Interest rates play a crucial role in the financial world, influencing everything from personal savings to large-scale investments. Understanding how interest rates function can empower individuals and businesses to make informed decisions about their finances. Whether you're considering a loan, evaluating investment opportunities, or simply looking to maximize your savings, having a solid grasp of interest rates is essential.

This article will delve into the intricacies of interest rates, covering their definitions, types, and impacts on the economy. We will also explore how interest rates affect various financial products, such as mortgages, savings accounts, and bonds. By the end of this guide, you will have a comprehensive understanding of interest rates and how to navigate them effectively.

In the ever-evolving financial landscape, staying informed about interest rates can significantly influence your financial health. Thus, let’s dive deeper into the world of interest rates and discover how they can work for you.

Table of Contents

1. What is an Interest Rate?

An interest rate is the cost of borrowing money or the return on investment for saving money, usually expressed as a percentage of the principal amount over a specified period. It essentially reflects the time value of money, which suggests that money available now is worth more than the same amount in the future due to its potential earning capacity.

2. Types of Interest Rates

Interest rates can be categorized into various types based on their nature and application. Understanding these types is crucial for making informed financial decisions.

2.1 Fixed Interest Rates

Fixed interest rates remain constant throughout the duration of a loan or investment. This predictability makes fixed rates appealing for borrowers who want to budget their repayments without worrying about fluctuations in interest rates.

2.2 Variable Interest Rates

Variable interest rates, on the other hand, can change periodically based on market conditions. While they may start lower than fixed rates, they can increase over time, potentially leading to higher overall costs for borrowers.

3. The Impact of Interest Rates on the Economy

Interest rates are a crucial tool for economic policy, influencing consumer spending, business investment, and overall economic growth. Central banks, such as the Federal Reserve in the United States, adjust interest rates to manage inflation and stabilize the economy.

- When interest rates are low, borrowing is cheaper, encouraging consumer spending and business investments.

- Conversely, high interest rates can slow down economic growth as borrowing costs increase, leading to reduced spending.

4. Interest Rates and Financial Products

Interest rates significantly impact various financial products, affecting how consumers manage their money. Here’s how they influence key financial products:

4.1 Mortgages

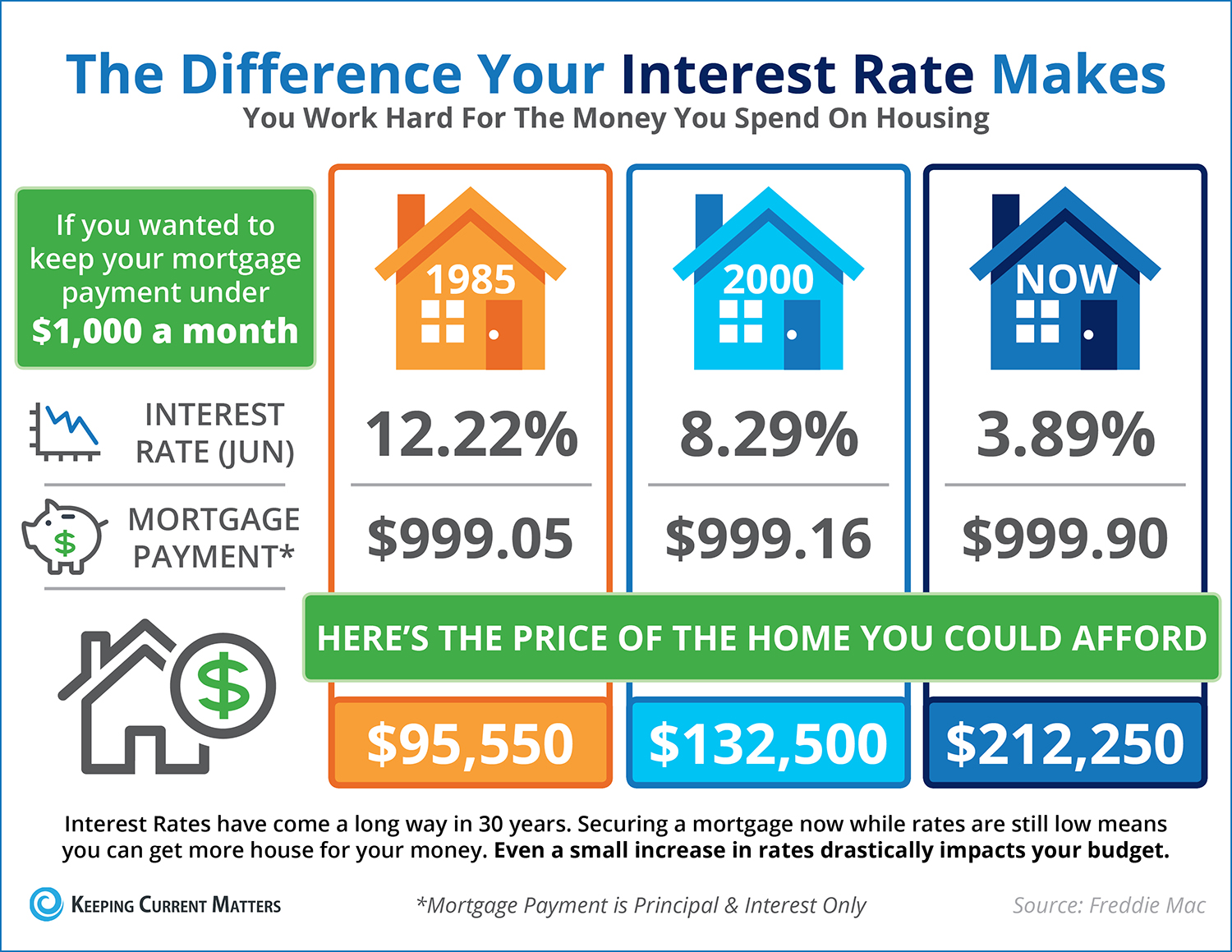

Interest rates directly affect mortgage rates, influencing home buying affordability. A lower interest rate can save homeowners thousands over the life of the loan, while higher rates can limit purchasing power.

4.2 Savings Accounts

For savings accounts, higher interest rates can lead to better returns on deposits. Consumers should seek accounts with competitive rates to maximize their savings.

4.3 Bonds

Bonds are also influenced by interest rates. When rates rise, existing bond prices typically fall, and vice versa. Investors need to consider the interest rate environment when buying or selling bonds.

5. Factors Influencing Interest Rates

Several factors can influence interest rates, including:

- Inflation: Higher inflation typically leads to higher interest rates.

- Central Bank Policies: Decisions by central banks regarding interest rates can have a widespread impact.

- Economic Indicators: Unemployment rates and GDP growth can influence interest rate adjustments.

6. How to Navigate Interest Rates

Understanding how to navigate interest rates can help you make better financial decisions:

- Monitor Economic Trends: Stay informed about economic indicators and central bank announcements.

- Compare Offers: Always compare interest rates from different lenders and financial products.

- Evaluate Your Financial Situation: Consider your financial goals and risk tolerance before making decisions.

7. Conclusion

Interest rates play a pivotal role in shaping the financial landscape. By understanding the different types of interest rates and their impact on various financial products, you can make informed decisions that positively affect your financial future. As we have discussed, whether you are looking to borrow, invest, or save, being aware of interest rates is essential.

We invite you to leave comments with your thoughts or questions about interest rates, share this article with others, or explore more articles on our site for further financial insights.

Thank you for reading, and we hope to see you back for more valuable information!

ncG1vNJzZmivp6x7rLHLpbCmp5%2Bnsm%2BvzqZmm6efqMFuxc6uqWarlaR8qrrTnqmeq6Riv6LAxGefraWc