An audit plan is a crucial document in the auditing process, serving as a roadmap for auditors to follow during their assessments. It outlines the specific procedures, timelines, and resources needed to conduct an effective audit. In this article, we will delve into the essential components of an audit plan, highlighting its importance in ensuring compliance and the accuracy of financial reporting.

The audit plan not only provides a structured approach to auditing but also helps in identifying potential risks and areas of concern within an organization. By having a detailed listing of the audit procedures to be followed, auditors can allocate their time and resources more efficiently, ultimately leading to a more thorough and effective audit process. In this article, we will explore the various elements that comprise a comprehensive audit plan and why they matter.

Furthermore, understanding the intricacies of an audit plan is essential for organizations striving for transparency and accountability. This article will also touch on the best practices for developing an audit plan that aligns with industry standards and regulatory requirements. Whether you are an auditing professional or a business owner, this information will prove invaluable in navigating the complexities of the audit process.

Table of Contents

What is an Audit Plan?

An audit plan is a formalized document that outlines the scope, objectives, timelines, and procedures for an audit. It serves as a guide for auditors to follow throughout the auditing process, ensuring that all necessary steps are taken to achieve the audit objectives. The audit plan is typically developed before the audit begins and is based on the auditor's understanding of the client's business, internal controls, and relevant regulations.

Importance of an Audit Plan

Having a well-structured audit plan is essential for several reasons:

- Enhances Efficiency: A detailed audit plan enables auditors to allocate their time and resources effectively, reducing the likelihood of missed steps or overlooked areas.

- Identifies Risks: The audit plan helps in identifying potential risks and areas of concern, allowing auditors to focus their efforts where they are most needed.

- Ensures Compliance: By detailing the necessary procedures and regulations, an audit plan ensures that the audit complies with industry standards and legal requirements.

- Facilitates Communication: A clear audit plan improves communication between auditors and clients, ensuring that all parties are aligned on expectations and deliverables.

Components of an Audit Plan

A comprehensive audit plan typically includes the following components:

- Objectives of the Audit: Clearly defined goals that outline what the audit aims to achieve.

- Scope of the Audit: The boundaries of the audit, including the areas to be examined and any exclusions.

- Audit Procedures: A detailed listing of the specific procedures to be performed during the audit.

- Timeline: A schedule outlining when each phase of the audit will take place.

- Resources Required: Identification of personnel, tools, and materials needed to conduct the audit.

- Risk Assessment: An evaluation of potential risks that could impact the audit process.

Audit Procedures in an Audit Plan

Audit procedures are the specific steps that auditors take to gather evidence and assess the accuracy of financial statements. These procedures can be categorized into several types, including:

Substantive Procedures

These procedures are designed to detect material misstatements in financial statements. They may involve:

- Testing transactions and balances

- Analytical procedures

- Confirmation with third parties

Control Procedures

Control procedures assess the effectiveness of an organization’s internal controls. They may include:

- Walkthroughs of processes

- Testing the design and operating effectiveness of controls

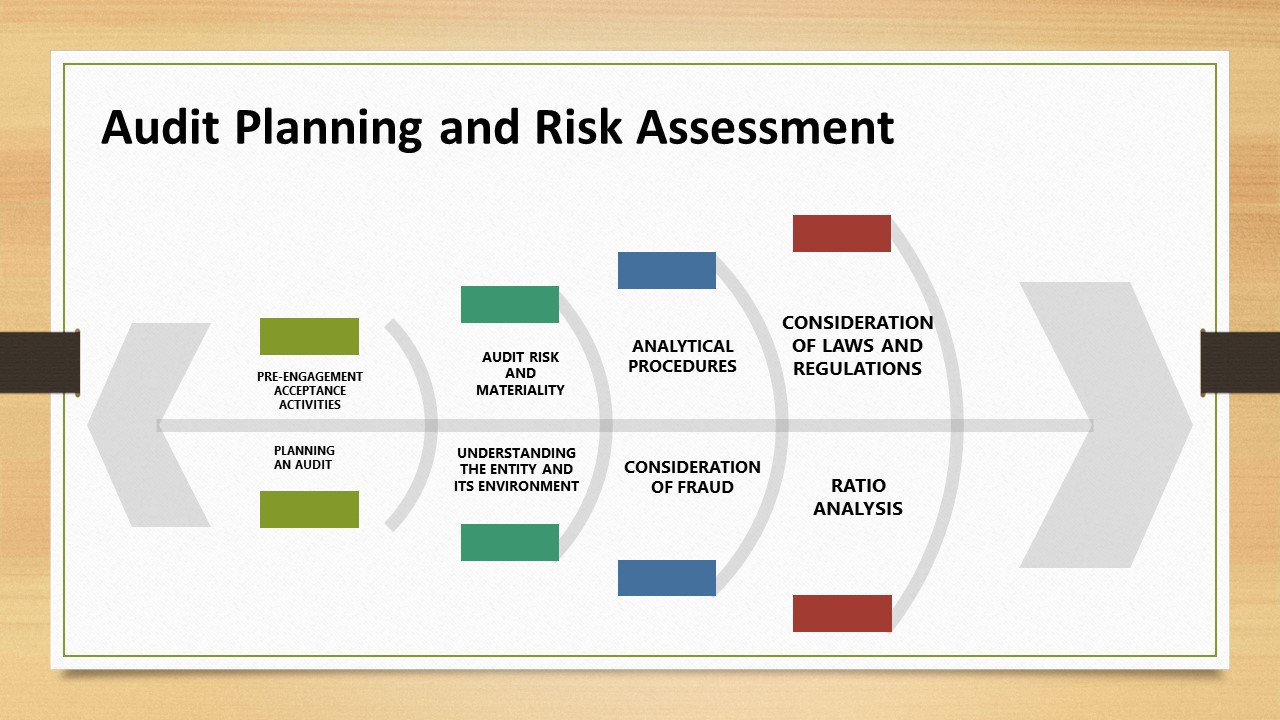

Risk Assessment in Audit Planning

Risk assessment is a critical component of audit planning. It involves identifying and evaluating risks that could lead to material misstatements in financial reporting. The risk assessment process typically includes:

- Understanding the Entity: Gaining insight into the client’s operations, industry, and regulatory environment.

- Identifying Risks: Considering inherent risks, control risks, and detection risks.

- Assessing Risks: Evaluating the likelihood and impact of identified risks on the audit.

Developing an Audit Plan

Creating an effective audit plan involves several key steps:

- Gather Information: Collect data about the organization’s operations, financial statements, and internal controls.

- Define Objectives: Establish clear and measurable audit objectives.

- Determine Scope: Outline the boundaries and focus areas of the audit.

- Select Procedures: Choose the appropriate audit procedures based on the identified risks and objectives.

- Prepare Timeline: Develop a schedule that outlines when each procedure will be performed.

- Review and Revise: Continuously review and adjust the audit plan as needed throughout the audit process.

Common Challenges in Audit Planning

While developing an audit plan, auditors may encounter several challenges:

- Time Constraints: Limited time to complete the audit can lead to rushed planning and execution.

- Changing Regulations: Frequent changes in laws and regulations can complicate compliance efforts.

- Inadequate Information: Lack of access to necessary data can hinder the risk assessment process.

- Resource Limitations: Insufficient personnel or tools can impact the quality and thoroughness of the audit.

Conclusion

In conclusion, an audit plan is a vital tool in the auditing process, providing a structured approach that enhances efficiency, ensures compliance, and identifies risks. By including a detailed listing of the audit procedures to be followed, auditors can conduct more effective and thorough assessments. It is essential for both auditing professionals and organizations to understand the importance of a well-developed audit plan and the best practices for creating one. We encourage you to share your thoughts in the comments section below or explore more articles on our site to deepen your understanding of auditing practices.

Thank you for reading! We hope you found this article informative and helpful. Don't forget to come back for more insights and updates on auditing and financial practices.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8orqMmqydoaRiva2tzWagp5ucqrGmv4yaZJ2dpJa2rbHDZqOiq6Seu6h5zp9kraCVYq62sMitZKmqn5iypcHRnqpmrJ9ir6Z6x62kpQ%3D%3D