Understanding the break-even point is crucial for any investor looking to navigate the complexities of financial markets. It serves as a pivotal metric that can guide investment decisions, risk assessments, and financial strategies. Whether you are a seasoned investor or just starting, grasping this concept can significantly impact your investment outcomes.

In this article, we will delve deep into the break-even point, exploring its definition, significance, and application in the investment world. We will also discuss how to calculate the break-even point and analyze various scenarios where it plays a crucial role in decision-making.

As we navigate through this guide, expect to uncover valuable insights and strategies that can enhance your investment acumen. Let's embark on this journey to understand the break-even point for investors.

Table of Contents

What is Break-Even Point?

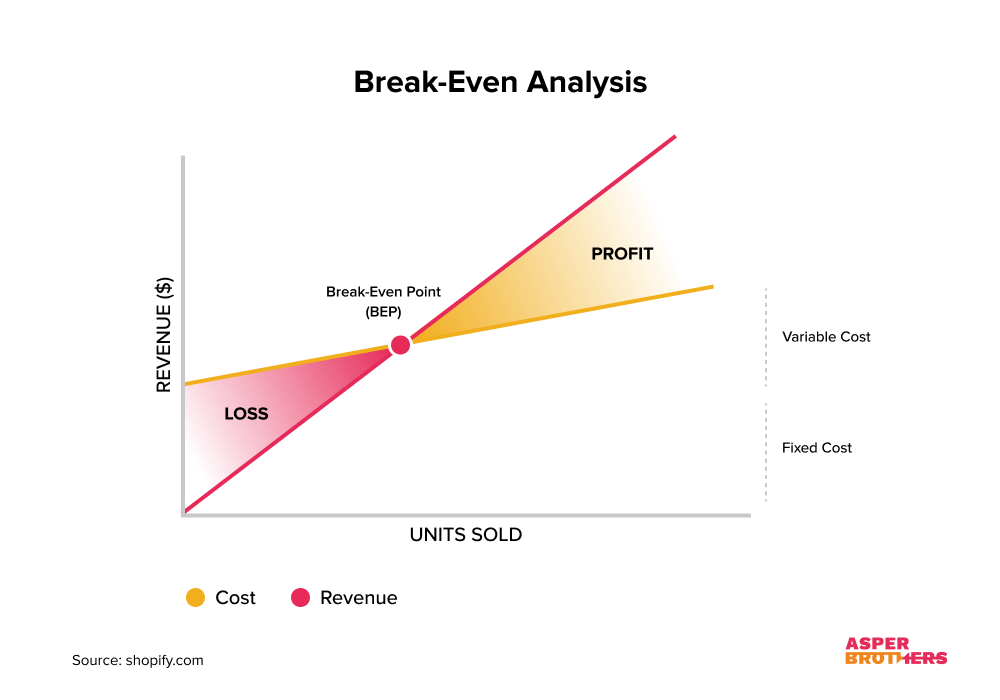

The break-even point is a financial metric that represents the level of sales or investment return at which total revenues equal total costs. In simpler terms, it is the point where an investor neither makes a profit nor incurs a loss. Understanding this concept is vital for investors as it helps in evaluating the feasibility of an investment.

Key Components of Break-Even Analysis

- Fixed Costs: These are costs that do not change with the level of production or sales, such as rent, salaries, and insurance.

- Variable Costs: Costs that vary directly with the level of production or sales, including materials and labor.

- Revenue: The total income generated from sales or investments.

Importance of Break-Even Point for Investors

The break-even point serves as a crucial tool for investors for several reasons:

- Risk Assessment: Knowing the break-even point helps investors understand the risks associated with their investments.

- Investment Decision Making: It aids in making informed decisions about buying or selling an asset.

- Performance Monitoring: Investors can track their investments against the break-even point to measure performance.

Calculating the Break-Even Point

To calculate the break-even point, investors can use the following formula:

Break-Even Point (in units) = Fixed Costs / (Selling Price per Unit - Variable Cost per Unit)

This formula enables investors to determine the number of units that must be sold to cover all costs. Let’s break this down further:

Example Calculation

Consider an investor with the following details:

- Fixed Costs: $10,000

- Selling Price per Unit: $50

- Variable Cost per Unit: $30

Using the formula, the break-even point would be:

Break-Even Point = $10,000 / ($50 - $30) = 500 units

This means the investor needs to sell 500 units to break even.

Break-Even Analysis in Investment

Break-even analysis can be applied to various types of investments. It provides a framework for assessing the viability of potential investments before committing financial resources.

Applying Break-Even Analysis to Different Investments

Investors can leverage break-even analysis in multiple areas, including:

- Startups: Assessing when a startup will become profitable.

- Real Estate: Determining if rental income will cover mortgage and maintenance costs.

- Stock Investments: Evaluating when stock prices will cover the cost of purchase.

Break-Even Point in Real Estate Investments

In real estate, understanding the break-even point is critical for evaluating rental properties. Investors need to know how much rent they must charge to cover their expenses.

Calculating Break-Even Point in Real Estate

The formula for calculating the break-even point in real estate is:

Break-Even Point (in months) = Total Operating Expenses / Monthly Rental Income

For instance, if a property has total operating expenses of $2,400 and generates $800 in monthly rent, the break-even point would be:

Break-Even Point = $2,400 / $800 = 3 months

This indicates the property will break even in three months, guiding the investor's decision-making process.

Break-Even Point in Stock Market Investments

For stock investors, the break-even point is essential for determining whether to hold or sell a stock. It helps in setting price targets based on purchase prices and associated fees.

Example of Break-Even Point in Stock Investments

Suppose an investor buys shares at $100 each and pays a commission of $10. The break-even point here would be:

Break-Even Point = Purchase Price + Commission = $100 + $10 = $110

Thus, the investor needs the stock price to reach $110 to recover the costs incurred.

Using Break-Even Point for Risk Management

Effective risk management involves understanding the break-even point. Investors can use it to set stop-loss orders and make informed decisions about portfolio adjustments.

Strategies for Risk Management

- Diversification: Spread investments across various asset classes to mitigate risk.

- Setting Stop-Loss Orders: Automatically sell assets at predetermined prices to limit losses.

- Regular Monitoring: Continuously assess investments against the break-even point to make timely adjustments.

Case Studies and Examples

Real-world examples of break-even analysis can provide valuable insights into its application. Consider the following case studies:

Case Study 1: A Local Restaurant

A local restaurant wants to assess its break-even point to determine the number of customers needed per day. With fixed costs of $5,000 and a meal price of $20, the break-even point in terms of customers would be:

Break-Even Point = $5,000 / ($20 - $10) = 500 customers per month

Case Study 2: An E-commerce Business

An e-commerce business has fixed costs of $10,000 and sells products for $50 with a variable cost of $30. The break-even point would be:

Break-Even Point = $10,000 / ($50 - $30) = 500 units

These examples illustrate how break-even analysis can aid in strategic planning and operational decision-making.

Conclusion

In conclusion, understanding the break-even point is essential for investors in making informed decisions, assessing risks, and evaluating the feasibility of their investments. By calculating and analyzing this metric, investors can enhance their investment strategies and improve their chances of achieving financial success.

If you found this article helpful, consider leaving a comment or sharing it with others who may benefit. Explore more articles on our site to further enhance your investment knowledge!

Call to Action

Are you ready to take control of your investments? Start applying break-even analysis today and watch your investment decisions become more informed and strategic!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8o77EmqJmnaaau268zqKlrWWWpL9uwMeeZKKmpprAtbvRZ5%2BtpZw%3D