over time.

- Diversification: Investing allows you to diversify your income sources, reducing financial risk.

- Retirement Savings: Investing is essential for building a retirement fund that can sustain your lifestyle in later years.

Investment Options to Explore

There are numerous investment options available, depending on your financial goals and risk tolerance:

1. Stocks

Buying shares in companies can offer substantial long-term returns, though they come with higher risks.

2. Bonds

Bonds are generally considered safer than stocks and provide fixed interest payments over time.

3. Mutual Funds

Mutual funds allow investors to pool their money to invest in a diversified portfolio managed by professionals.

4. Real Estate

Investing in real estate can provide rental income and appreciation over time.

How to Spend Less to Save More

To make room for insurance and investment contributions, it’s important to evaluate your spending habits. Here are some strategies to consider:

- Track Your Expenses: Keeping a detailed record of your expenses can help identify areas where you can cut back.

- Prioritize Needs Over Wants: Focus on essential expenses and limit discretionary spending.

- Set Savings Goals: Establish clear goals for how much you want to save or invest, and adjust your spending accordingly.

Budgeting Tips for Better Financial Planning

Creating a budget is essential for effective financial management. Here are some tips to help you budget effectively:

- Use the 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and investments.

- Review and Adjust Regularly: Regularly review your budget to ensure it aligns with your financial goals.

- Utilize Budgeting Apps: Consider using budgeting tools and apps to simplify the process and track your progress.

Common Expenses to Cut Back On

Identifying and cutting back on common unnecessary expenses can free up funds for insurance and investments:

- Dining Out: Reduce the frequency of eating out and cook at home more often.

- Subscriptions: Review and cancel any unused subscriptions or memberships.

- Impulse Purchases: Avoid shopping without a list to reduce impulse buying.

Conclusion

In conclusion, buying insurance and investing for the future requires a conscious effort to spend less. By understanding the importance of insurance and the benefits of investing, and by implementing effective budgeting strategies, you can secure your financial future without sacrificing your current lifestyle. Start taking small steps today to cut back on unnecessary expenses and allocate those funds towards your insurance and investment goals. Share your thoughts in the comments below, and feel free to explore other articles on our site for more financial tips!

Thank you for reading! We hope this article has provided valuable insights into managing your finances effectively. Don’t forget to return for more informative content!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8o8HYoqWgZZmjwLa%2BwKeanmWRo7Futc2vnKysmaO0brLOq2StoJVis7bA1KucZqqVpsKqvsSsZKyolaOxqrrGZqOeq6Nitq9506GcZ6Ckork%3D