Beginning inventory refers to the total value of goods available for sale at the start of an accounting period. For businesses, accurately tracking beginning inventory is crucial for financial reporting and effective inventory management. In this article, we will explore the concept of beginning inventory, specifically focusing on the scenario where 30 units are purchased at $120 each. We will break down the components of inventory management, the implications of these purchases on financial statements, and how to maintain accurate records. This comprehensive guide aims to provide valuable insights for business owners, accountants, and anyone interested in understanding inventory management.

The importance of beginning inventory cannot be overstated. It serves as the baseline for calculating the cost of goods sold (COGS) and affects the overall profitability of a business. Understanding how to accurately account for beginning inventory will enable you to make informed decisions regarding purchasing, pricing, and sales strategies. In this article, we will delve into the key aspects of beginning inventory, including its role in financial statements, methods of inventory valuation, and best practices for tracking and managing inventory.

Whether you are a seasoned business owner or new to inventory management, this guide will provide valuable knowledge that can help you optimize your inventory processes. We will discuss practical examples, industry best practices, and tools that can assist you in managing your beginning inventory effectively. Let's get started!

Table of Contents

What is Beginning Inventory?

Beginning inventory refers to the value of all goods available for sale at the start of an accounting period. It is an essential component of inventory management and serves as the starting point for calculating the cost of goods sold (COGS). In our case, the beginning inventory consists of 30 units purchased at $120 each, which totals $3,600.

Definition and Key Components

Beginning inventory typically includes:

- Physical goods available for sale

- Raw materials and supplies

- Work-in-progress items

By accurately determining the value of beginning inventory, businesses can ensure that their financial statements reflect the true cost of goods sold and the overall profitability of their operations.

Importance of Beginning Inventory

Beginning inventory plays a critical role in the overall financial health of a business. Here are some key reasons why it is important:

- Accurate Financial Reporting: Beginning inventory is necessary for accurate financial reporting and compliance with accounting standards.

- Cost Control: Tracking beginning inventory allows businesses to identify trends in inventory usage and optimize purchasing strategies.

- Profitability Analysis: Understanding the cost of goods sold is essential for determining profitability and making informed pricing decisions.

Calculating Cost of Goods Sold (COGS)

The cost of goods sold (COGS) is a crucial metric for businesses as it directly affects gross profit. To calculate COGS, the formula is as follows:

COGS = Beginning Inventory + Purchases - Ending Inventory

In our example, if the beginning inventory is $3,600 and additional purchases are made during the period, this figure will help determine the total COGS.

Inventory Valuation Methods

There are several methods for valuing inventory, which can significantly impact financial statements. The most common methods include:

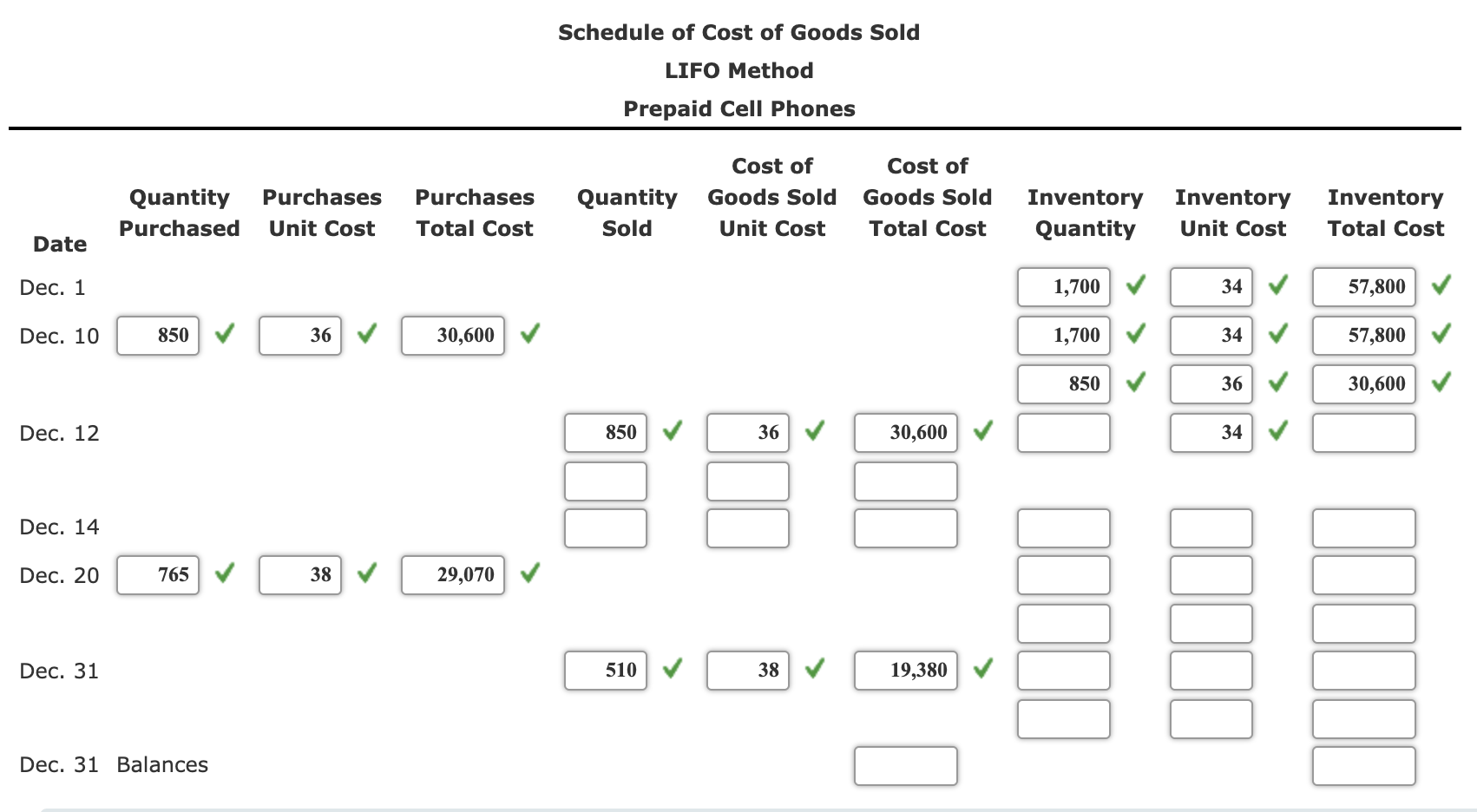

- FIFO (First In, First Out): Assumes that the oldest inventory items are sold first.

- LIFO (Last In, First Out): Assumes that the newest inventory items are sold first.

- Weighted Average Cost: Calculates an average cost for all units available for sale.

Choosing the Right Method

The choice of inventory valuation method can affect tax liabilities, financial ratios, and overall financial performance. It's essential to select a method that aligns with the business's operational model and financial goals.

Tracking Beginning Inventory

Maintaining accurate records of beginning inventory is vital for effective inventory management. Here are some best practices for tracking beginning inventory:

- Implement a robust inventory management system.

- Conduct regular physical inventory counts.

- Utilize barcode scanning or RFID technology to automate tracking.

Impact on Financial Statements

Beginning inventory has a direct impact on financial statements, including the balance sheet and income statement. Accurate reporting of beginning inventory ensures that:

- Assets are correctly stated on the balance sheet.

- COGS is accurately reflected on the income statement.

- Gross profit and net income are reported correctly.

Best Practices for Inventory Management

To optimize inventory management and improve financial performance, businesses should consider the following best practices:

- Regularly review inventory levels and sales trends.

- Establish reorder points to prevent stockouts.

- Analyze inventory turnover ratios to identify slow-moving items.

Conclusion

In conclusion, beginning inventory is a fundamental aspect of effective inventory management. By understanding its importance, calculating COGS accurately, and implementing best practices, businesses can enhance their financial reporting and overall profitability. We encourage readers to evaluate their inventory management processes and consider how improvements can be made. If you have any questions or insights, please leave a comment below or share this article with others who may find it helpful.

Thank you for reading! We hope to see you back here for more insightful articles on inventory management and financial strategies.

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8o7HGoqWnoZ6ceqq61Z6lraeirnqwsoxsZ2atnp7BtHnPrqmcoJGosqV5wK1kampgYrKir8dmmKecXaKupbGMrZ%2BeZpipuq0%3D